Increase Far Surpasses 1.8 Trillion Won in the First Half

Average SME Loan Rate Falls Below 5% Annually

Technology Credit Loans Rebound After Hitting Bottom

With commercial banks actively aligning themselves with the government's "productive finance" policy, loans to small and medium-sized enterprises (SMEs) have surged in the second half of this year. In just the past three months, approximately 7 trillion won has been lent out. This stands in stark contrast to the first half of the year, when subdued demand and a cautious lending approach led to weak performance. As even the heads of major financial institutions are directly responding to the call for a shift toward productive finance, SME lending is expected to continue growing in the future.

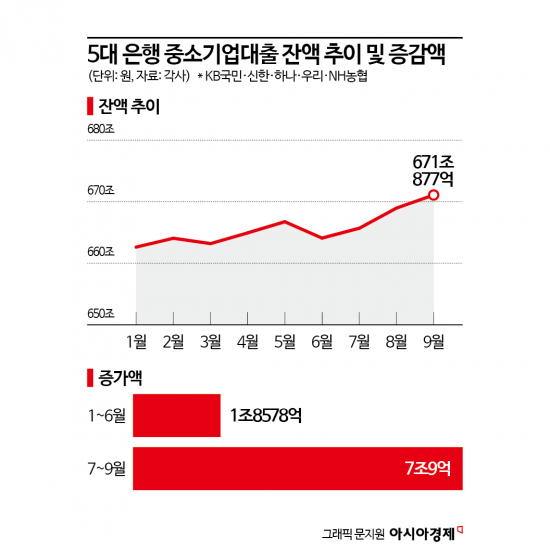

According to the financial sector on October 2, the outstanding balance of SME loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 671.0877 trillion won as of the end of last month, an increase of 2.1255 trillion won in just one month.

SME lending has been increasing noticeably in the second half of the year. Since turning to an upward trend in July, the outstanding loan balance has grown for three consecutive months. From July to September, the increase totaled 7.009 trillion won, far surpassing the 1.8578 trillion won increase in the first half. In August alone, the balance rose by 3.2762 trillion won, marking the largest monthly increase so far this year.

The rapid growth in SME loans at the five major banks is closely linked to the recent emphasis on "productive finance" in the financial sector. Financial authorities are strongly urging banks to shift their business models from a focus on real estate-secured lending to corporate finance and venture capital, that is, productive finance. A financial industry official stated, "In the first half of the year, there was not much demand from companies for loans, and banks were not proactive due to concerns about asset quality. However, with stricter regulations on household loans and a greater emphasis on productive finance, the attitude toward SME lending is changing."

As a result, interest rates on SME loans at banks are also falling rapidly. According to the Korea Federation of Banks, the average interest rate for unsecured SME loans at the five major banks fell below 5% to 4.95% per annum as of the end of September. This is down 0.08 percentage points from the previous month (5.03%) and 0.85 percentage points compared to January this year (5.8%). This decline is partly due to a general drop in benchmark interest rates, but it is also the result of banks increasing preferential rates and lowering additional margins.

The supply of "technology credit loans," which are recognized as a representative productive finance product, has also started to increase. As of the end of August, the outstanding balance of technology credit loans at the five major banks was 156.6646 trillion won, up 1.3053 trillion won from the previous month. During the same period, the total outstanding balance of technology credit loans across all banks increased by 2.1589 trillion won, with the five major banks accounting for 60% of the total. Technology credit loans are a system in which companies can receive loans based on their technological capabilities and commercialization potential, even if they lack sufficient collateral such as sales or assets.

Since their introduction in 2014, technology credit loans have been regarded as a key funding source for SMEs and venture companies. However, as evaluation criteria tightened in 2023 and banks placed greater emphasis on asset quality, the outstanding balance gradually declined. According to the Korea Federation of Banks, the outstanding balance of technology credit loans, which was 309 trillion won in June last year, had decreased to 302 trillion won by January this year. The number of technology credit loans also failed to recover after falling below 700,000 in July last year.

However, in August this year, technology credit loans posted their largest monthly increase, showing signs of a rebound. This is because banks have begun to actively invest in innovative industries in line with the government's productive finance policy.

Shinhan Financial Group was the first among commercial banks to establish a dedicated agile team to support the "15 Leading Projects for the Ultra-Innovative Economy," and has also begun hiring specialized personnel. KB Financial Group launched the "Productive Finance Council" on September 30, with participation from key executives of its major affiliates, and publicly announced a rebalancing of its loan portfolio away from real estate. Woori Financial Group Chairman Lim Jongryong personally announced a plan to invest 73 trillion won over the next five years and set a goal to increase the share of corporate loans at Woori Bank to 60%.

Hana Financial Group has also identified three core initiatives in line with the policy shift: supplying productive capital, expanding venture investment, and participating in the National Growth Fund. NH Nonghyup Financial Group established a company-wide "Productive Finance Activation Task Force" led by the chairman of the financial holding company just yesterday.

These moves are also related to a growing determination to strengthen corporate finance as government regulations on household loans have put the brakes on mortgage lending. In fact, as banks have stepped up their corporate lending, the outstanding balance of large corporate loans also surpassed 170 trillion won as of the end of September. Since turning to an upward trend in August, the balance increased by an additional 2.1415 trillion won last month. A financial industry official commented, "Various conditions are driving the expansion of SME lending. However, expanding venture capital is bound to affect non-performing loans and delinquency rates, so effective risk management is critical."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)