Lee Yonghan of Wonik Tops Growth Rate

Seven Group Leaders See Stock Wealth Rise Over 20%

Stock Value Drops for Bang Si-hyuk, Jang Byungkyu, and Others

In the third quarter of this year, the combined stock valuation of major conglomerate leaders in South Korea increased by more than 4 trillion won. Among the leaders of 45 conglomerates, the stock assets of 21 individuals increased, which is less than half, while the stock value of 24 individuals decreased, resulting in mixed fortunes.

According to the "2025 Q3 Changes in Stock Valuations of Major Conglomerate Leaders" report released by the Korea CXO Institute on October 1, the combined stock valuation of the 45 conglomerate leaders stood at 7.4289 trillion won at the end of June, but grew by 5.8% to 7.83004 trillion won by the end of September.

The highest rate of increase was recorded by Lee Yonghan, Chairman of Wonik, whose stock valuation soared by 93.8% in three months, rising from 168.4 billion won to 326.3 billion won. This was attributed to the 167.8% increase in the share price of Wonik Holdings and the 32.4% rise in Wonik QNC. Jeon Phillip, Chairman of Paradise, also saw a 38.2% increase in the same period, reaching 502.6 billion won. This was due to the share price of Paradise’s common stock held by Chairman Jeon rising from 15,270 won to 21,100 won per share.

A total of seven conglomerate leaders saw their stock assets increase by more than 20%. This group includes Lee Jae-yong, Chairman of Samsung Electronics; Cho Hyunjoon, Chairman of Hyosung; Chung Mongjin, Chairman of KCC; Lee Woo-hyun, Chairman of OCI; and Chung Mongjoon, Chairman of the Asan Foundation (HD Hyundai). In particular, Chairman Lee Jae-yong’s stock assets were valued at 15.2537 trillion won at the end of June, but this figure rose to 18.976 trillion won by the end of September.

Chairman Cho Hyunjoon’s stock valuation increased by 23.4% over the same period, from 1.8201 trillion won to 2.2458 trillion won. Chairman Cho holds shares in seven companies, including Hyosung Heavy Industries, Hyosung, and Hyosung TNC. Among these, the share price of Hyosung Heavy Industries rose by 50.4% and Hyosung’s share price increased by 11.3% between the end of June and the end of September, driving up Chairman Cho’s total stock value by more than 20%.

Chung Mongjin, Chairman of KCC, saw his stock valuation rise by 23.1% over the past three months, from 554.5 billion won to 682.4 billion won. Chairman Chung holds shares in only one company, KCC. The share price of this company increased by 23.1%, from 312,000 won at the end of June to 384,000 won at the end of September, resulting in a proportional increase in his stock valuation.

Lee Woo-hyun, Chairman of OCI, had stock assets valued at 97.5 billion won at the end of June, but this rose by 21.1% to 118.3 billion won at the end of September, allowing him to join the "100 billion won club." Chung Mongjoon, Chairman of the Asan Foundation and leader of HD Hyundai Group, also saw his stock value rise from 2.7209 trillion won to 3.2651 trillion won in the third quarter alone, a 20% increase. The share price increases of OCI Holdings and HD Hyundai directly contributed to the rise in the stock values of Chairman Lee Woo-hyun and Chairman Chung Mongjoon, respectively.

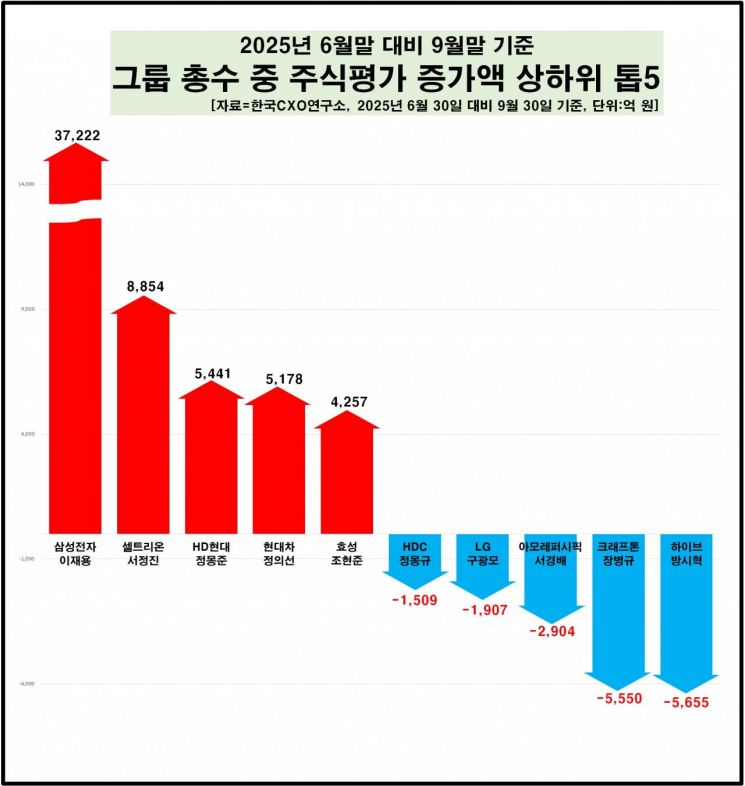

Among the 45 conglomerates, Lee Jae-yong, Chairman of Samsung Electronics, saw the largest increase in stock assets in the third quarter. Over the past three months, Chairman Lee’s stock assets increased by more than 3.7222 trillion won, the highest among all. He was followed by Seo Jungjin, Chairman of Celltrion (an increase of 885.4 billion won), Chung Mongjoon, Chairman of the Asan Foundation (an increase of 544.1 billion won), and Chung Euisun, Chairman of Hyundai Motor Company (an increase of 517.6 billion won), all of whom saw their stock values increase by more than 500 billion won in the third quarter alone.

On the other hand, Bang Si-hyuk, Chairman of HYBE, saw his stock valuation fall from 4.0637 trillion won at the end of June to 3.4982 trillion won at the end of September, a decrease of more than 565.5 billion won over the past three months. This represents a 13.9% decline in the third quarter. This was influenced by the drop in the share price of HYBE’s common stock from 309,000 won on June 30 to 266,000 won on September 30. Jang Byunggyu, Chairman of Krafton, also saw his stock assets decrease by more than 555 billion won over the past three months. In addition, Seo Kyungbae, Chairman of Amorepacific (down 290.4 billion won), Koo Kwangmo, Chairman of LG (down 190.7 billion won), and Chung Monggyu, Chairman of HDC (down 150.9 billion won), all saw their stock assets decrease by more than 150 billion won in the third quarter.

As of the end of September, 16 out of the 45 conglomerate leaders surveyed were members of the "1 trillion won club," which is the same number as at the end of March and June.

Oh Ilseon, head of the Korea CXO Institute, commented, "Among the 140 or so stocks held by conglomerate leaders, the ratio of those whose share prices fell compared to the end of June to those that rose was about 6 to 4. In the fourth quarter, the focus will be on how many stocks will see price increases, when Chairman Lee Jae-yong’s stock assets will surpass 20 trillion won, and whether the all-time domestic record of 22 trillion won set by the late Chairman Lee Kun-hee will be broken within this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)