Samsung Electronics and SK Hynix Hit New Highs Together

Sharp Rise in Won-Dollar Exchange Rate Emerges as a Variable

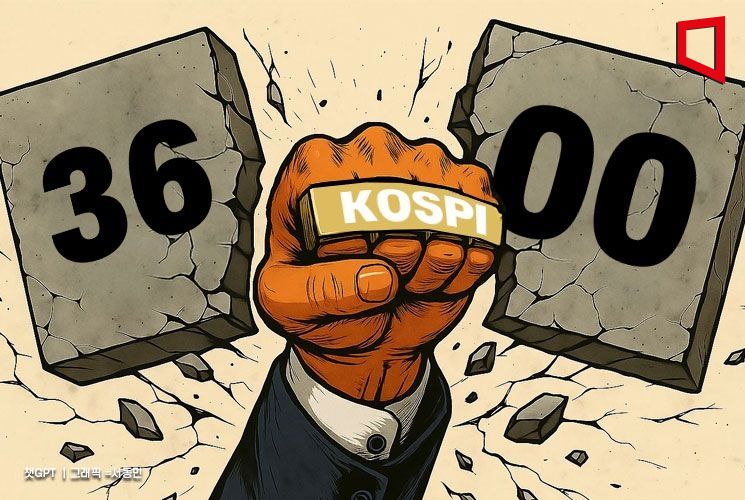

After the Chuseok golden holiday, the KOSPI resumed trading and continued its strong momentum by surpassing the 3,600 mark for the first time in history. The semiconductor 'two top' companies, Samsung Electronics and SK Hynix, once again led the rally, demonstrating their resilience.

As of 9:02 a.m. on October 10, the KOSPI was trading at 3,605.21, up 56 points (1.58%) from the previous session. The index opened at 3,598.11, up 48.90 points (1.38%), and reached the 3,600 milestone for the first time ever as foreign investors increased their buying. This comes after the index surpassed 3,500 for the first time on October 2, just before the long holiday, setting another new record.

In the Korea Exchange, foreign investors purchased 463.4 billion won worth of stocks, driving the market upward, while individual investors and institutions sold 40.8 billion won and 424.4 billion won, respectively. However, in the KOSPI 200 futures market, foreign investors showed a net selling position of about 340 billion won.

The semiconductor sector, led by the KOSPI's 'two engines' Samsung Electronics and SK Hynix, drove the upward trend. As of 9:30 a.m. that day, Samsung Electronics and SK Hynix were trading at 93,700 won (up 5.28%) and 427,000 won (up 7.96%), respectively, both hitting new 52-week highs. As a result, the semiconductor sector recorded a rise of over 6%, leading all industry sectors.

Heo Jaehwan, a researcher at Eugene Investment & Securities, said, "The outlook for semiconductor demand, confirmed by the high-bandwidth memory (HBM) supply contract with OpenAI announced before the Chuseok holiday, greatly increases the likelihood that domestic semiconductor companies' performance will improve significantly at least through 2027." He added, "This year, semiconductor companies' operating profit is expected to reach 70 trillion won, and next year, 95 trillion won."

Experts widely agree that, as major stock markets in the United States, Japan, and other countries showed strong performances centered on artificial intelligence (AI) during the long holiday, Korean semiconductor stocks are also likely to remain in the spotlight for the time being. Lee Woongchan, a researcher at iM Investment & Securities, said, "In our market, the gap between sectors that benefited from news during the holiday, such as semiconductors, power infrastructure, and inbound consumer goods, and those that did not, will widen." He added, "Afterward, the market will have to digest issues such as overheating in tech stocks, tariff negotiations, the prolonged Shut Down (temporary suspension of government work), and the earnings season."

The top KOSPI stocks showed mixed performances. LG Energy Solution dropped by more than 10%, while Hanwha Aerospace (-5.20%), KB Financial Group (-3.42%), HD Hyundai Heavy Industries (-2.84%), and Hyundai Motor (-0.45%) also declined. In contrast, NAVER (6.52%), Doosan Enerbility (4.48%), and Samsung Biologics (0.50%) posted gains. The KOSDAQ, which opened higher along with the KOSPI, turned weaker as no clear buying force emerged.

The sharp rise in the won-dollar exchange rate is also cited as a factor dampening investor sentiment. In the Seoul foreign exchange market, the won began trading at 1,423.0 per dollar, up 23.0 won from the previous day.

Lee Sunghoon, a researcher at Kiwoom Securities, said, "While the sharp rise in the exchange rate is being discussed as a potential risk factor, temporary price corrections may occur due to macroeconomic uncertainty stemming from the Shut Down, the burden of soaring stock prices since September, and the possibility of a short-term concentration in the semiconductor sector. However, considering the AI momentum, third-quarter earnings, and policy expectations, the upward trend remains intact."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.