Seoul Metropolitan Area Apartment Prices Continue to Surge Despite Government Measures

Further Restrictions on Real Estate Loans Appear Unavoidable

Some Call for an Increase in Property Holding Taxes

Ruling Party and Government Discuss Additional

Despite a series of real estate regulatory policies, housing prices in the Seoul metropolitan area continue to rise, prompting the government to announce additional measures this week. Tighter restrictions on real estate-related loans are being strongly considered, and there are expectations that a comprehensive real estate policy package will be introduced again, including expanding regulated areas and strengthening property holding taxes.

Metropolitan Apartment Prices Continue to Surge Despite Government Real Estate Policies

According to the Financial Services Commission, the Ministry of Land, Infrastructure and Transport, the Ministry of Economy and Finance, and other relevant agencies on the 13th, the government has repeatedly discussed related measures after the Chuseok holiday as housing prices in Seoul and some parts of the metropolitan area have continued to rise. The Democratic Party of Korea, the government, and the presidential office held a high-level policy meeting the previous day and stated, "We will announce housing market measures at an appropriate time this week." Park Soo-hyun, chief spokesperson for the Democratic Party, emphasized, "Instability in the housing market is a national issue that undermines residential stability for ordinary citizens, increases household burdens, and dampens overall economic vitality by reducing consumption. The party and government are closely monitoring the situation and have agreed to work together to resolve it."

Although the government announced real estate market stabilization measures on June 27 and again on September 7, housing prices have continued to rise, prompting the authorities to prepare additional measures. According to the Korea Real Estate Board, as of September 29, the apartment sales price in Seoul increased by 0.27% compared to the previous week. The rate of increase in Seoul apartment prices grew from 0.08% on September 1 to 0.09% on September 8, 0.12% on September 15, 0.19% on September 22, and 0.27% on September 29, showing a larger weekly increase. Not only in Seoul, but also in Bundang District of Seongnam, Gwangmyeong, Gwacheon, and Hanam in Gyeonggi Province, apartment prices have continued to surge throughout the metropolitan area. The market believes that, although statistics were unavailable due to the Chuseok holiday, housing prices continued to rise in October as well.

President Lee Jaemyung also stated at a press conference marking his 100th day in office on September 11, "We will repeatedly introduce measures to prevent a sharp rise in housing prices." Minister of Land, Infrastructure and Transport Kim Yoonduk similarly said at a press briefing late last month, "We are continuously monitoring market conditions and will announce measures after comprehensively reviewing demand suppression and supply policies."

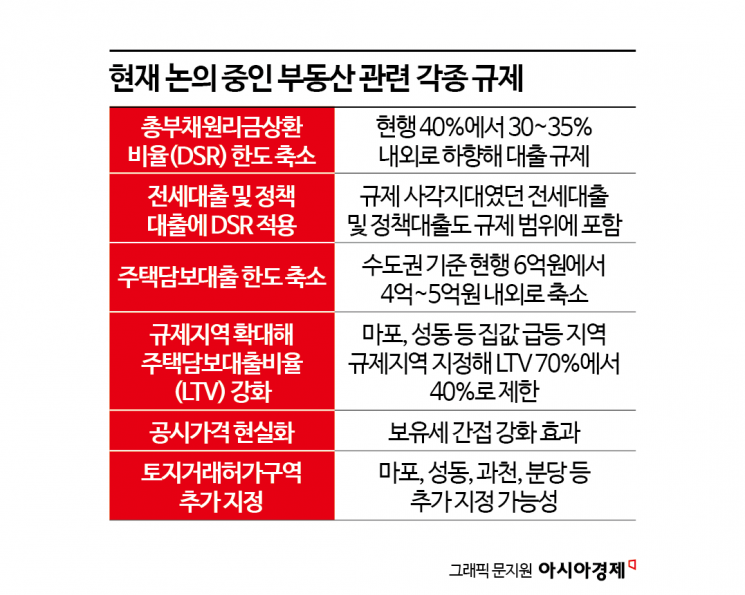

The market expects the government to introduce comprehensive measures covering finance, taxation, and supply. In the financial sector, options being considered include reducing the debt service ratio (DSR) and mortgage loan limits, expanding DSR application to include jeonse loans and policy loans, and tightening the loan-to-value ratio (LTV).

Financial authorities are considering expanding the application of the DSR to jeonse loans and policy loans. The DSR is a lending regulation that limits the total annual principal and interest repayments on all loans to no more than 40% of the borrower's annual income (for banks). Since DSR does not currently apply to jeonse loans and policy loans, critics argue this has led to rising jeonse prices, increased gap investment, and a vicious cycle of rising housing prices. The Financial Services Commission has also stated on several occasions that if housing market instability persists, the DSR could be expanded to cover jeonse loans and other products.

Authorities are also considering lowering the DSR cap from the current 40% to 35% or less. This measure could reduce the scale of loans, thereby slowing the rise in housing prices, and help decrease Korea's household debt ratio, which is excessively high compared to other countries. Another option being discussed is lowering the mortgage loan limit in the metropolitan area from the current 600 million won to 400 million won.

The Ministry of Land, Infrastructure and Transport is reportedly considering expanding regulated areas. In addition to the Gangnam area of Seoul, it is highly likely that Mapo, Seongdong, and Bundang in Seongnam will be designated as speculative overheated districts or adjustment target areas. If designated as regulated areas, the LTV will be limited from the current 70% to 40%, naturally tightening lending regulations.

A panoramic view of apartment complexes in downtown Seoul as seen from Namsan, Seoul. Photo by Dongju Yoon

A panoramic view of apartment complexes in downtown Seoul as seen from Namsan, Seoul. Photo by Dongju Yoon

Government Considering Indirect Increase of Real Estate Holding Tax

There is speculation that the government may once again consider increasing the holding tax. However, due to concerns about the side effects of raising tax rates, the government is reportedly reviewing ways to indirectly raise the holding tax by increasing the official property price realization rate or the fair market value ratio (fair ratio), rather than directly raising the holding tax rate.

For apartment complexes, the average official property price is 69% of the market price this year, and the fair market value ratio used to calculate the taxable standard for the comprehensive real estate tax is 60% for single-homeowners. For example, a homeowner with an apartment valued at 1 billion won faces a taxable standard of about 410 million won, which has been criticized as too large a gap between market value and the tax base.

The Yoon Sukyeol administration previously lowered the fair market value ratio from 80% to 60%, but there are discussions about restoring it to its original level. As this can be implemented through a revision of the enforcement decree, it does not require a tax law amendment, so the burden on the National Assembly is relatively low. Minister Kim also mentioned at a press briefing, stating his personal opinion, "If necessary, we should also consider strengthening the real estate tax system."

However, within the Ministry of Economy and Finance, which is in charge of taxation, there is a cautious stance regarding both direct and indirect increases in the holding tax. This is due to concerns that there is no clear causal relationship between holding tax increases and falling housing prices, and that such measures could worsen public sentiment. Deputy Prime Minister and Minister of Economy and Finance Koo Yooncheol also said at a press briefing last month, "If possible, we will proceed cautiously when using the tax system as a tool to stabilize the real estate market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.