95% of Losses Caused by Hacking

"Request Immediate Payment Suspension Upon Detection"

#A domestic company, referred to as Company A, which imported Hungarian goose down, fell victim to email hacking. The company received an email requesting that payment accounts be changed from their usual Hungarian bank to a U.S. bank. Company A transferred approximately 230 million won (163,000 dollars), but was unable to recover the funds.

Financial Supervisory Service Headquarters, Yeouido, Yeongdeungpo-gu, Seoul. Financial Supervisory Service

Financial Supervisory Service Headquarters, Yeouido, Yeongdeungpo-gu, Seoul. Financial Supervisory Service

It has been found that domestic trading companies like Company A have suffered a total of 133 billion won in foreign exchange fraud losses over the past five years. Of this amount, 95% resulted from trade fraud involving email hacking.

According to the Financial Supervisory Service on September 29, from 2021 to the first half of this year, there were 1,591 cases of foreign exchange trade fraud through banks, with losses totaling approximately 133 billion won (95.84 million dollars). On an annual average, this equates to 318 cases and about 26.6 billion won (19.17 million dollars).

In terms of the proportion of losses by country, funds received in the United States, United Kingdom, China, and Hong Kong accounted for 61% of the total.

The main type of fraud involved criminal groups hacking into the email exchanges between overseas exporters and domestic importers, impersonating the legitimate business partners.

These groups would send false emails, including forged invoices, to domestic companies, tricking them into transferring trade payments to fraudulent accounts.

Most victimized companies only realized they had been defrauded after a significant amount of time had passed. In most cases, they were unable to recover their funds. They only became aware of the fraud after receiving notifications of non-payment or payment reminders from their counterparties.

There were also incidents where fraudsters impersonated overseas importers, exporters, government agencies, or intermediary organizations to fraudulently collect fees from domestic companies. They deceived companies by proposing intermediary roles and requesting money under the pretense of fees or commissions.

Guidelines for Responding to Suspected Trade Fraud Cases. Korea Trade-Investment Promotion Agency (KOTRA)

Guidelines for Responding to Suspected Trade Fraud Cases. Korea Trade-Investment Promotion Agency (KOTRA)

The Financial Supervisory Service advised companies to directly contact their overseas partners to reconfirm payment account information before transferring funds, especially if the payment account differs from the usual account during email-based trade transactions.

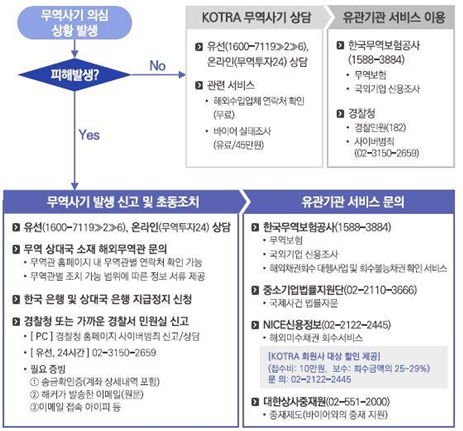

If a company becomes aware that it has fallen victim to foreign exchange trade fraud, the Financial Supervisory Service emphasized the need to immediately request a payment stop from their bank and report the incident to the Korea Trade-Investment Promotion Agency (KOTRA) and the National Police Agency.

The Financial Supervisory Service also announced that it has reached an agreement with major banks to share information on fraud cases and jointly implement preventive measures in the fourth quarter. The agency plans to revise its criteria for monitoring suspicious activity and strengthen customer guidance.

Banks will share criteria for identifying suspicious transactions, such as accounts with no deposit history for a certain period, discrepancies between the recipient and the recipient account's country, and accounts previously involved in fraudulent transactions.

They will also update customer guidance manuals regarding the details of suspicious transactions and appropriate response measures.

A Financial Supervisory Service official stated, "We will continue to work with the banking sector and other stakeholders to develop and implement measures to eradicate trade fraud losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.