Up 40% since the start of the year... "Driven by expectations of rate cuts"

"If gold prices feel too high, consider ETFs or other precious metals"

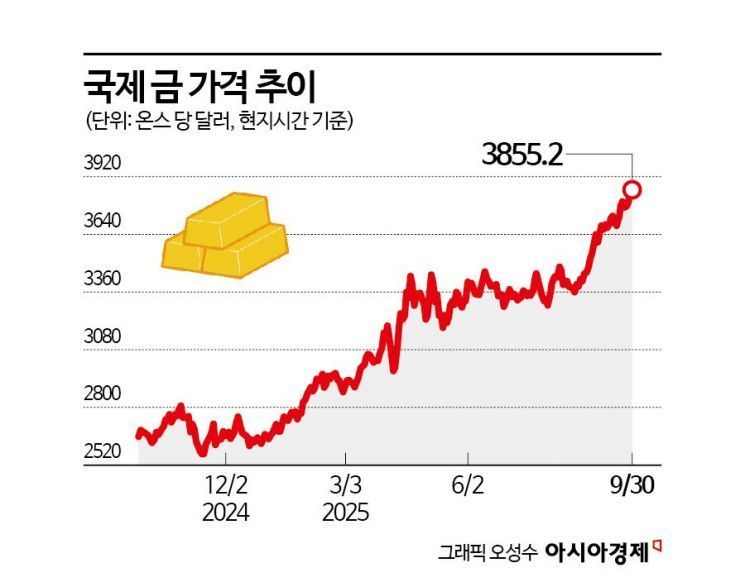

The price of gold has surged by 40% compared to the end of last year, reaching its highest level of the year. The recent rally has accelerated as expectations for interest rate cuts in the United States have pushed gold prices higher.

The financial investment industry is betting on further increases. With the Federal Reserve maintaining a policy of lowering its benchmark interest rate, gold's appeal as an inflation-hedging asset has grown stronger.

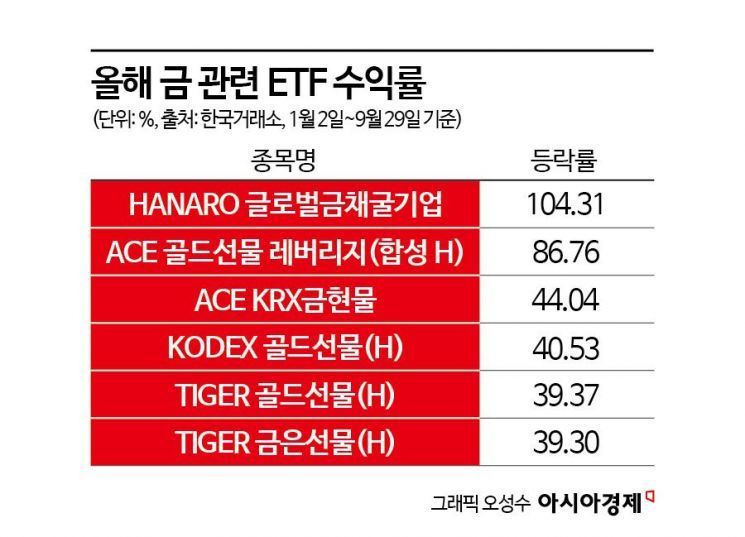

According to the Korea Exchange on September 29, the price of gold per ounce stood at $3,812.76. This represents a 44.73% increase from $2,634.30 on January 2 of this year. Related exchange-traded funds (ETFs) have also posted significant gains. During the same period, the HANARO Global Gold Mining Companies ETF soared by 104.31%, and the ACE Gold Futures Leverage (Synthetic) ETF jumped by 87.76%.

Gold up 45% this year... "Driven by Expectations of Rate Cuts"

Gold prices continued to rise in the first half of this year. Starting at $2,600 at the beginning of the year, prices surpassed $3,000 in March and $3,400 in April. Since the end of the Federal Reserve's tightening cycle in the fourth quarter of 2023, expectations for monetary policy easing have played a role. Gold prices then hovered around the $3,400 level until August, as the United States intensified its trade war and the Fed adopted an uncertain stance on its benchmark rate. However, this did not reverse the overall upward trend. Gold, which had stalled, resumed its rapid ascent in September, rising by more than 9% in just one month.

Ha Geonhyeong, a researcher at Shinhan Securities, explained, "Central banks in major countries have continued to buy gold as global fragmentation has intensified. Financial repression policies, characterized by artificially low interest rates in advanced economies, have triggered concerns over fiscal soundness and inflation, which in turn have stimulated gold purchases."

A representative from Korea Investment Management stated, "In the first half of the year, the impact of a weak dollar and concerns over stagflation were significant, while now, the Federal Reserve's monetary policy easing is the main driver of the current rally."

Last month, Federal Reserve Chair Jerome Powell's remarks at Jackson Hole reignited expectations for rate cuts. Hwang Byungjin, a researcher at NH Investment & Securities, said, "Chair Powell's comments that 'the short-term risk to employment is to the downside, while the risk of inflation is to the upside' have enhanced the appeal of gold and the precious metals sector as representative safe-haven and inflation-hedging assets."

A representative from Samsung Asset Management commented, "As global uncertainty rises, gold ETFs are emerging as a leading safe-haven investment. Expectations for US rate cuts and the occurrence of global conflicts in various regions are also contributing to the rise in gold prices."

Gold Prices Expected to Continue Rising, but If the Burden Is High... "Consider Investing in ETFs or Other Precious Metals Like Silver"

The financial investment industry expects gold prices to keep rising. Researcher Hwang said, "As long as the Federal Reserve maintains its monetary policy easing, the outlook remains strong for precious metals such as gold and silver."

A representative from Korea Investment Management also predicted, "Since the Russia-Ukraine war, structural gold purchases by global central banks and the decline in US real interest rates will continue to support gold prices."

However, experts advise that if the recent sharp rise in spot gold prices feels burdensome, investors should consider ETFs or other precious metals. The Korea Exchange has also urged caution, noting that gold prices traded on the KRX Gold Market have recently exceeded international prices.

An asset management representative stated, "A 'kimchi premium' phenomenon has emerged, with domestic spot gold prices forming higher than overseas gold prices, so investors should be cautious. While funds are flowing primarily into gold as a safe-haven asset, investments in silver are also recording strong returns, as silver serves both as a safe asset and for industrial demand."

A representative from Korea Investment Management added, "If gold prices seem too high, related ETFs can be an alternative. Gold spot ETFs can be divided into spot-based and futures-based types. Spot-based products are likely to be more popular among investors, as they avoid rollover (contract switching) costs compared to futures-based ETFs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.