Duty-Free Quota Slashed by 47%

50% High Tariff on Excess Volumes

"Steel Safeguard" Extended and Strengthened

Simultaneous Application of Quota and High Tariffs

Heavier Burden Than US Price Regulation Model

Direct Impact on Exporte

The European Union (EU) is moving to nearly halve its steel duty-free quota and impose a steep 50% tariff on quantities exceeding the quota, putting direct pressure on the export structure of Korean steel. While the United States applies a uniform 50% tariff under a "price regulation" model, the EU's approach combines volume restrictions with high tariffs, resulting in a heavier burden for exporters.

According to industry sources on October 15, the European Commission is currently considering reducing the steel duty-free quota by nearly half (47%) compared to the previous year and applying a 50% tariff-up from the current 25%-on quantities exceeding the quota. This measure effectively extends and restructures the safeguard system set to expire next year and will be finalized through a vote among member states.

Industry experts believe that if this measure is implemented, the impact will be greater than the high tariffs imposed by the United States. The reason lies in the quota system. The United States employs a "price regulation" model, applying a uniform tariff rate that allows for volume adjustments. In contrast, the EU's dual regulatory model imposes a 50% tariff immediately upon exceeding the duty-free limit. With both volume restrictions and high tariffs in effect, export volumes are likely to decrease significantly.

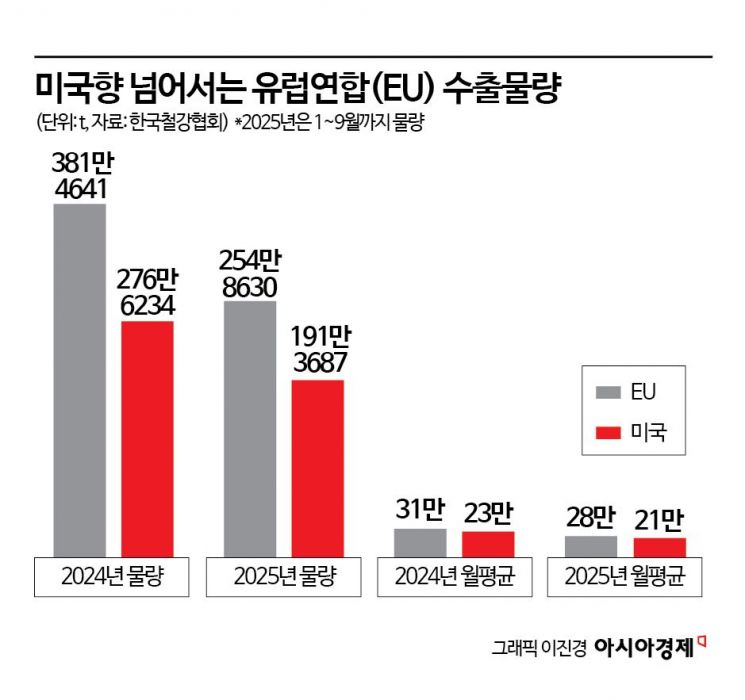

Export volumes also show that the EU poses a greater burden than the United States. According to the Korea Iron & Steel Association, Korea exported 3,811,464 tons of steel to the EU last year, about 38% more than the 2,766,234 tons exported to the United States. This year, monthly average exports to the EU have remained at around 280,000 tons, surpassing the United States (210,000 tons per month). Notably, due to the impact of high tariffs, monthly exports to the United States have dropped below 200,000 tons since July this year.

Industry insiders expect that companies focusing on flat steel products, such as POSCO and Hyundai Steel, will be directly affected. These products-hot-rolled, cold-rolled, and galvanized steel sheets-are key intermediate goods for downstream industries like automotive, home appliances, and construction. Price increases are highly likely to lead directly to weakened demand and reduced production. In fact, from January last year to September this year, flat steel accounted for 3.49 million tons, or 88% of Korea's steel exports to the EU. Specifically, hot-rolled steel made up 1.57 million tons (40%), cold-rolled steel 980,000 tons (25%), and galvanized steel 900,000 tons (23%), constituting the majority of exports.

Companies specializing in steel pipes and specialty steel, such as SeAH Group and Dongkuk Steel, are also expected to face secondary impacts. If flat steel exports decline, reduced demand and increased costs within the supply chain will be passed on to downstream product groups. An industry official stated, "Although steel pipe exports to the EU are only 2,000 to 5,000 tons per month, any increase in flat steel prices is immediately reflected in production costs."

The government and industry are taking action in response. On October 10, the Ministry of Trade, Industry and Energy held an emergency meeting of the steel industry at the Korea Chamber of Commerce and Industry in Seoul, chaired by Deputy Minister Park Jongwon, to discuss countermeasures against the EU's import restrictions. Representatives from major steelmakers-including POSCO, Hyundai Steel, SeAH Steel, and Dongkuk Steel-as well as the Korea Iron & Steel Association, attended the meeting. The ministry plans to closely monitor the allocation of quotas by member states until the EU's measures are finalized and to actively negotiate for favorable quota allocations, taking into account Korea's status as an FTA partner with the EU.

In the short term, the industry is seeking to shift toward higher value-added steel grades and diversify export markets. In the medium to long term, companies are considering transitioning to low-carbon production processes and strengthening their capabilities to respond to the Carbon Border Adjustment Mechanism (CBAM). From next year, when CBAM is fully implemented, additional costs based on carbon emissions are expected to further erode export competitiveness.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.