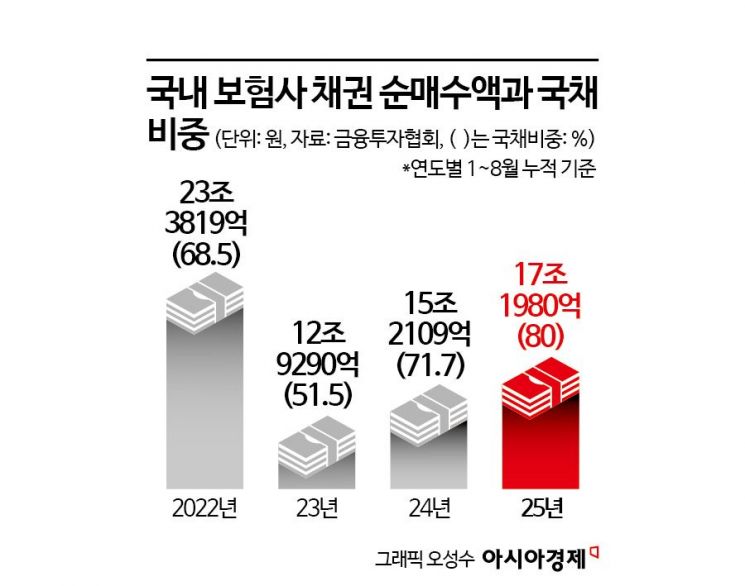

This year, government bonds account for 80% of insurers’ net bond purchases... Up 29 percentage points in two years

Financial authorities lower investment risk coefficients to promote productive finance, but clear limitations remain

"Comprehensive c

In line with the policy direction of the Lee Jaemyung administration, "productive finance" has become a key topic in the financial sector. Banks have already announced investment plans totaling 80 trillion won and established dedicated teams, moving quickly to implement these strategies. In contrast, the insurance sector is showing clear signs of hesitation. This is because, amid successive capital adequacy regulations that have reduced their capacity for dividends, insurers are reluctant to make additional investments. Without fundamental regulatory reforms in insurance accounting, it is expected that the participation of the insurance sector in productive finance will remain difficult.

According to the Bond Information Center of the Korea Financial Investment Association on September 30, domestic bond net purchases by insurance companies from January to August this year amounted to 17.198 trillion won, a 13% increase compared to the same period last year. Of this, government bonds accounted for 80%, the highest proportion in the past four years. In 2023, when the International Financial Reporting Standards (IFRS17) were introduced, government bonds made up 51.5% of insurers' net bond purchases for the January to August period, but this figure has risen by about 29 percentage points in just two years. As insurance companies significantly increase their holdings of government bonds, which are considered safe assets, their capacity to invest in productive finance areas such as venture capital and infrastructure is correspondingly diminished.

The increase in the proportion of government bond purchases by insurers is closely related to the trend of declining interest rates. When interest rates are expected to fall in the future, insurers can secure long-term government bonds in advance and use their fixed rates to hedge against losses resulting from falling rates. There is also the aspect of mass purchasing long-term government bonds as part of efforts to reduce the "duration gap," a measure emphasized by financial authorities. The duration gap refers to the difference in maturity between an insurer’s assets and liabilities. When the maturity of liabilities (insurance payouts) that insurers must pay in the future matches the maturity of assets managed through premiums, the impact of interest rate changes is minimized. Since most insurance contracts are long-term, insurers must hold assets with the longest possible maturities to reduce the duration gap.

Due to these structural factors, insurance companies are hesitant to participate in productive finance. Instead, they are focusing on improving their capital adequacy ratios in preparation for the upcoming K-ICS (Korean Insurance Capital Standard) regulation, which is set to be introduced this year. This includes issuing new capital securities worth hundreds of billions of won or conducting paid-in capital increases, rather than making investments. The number of insurers suspending dividends in order to accumulate surrender value reserves is also steadily increasing.

In response, financial authorities have recently announced plans to ease the K-ICS burden by lowering the risk coefficients applied to stock and fund investments by insurance companies. K-ICS is calculated by dividing available capital by required capital, and the intent is to reduce the K-ICS burden by lowering the risk coefficients reflected in required capital. Currently, a high risk coefficient of 49% is imposed when insurers invest in unlisted stocks. For listed stocks, the coefficient is 35%, and for infrastructure or long-term stocks, it is 20%. This has been a major factor preventing insurers from actively investing in small and venture companies through policy funds such as the National Growth Fund.

However, the insurance industry believes that simply adjusting risk coefficients, without fundamentally reforming the current capital adequacy regulations, will not be enough to encourage the sector’s participation in productive finance. An industry insider commented, "Even if the risk coefficients are lowered, it will still be difficult for small and medium-sized insurers to make active investments, as all insurers are subject to the same capital adequacy regulations regardless of size. At present, insurers are preoccupied with meeting K-ICS and asset-liability management (ALM) requirements."

Kim Haesik, Senior Research Fellow at the Korea Insurance Research Institute, stated, "Even if the supply of long-term investment products such as policy funds is expanded, the current accounting standards are causing insurers to hesitate in participating in the new administration’s investment projects. This is because K-ICS and IFRS17 place restrictions on long-term investments with unstable cash flows." He added, "The current K-ICS regulation being implemented may act as a short-term restraint on long-term investments that involve high funding costs and capital burdens. It is necessary to comprehensively consider improvements to key performance indicators (KPIs), as well as ALM and productive finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.