Household Debt Growth in September Slows to One-Third of Previous Month

Mortgage Loan Growth Hits 11-Month Low, Unsecured Loans Turn Negative

Loan Demand Persists Amid Expectations of Rising Real Estate Prices

The increase in household debt in September was reduced to one-third of the previous month's level. In particular, the growth in mortgage loans reached its lowest point in 11 months, indicating that the effects of the June 27 measures are becoming visible. Credit loans, which had also risen alongside mortgages due to the so-called 'Yeongkkeul' (all-in real estate investment) demand, have also shifted to a downward trend.

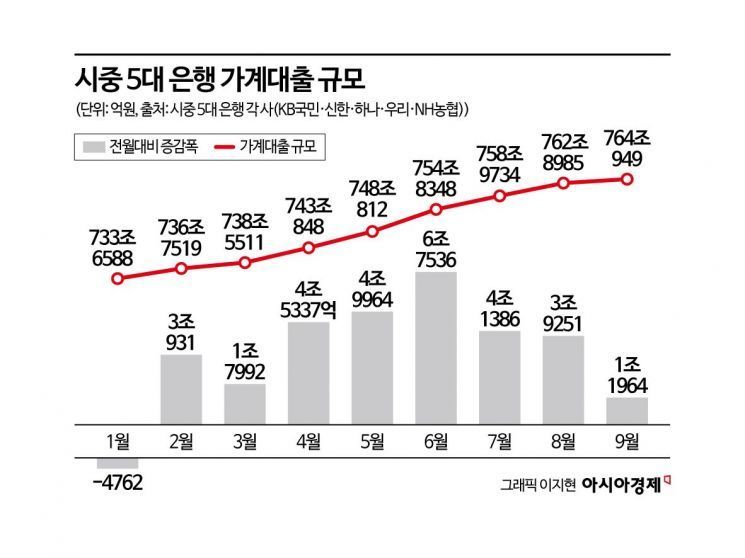

According to the banking sector on October 2, the outstanding balance of household loans at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) as of the end of September stood at 764.0949 trillion won. This represents an increase of 1.1964 trillion won from the previous month (762.8985 trillion won). Although the increase continued, the pace slowed significantly. The increase is only one-third of the previous month's rise (3.9251 trillion won) and just one-fifth of the largest monthly increase this year, which occurred in June (6.7536 trillion won). Excluding January, when there was a month-on-month decrease, this is the smallest increase so far this year.

In particular, the slowdown in mortgage loan growth among household loans was notable. The outstanding balance of mortgage loans in September increased by only 1.3135 trillion won from the previous month, reaching 608.9848 trillion won. This is just one-third of the previous month's increase (3.9251 trillion won) and marks the lowest monthly growth in 11 months since October of last year (1.3923 trillion won). This is in stark contrast to just two or three months ago, when monthly increases exceeded 4 to 5 trillion won.

Credit loans also turned to a decline. As of the end of September, the outstanding balance of credit loans at the five major banks was 103.8079 trillion won, down by 271.1 billion won from the previous month.

This slowdown in household loan growth is attributed to the effects of the June 27 measures and the September 7 follow-up measures. The loan-to-value (LTV) ratio for regulated areas was reduced from 50% to 40%, and the mortgage loan limit was capped at 600 million won. In addition, stricter management of the total volume of household loans by banks in the second half of the year, combined with the complete suspension of loan broker channels, appears to have suppressed loan demand.

A commercial bank official stated, "Banks usually place more emphasis on household loan management in the second half of the year when formulating business strategies, but with household loans nearly halved in the second half, most banks have already exceeded or are close to reaching their new total volume targets. As a result, banks have no choice but to continue tightening household loans."

While the growth in household loans has slowed, the upward trend in housing prices, especially in Seoul, has not subsided. According to the Korea Real Estate Board, apartment sale prices in Seoul rose by 0.19% in the fourth week of September. This is a wider increase than the previous week (0.12%) and marks the third consecutive week of gains. The rise was particularly pronounced in areas with excellent infrastructure and proximity to the Han River, such as Seongdong-gu (0.59%), Mapo-gu (0.43%), Gwangjin-gu (0.35%), Songpa-gu (0.35%), and Gangdong-gu (0.31%).

Despite the June 27 and September 7 measures, the continued rise in housing prices centered on Seoul has prompted the government to hint at additional measures. After the June 27 loan regulations, Seoul apartment prices had slowed, but they began to rise again after the September 7 measures. The Financial Services Commission is considering applying the debt service ratio (DSR) regulations to jeonse loans and policy loans, or further lowering the guarantee ratio for jeonse loans. There is also strong discussion about designating popular areas such as the 'Han River Belt' (Mapo, Yongsan, Seongdong) and regions like Gwacheon and Bundang in Gyeonggi Province as regulated areas. The possibility of lowering the mortgage loan limit from 600 million won to 400 million won is also being mentioned in the market. In fact, Financial Services Commission Chairman Lee Eogwon has stated, "We will closely monitor trends in the real estate market and household debt and will prepare countermeasures whenever necessary."

A banking sector official said, "With the possibility of additional regulations being discussed, inquiries from customers looking to purchase real estate are continuing. Although the growth in household loans has slowed, expectations for rising real estate prices persist, so it is too early to be relieved."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.