Most Automakers Appear Not to Reflect Tariffs in Prices

Five months after the United States imposed a steep 25% tariff on imported vehicles, car prices in the local market have risen by only 3%. This phenomenon has occurred because most global automakers have not actively reflected the increased tariff in their sales prices. For Hyundai Motor Company and Kia, which continue to see strong sales in the U.S., the situation remains such that raising prices is not an option.

Recently, as the U.S. lowered tariffs on imported vehicles from Europe (EU) from the previous 25% to 15%, following a similar move for Japan, automakers are now in a position where they may need to lower prices to stay competitive. There are growing concerns about deteriorating profitability from all angles.

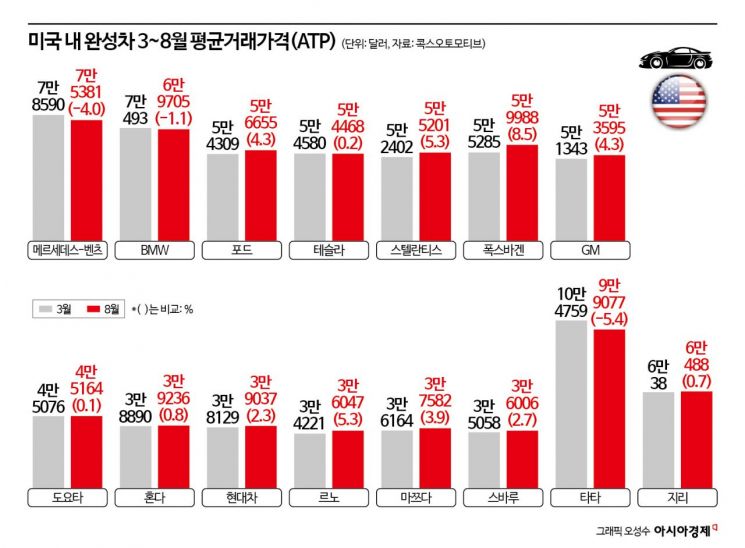

According to a comparison of the average transaction prices (ATP) of 15 automakers in the U.S., published monthly by the U.S. market research firm Cox Automotive, the ATP for the 15 companies was $47,512 (66.2 million KRW) in March. By August, it had risen to $49,077 (68.38 million KRW), an increase of about 3.2% over five months, which equates to approximately 2.18 million KRW.

Given that the tariff rate, which took effect on April 3 in the U.S., stands at 25%, the price increase is relatively modest compared to the tariff. The ATP represents the average price at which vehicles are transacted in the market, factoring in incentives and discounts offered by automakers. This suggests that most automakers have not reflected the tariff in their prices.

Hyundai Motor Company (including Kia and Genesis) saw its ATP rise from $38,129 in March to $39,037 in August, an increase of 2.3%, which is lower than the average. However, its main competitor, Toyota of Japan, raised its ATP by only 0.1%. Industry analysts attribute this difference to the varying proportions of local production between the two companies.

According to Korea Ratings, Toyota's local production ratio for vehicles sold in the U.S. is as high as 54%, while Hyundai Motor Company and Kia have a lower ratio at 42%. Notably, Volkswagen, which has only a 24% local production ratio in the U.S., raised its ATP by 8.5%, the highest among global automakers. Stellantis (5.3%), Ford (4.3%), and General Motors (4.3%) also raised their prices.

Korea Ratings stated, "Contrary to expectations that Korean companies with low local production ratios would be most affected by tariffs, U.S. companies such as Ford, which have high local production ratios, experienced a greater decline in performance." The agency added, "Hyundai Motor Company and Kia, which have strong profit-generating capabilities, can absorb the tariff burden." Hyundai's operating margin in the second quarter was 8.2%, down 2.7 percentage points from 10.9% in the same period last year, while General Motors and Ford each saw a 2.9 percentage point decline.

An industry official commented, "The fact that other automakers are not actively reflecting tariffs in their prices is an irresistible factor that compels Hyundai Motor Company to absorb the tariff and maintain its prices." The official added, "The key issue will be when the 15% tariff, agreed upon by the U.S. and South Korean governments, comes into effect."

Meanwhile, Hyundai Motor Company maintains its position that there will be no price increases due to tariffs. At a recent 'CEO Investor Day,' Jose Munoz, President of Hyundai Motor Company, stated, "The imposition of tariffs by the United States does not immediately translate into higher vehicle prices in the U.S. market," adding, "Now is the time to act smartly in the market, given the imposition of tariffs."

At the same time, Hyundai Motor Company raised its target for annual consolidated revenue growth from the previous 3-4% to 5-6%, an increase of 2 percentage points, while lowering its operating margin target by 1 percentage point, from the previous 7.0-8.0% to 6.0-7.0%, to reflect the tariff burden.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.