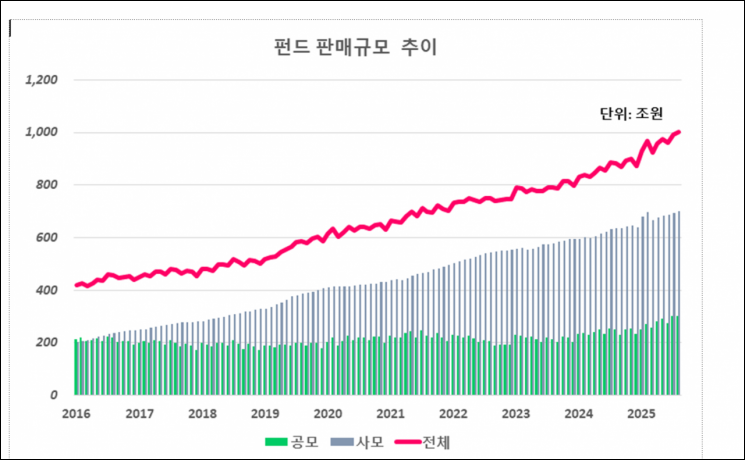

The total fund sales balance has surpassed 1,000 trillion won for the first time in history.

According to the Korea Financial Investment Association on September 29, the total fund sales balance reached 1,002.989 trillion won as of the end of last month.

The fund sales balance refers to the total amount of funds sold through financial institutions such as securities firms and banks, including their branches and online websites. Funds traded on listed markets, such as ETFs, real estate funds, and special asset funds, are excluded from this figure.

The total fund sales balance increased by 14.9%, or 130.2 trillion won, compared to 872.8 trillion won at the end of 2024.

By type, public offering funds, which are open to general investors, recorded 302.5 trillion won, a 29.8% increase from 233 trillion won at the end of last year. Private equity funds, mainly invested in by professional investors, reached 700.5 trillion won, up 9.5% from 639.8 trillion won at the end of last year.

By fund type, MMFs (Money Market Funds) accounted for 224.7 trillion won, representing 22.4% of total sales. Real estate funds followed with 185.7 trillion won (18.5%), and bond-type funds with 172.5 trillion won (17.2%).

By major financial institution, securities firms had the largest sales balance at 799.5 trillion won (79.7%). Banks recorded 112 trillion won (11.2%), and insurance companies 12.1 trillion won (1.2%).

By customer type, institutional financial corporations accounted for the largest share at 666.5 trillion won (66.5%), mainly due to retirement pensions and corporate MMFs. General corporations followed with 236.9 trillion won (23.6%), and individuals with 99.6 trillion won (9.9%).

Individual investors mainly invested in equity funds, which accounted for the largest share at 20.7 trillion won (20.7%). MMFs also showed a similar scale at 20.2 trillion won (20.3%).

The total number of fund accounts was recorded at 36.02 million. Public offering funds accounted for the vast majority with 35.93 million accounts (99.8%), while private equity funds had 90,000 accounts (0.2%).

Lee Hwantae, head of the Industry and Market Division at the Korea Financial Investment Association, stated, "Funds are the most popular and universal investment tool used for asset management and wealth growth by the public," adding, "Amid the recent trend of a major shift toward productive finance, the growth of the fund market can make a significant contribution to the renewed growth of our economy."

Including listed funds such as ETFs, the total size of the Korean fund market reached 1,308.8 trillion won in net asset value (NAV) as of the end of August. Public offering funds grew to 578.1 trillion won, while private equity funds reached 730.7 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)