Steady Growth Since First Surplus in 2014

Continued Expansion Expected on the Back of Current Account Surpluses

Asset Holdings Deemed Well-Diversified

40% in Equities and Bonds, 60% in US Dollar-Denominated Assets

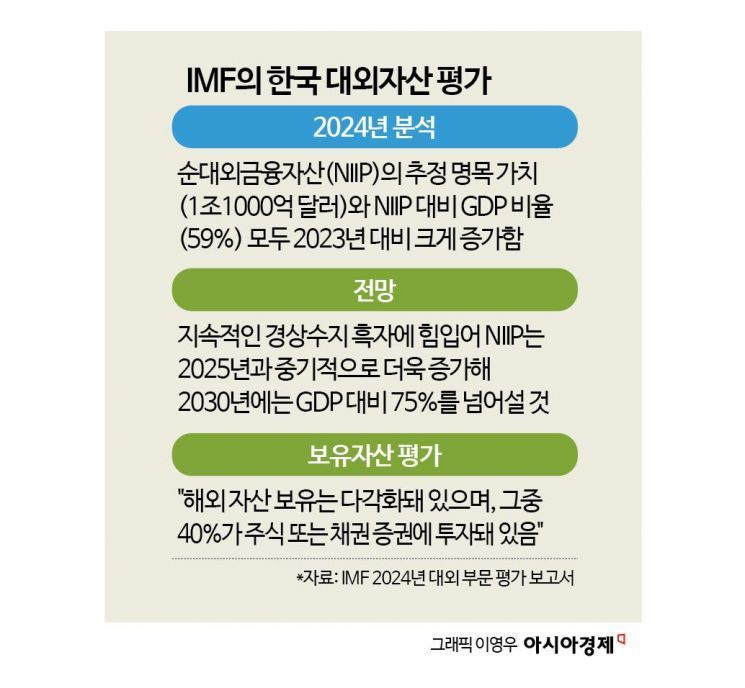

It is projected that South Korea's Net International Investment Position (NIIP) as a percentage of Gross Domestic Product (GDP) will exceed 75% by 2030, up from 59% in 2024. External assets, along with foreign exchange reserves, serve as indicators of a country's external soundness and help curb sharp currency fluctuations or net capital outflows during shock events such as a currency crisis.

According to the International Monetary Fund's "2024 External Sector Report" released on the 26th, South Korea's NIIP in 2024 was approximately $1.1 trillion, equivalent to 59% of GDP. This figure has steadily increased since first turning positive in 2014. The NIIP is calculated by subtracting foreign investment in domestic financial assets from the overseas financial assets held by domestic entities. The larger this figure, the greater the country's buffer against external shocks. In times of crisis, these assets can be sold to bring funds into the country, serving as an indirect safeguard.

The IMF expects South Korea's NIIP to continue expanding, supported by sustained current account surpluses. It projects that by 2030, the NIIP will exceed 75% of GDP. The IMF also assessed that the structure of South Korea's large-scale NIIP is diversified. "About 40% of overseas assets are invested in equities and bonds, and around 60% are denominated in US dollars, indicating a diversified overseas asset portfolio," the IMF stated.

The IMF also commented on South Korea's foreign exchange reserves, another pillar of the country's economic stability. It noted, "South Korea's foreign exchange reserves provide sufficient liquidity buffers even under various realistic shock scenarios." As of the end of 2024, South Korea's foreign exchange reserves were evaluated as follows: 22% of GDP, 2.1 times the amount of short-term external debt, covering 6.4 months of imports, and equivalent to 13% of broad money supply (M2). The IMF concluded that these levels are within a stable range and are sufficient by international standards.

There remains ongoing debate over the optimal size of foreign exchange reserves. Major economies like the United States estimate the extent of market intervention by monitoring changes in foreign exchange reserves, so authorities face the challenge of striking a balance between minimizing intervention signals and maintaining sufficient defensive capacity. Common benchmarks include whether reserves are sufficient to cover short-term external debt maturing within one year, whether they can finance at least three months of imports during a crisis, and whether reserves amount to at least 5% of broad money supply to guard against capital flight during a currency crisis.

Japan's NIIP Reaches 90% of GDP

Japan, the world's largest holder of net external assets, recorded a NIIP of $3.6 trillion at the end of 2024. This is equivalent to 90% of GDP, a significant increase from 80% in 2023. The IMF analyzed that "Japan's NIIP is significantly higher than the pre-pandemic (2016-2019) average of 62%, driven by increased net outward foreign direct and portfolio investment and positive effects from the depreciation of the yen."

The safety of Japan's external assets is also high. Portfolio investment accounts for 42% of Japan's overseas assets, and foreign direct investment (FDI) makes up 21%, indicating effective risk diversification. Of the portfolio investments, 56% are denominated in US dollars. Last year, Japan's net investment return was 7.4%, higher than the pre-pandemic average of 6.2%. Japan's large-scale external assets also help supplement consumption in an aging society.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.