62.5% of Respondents Expect KOSPI to Surpass 3,600 by Year-End

On September 29, Hanyang Securities announced the results of a survey conducted among 40 private bankers (PBs) at major branches nationwide ahead of the Chuseok holiday. The survey found that a majority of respondents believe there is a high possibility that the stock market will rise after the holiday. Regarding predictions for the KOSPI index at the end of the year, 62.5% of respondents expected it to surpass 3,600. Semiconductors were cited as the most noteworthy sector.

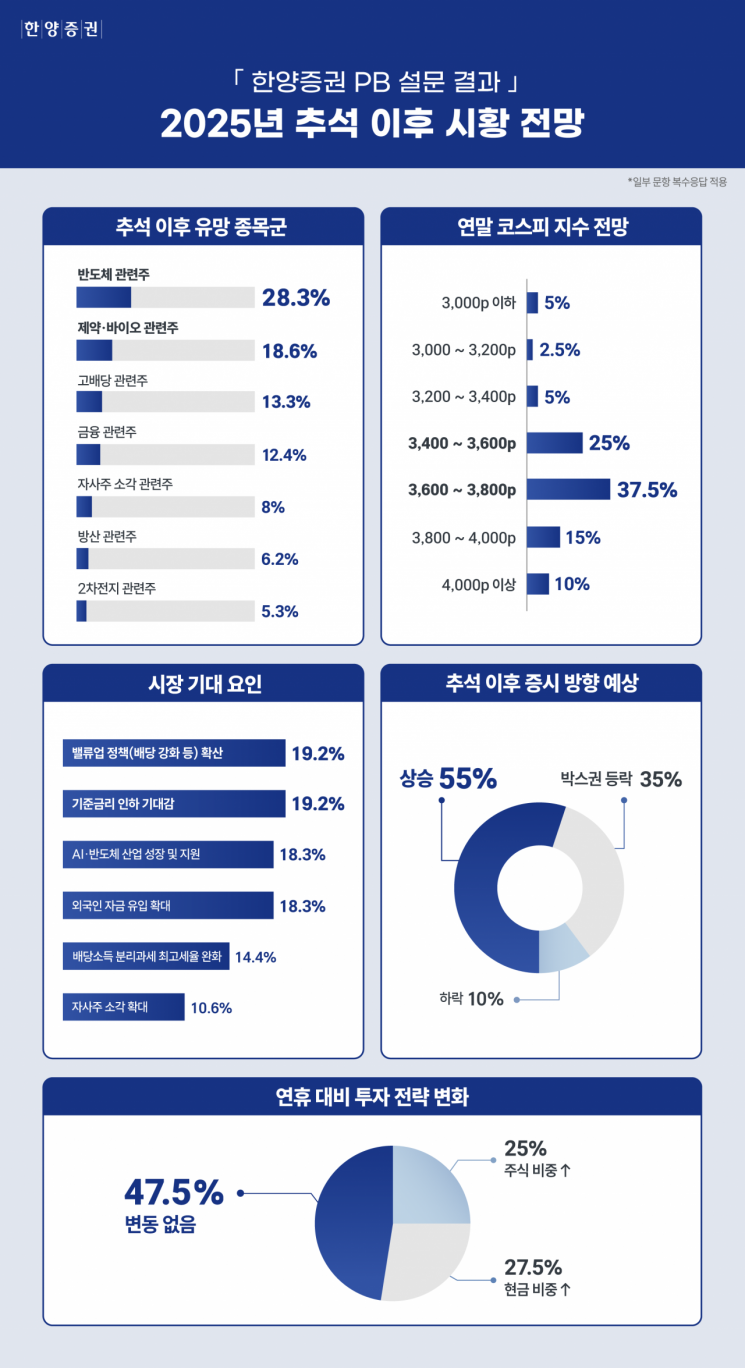

In response to the question about "market outlook after the holiday," 55% of respondents said there is a high chance of an upward trend. 35% expected the market to fluctuate within a certain range, while only 10% predicted a decline, indicating that expectations for a market rebound are relatively strong.

The optimism of PBs regarding the year-end market was also clearly evident. More than 6 out of 10 respondents anticipated that the KOSPI would exceed 3,600 by year-end. Specifically, the largest proportion of answers fell in the 3,600-3,800 range (37.5%), followed by 3,400-3,600 (25%), 3,800-4,000 (15%), and above 4,000 (10%).

Among domestic sectors considered promising after Chuseok, semiconductors ranked first (28.3%). This was followed by pharmaceuticals and bio (18.6%), high-dividend stocks (13.3%), financials (12.4%), and treasury stock cancellation (8%). A representative from Hanyang Securities analyzed, "PBs are showing a strong preference for sectors with high mid- to long-term growth potential amid market uncertainty." The sector that currently attracts the most interest from clients is also semiconductor-related stocks (29.4%), followed by defense (14.7%), pharmaceuticals and bio (12.7%), financials (11.8%), high-dividend stocks (8.8%), and treasury stock cancellation-related stocks (7.8%), showing a trend similar to the survey results.

PBs from Hanyang Securities who participated in the survey identified U.S. stock market corrections and economic slowdown (34.7%) and tariff risks (33.3%) as the main market risk factors. Interest rate and exchange rate volatility (14.7%), geopolitical risks (8%), and financial instability due to rising household debt (8%) were also cited as concerns. This suggests that, at the branch level, more attention is being paid to external factors such as global policy changes and macroeconomic trends rather than internal factors.

As for factors supporting market expectations, value-up policies (19.2%) and base interest rate cuts (19.2%) tied for first place. This was followed by the growth and policy support for artificial intelligence (AI) and the semiconductor industry (18.3%), increased inflow of foreign capital (18.3%), easing of separate taxation on dividend income (14.4%), and expansion of treasury stock cancellation (10.6%). Hanyang Securities explained that positive perceptions of policy direction are directly reflected in investment sentiment.

Regarding changes in investment strategy in preparation for the holiday, 47.5% of respondents said there was "no significant change" compared to before. 27.5% increased the proportion of safe assets such as cash, while 25% increased the proportion of investment assets such as stocks. This suggests that strategies are being developed by considering various factors such as structural growth potential and policy variables, rather than focusing solely on short-term market direction.

One PB from Hanyang Securities stated, "While expectations for economic recovery and policy direction are fueling optimism about the market, it is important to maintain a prudent and balanced approach to investment strategy," adding, "As a PB, I am committed to providing clients with sophisticated information and tailored strategies so they can make stable investment decisions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)