Highest Price in 45 Years... Up 64% This Year

Essential Metal for Solar Panels and Data Centers

The price of silver has surged, breaking through the $50-per-ounce mark for the first time in 45 years. This sharp rise is attributed to some investors shifting their demand to silver, as they felt burdened by the continued increase in gold prices over recent years. Experts are optimistic, noting that silver is considered an essential metal for future technologies such as solar panels and artificial intelligence (AI) data centers. As a result, silver's appeal as a safe-haven asset is being further enhanced by its practical applications.

Silver Soars Alongside Gold... Up More Than 64% This Year

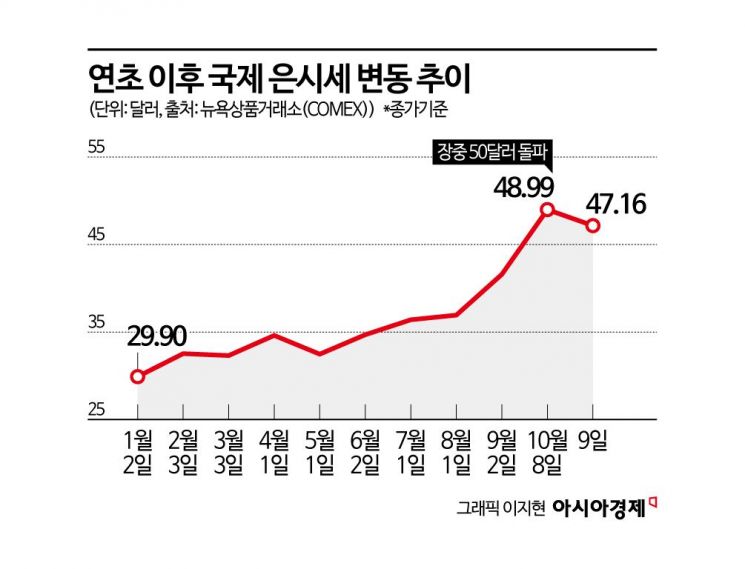

On October 8 (local time), the international price of silver surpassed the $50-per-ounce mark during intraday trading for the first time since January 1980, a span of 45 years. On the same day at the New York Commodity Exchange (COMEX), silver briefly reached $50.224 per ounce. Following profit-taking, it closed at $48.99. This represents an increase of more than 64% compared to the beginning of the year, when it was $29.90.

Silver prices remained around $30 per ounce through August this year, but began to surge last month. Growing concerns that the tariff wars and inflation issues under the Donald Trump administration would lead to a recession, combined with the shutdown of the U.S. federal government, have increased the preference for safe-haven assets. Previously, the U.S. federal government shut down after a temporary budget bill was rejected in Congress on October 1 amid a standoff between the Republican and Democratic parties. As a result, the international gold price surpassed a record high of $4,000 per ounce on October 7, and silver, another safe-haven asset, also saw its price soar.

Michael DiRienzo, CEO of the Silver Institute, a precious metals investment organization, told CNN, "As concerns about the global economy grow, investment demand is pouring into physical assets like gold and silver. Recently, silver prices had been rising slowly, but when gold surpassed its historical peak, silver also turned sharply upward. Going forward, silver is likely to follow the trend of gold prices," he predicted.

Essential for Solar Panels and AI Data Centers... Increasing Industrial Applications

Along with its value as a safe-haven asset, silver has recently seen a surge in industrial demand as it is increasingly used in advanced technology sectors such as solar panels and AI data center construction. This is expected to further support the upward trend in silver prices.

According to Bloomberg, silver is widely used as a key metal in various industries, including solar panels, smartphones, and semiconductor manufacturing, due to its excellent thermal conductivity and light reflectivity. Philip Newman, director at the mineral market consulting firm Metals Focus, stated, "Silver is not just an investment asset; it is a core material for building solar panels, wind turbines, and AI data centers. Unlike gold, where most demand is for value storage, over 80% of silver demand comes from industrial uses. Some supply shortages are also expected in the future, so silver prices are likely to rise in the medium to long term."

There is also analysis that the trade dispute between the United States and China is boosting industrial demand for silver. Greg Shearer, head of metals research at JP Morgan, said, "Chinese companies leading the global solar industry have tended to stockpile large amounts of silver, an essential material for solar panels, this year in preparation for the trade dispute with the United States."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.