Samsung and SK Secure a Solid "Cash Cow" Despite Economic Slowdown

DRAM Spot Prices Rise 5% in a Month

Memory Leaders Anticipate Prolonged Supercycle

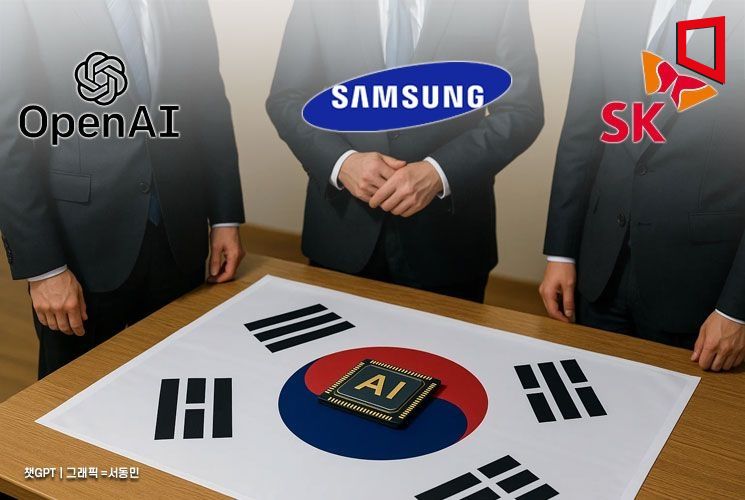

Samsung Electronics and SK Hynix have joined forces with OpenAI, the “big fish” of the artificial intelligence (AI) market, riding the wave of a semiconductor supercycle. This partnership gives them the opportunity to secure new semiconductor demand worth up to 100 trillion won over the next four years. If they successfully execute the globally anticipated “Stargate Project,” they could also secure a massive pool of potential customers, and there are high expectations that the technological prowess of these two market-leading companies will be sufficient to achieve this.

According to the semiconductor industry on October 2, Samsung Electronics and SK Hynix each signed a Letter of Intent (LOI) for the supply of AI memory semiconductors with Sam Altman, CEO of OpenAI, the previous day, announcing their participation in the Stargate Project.

It has been reported that OpenAI requested a monthly supply of up to 900,000 wafers of high-bandwidth memory (HBM), which is twice the current global HBM production capacity. Considering that the HBM market is valued at $34 billion (approximately 48 trillion won) this year, this translates to an order worth up to 100 trillion won. The volume for the Stargate Project alone secures a massive “cash cow” that will guarantee strong performance for several years.

Although the LOI is not legally binding at this stage, the semiconductor industry believes that both companies are well positioned to secure concrete orders. An industry insider stated, “Samsung Electronics has established itself as a comprehensive semiconductor company, covering chip design, production, foundry (semiconductor contract manufacturing), and advanced packaging capabilities, and now has the opportunity to fully capitalize on this. There is also no doubt that SK Hynix is the dominant player in HBM.”

The explosive growth in AI demand is granting new leadership to these two companies, which have long dominated the global memory market. The so-called “Memory Wall” phenomenon is a key differentiator: memory semiconductors are struggling to keep pace with the rapid advances in graphics processing units (GPUs) that power AI accelerators. Improving power efficiency is also a major challenge. This is why OpenAI has turned to Samsung Electronics and SK Hynix, both of which possess the required technological capabilities.

Samsung Electronics Chairman Lee Jae-yong shakes hands with Sam Altman, CEO of OpenAI, at Samsung Electronics Seocho Building on the 1st during the signing ceremony of the Letter of Intent (LOI) for mutual cooperation to establish global AI core infrastructure. Samsung Electronics

Samsung Electronics Chairman Lee Jae-yong shakes hands with Sam Altman, CEO of OpenAI, at Samsung Electronics Seocho Building on the 1st during the signing ceremony of the Letter of Intent (LOI) for mutual cooperation to establish global AI core infrastructure. Samsung Electronics

If Samsung Electronics adds OpenAI to its client list alongside Tesla and Apple, it could reverse years of sluggish semiconductor performance. The company can offer not only chip supply but also integrated solutions that combine packaging, memory, and system semiconductor technologies. SK Hynix captured 62% of the global HBM market in the second quarter of this year. For next-generation HBM4, SK Hynix has already established a mass production system, and Samsung Electronics is set to begin mass production within the year.

In particular, as global DRAM prices have recently surged, the memory market is showing signs of recovery, and there are projections that this collaboration will further strengthen the upward momentum of the semiconductor cycle. Last month, the fixed transaction price for PC DRAM exceeded $6.30, rising more than 10% from the previous month-the first time in about six years that it has surpassed the $6 mark. The spot price for leading products also rose by more than 5% during the same period, reaching $6.36.

An industry official commented, “Despite risk factors such as the global economic slowdown and trade uncertainties stemming from the United States, expectations for a memory supercycle are growing. At a time when AI demand is reshaping the market, this mega-project gives us the opportunity to secure stable performance in both domestic and international markets for an extended period.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)