Frozen Gimbap Hit by U.S. 'Tariff Bomb,' Exports Decline

Gimbap Struggles While Ramen Thrives: Contrasting Fortunes for K-Food Exports to the U.S.

Frozen Gimbap Falters Under Tariffs, While Buldak and Sauces Reach Record Highs

Frozen gimbap is struggling in the United States, the largest export market for Korean rice processed foods, due to tariff barriers.

According to the Ministry of Agriculture, Food and Rural Affairs and the food industry on September 28, the U.S. government has imposed a 15% tariff on Korean processed foods, leading to a decline in frozen gimbap exports. From January to August this year, exports of rice processed foods amounted to 183 million dollars (approximately 256.6 billion won), a decrease of 4.8% compared to the same period last year. This contrasts sharply with the more than 30% surge during the same period last year, which had continued a high-growth trend. The United States is the largest export destination for frozen gimbap. Major exporters include CJ CheilJedang, Sajo Daerim, and Olgot.

The sluggish export performance of frozen gimbap is largely due to tariffs. A representative from the Korea Rice Processing Association stated, "When a 15% tariff is applied, the price felt by consumers rises by at least 20%," adding, "Price competitiveness is rapidly weakening." The representative continued, "Local importers and distributors say they cannot bear the additional costs, and there is a tendency to reduce new orders."

Initially, frozen gimbap quickly established itself in the U.S. market by promoting its 'affordable price' and 'well-being concept.' The local retail price per roll was about 5,000 won, which was cheaper than sandwiches that typically cost 6,000 to 7,000 won. The combination of price competitiveness and the perception that it fits well with diet meals led to an explosive increase in consumer demand. In fact, last year, exports of rice processed foods reached 299.2 million dollars (about 419.5 billion won), a 38.4% increase from the previous year and an all-time high.

However, this year, the situation changed rapidly as U.S. inflation, exchange rate fluctuations, and tariffs all came into play. Since the first half of the year, U.S. buyers have been hesitant to place new orders, and some have even reduced the volume of existing contracts. An industry insider commented, "Domestic companies are trying various measures such as promotional events and strengthening local marketing, but the effects are limited," and predicted, "If the tariff burden continues, a decline in exports will be inevitable through next year." Although the recent global popularity of the Netflix animation "K-Pop Demon Hunters" has raised interest in K-food, it has not provided any significant boost to frozen gimbap exports.

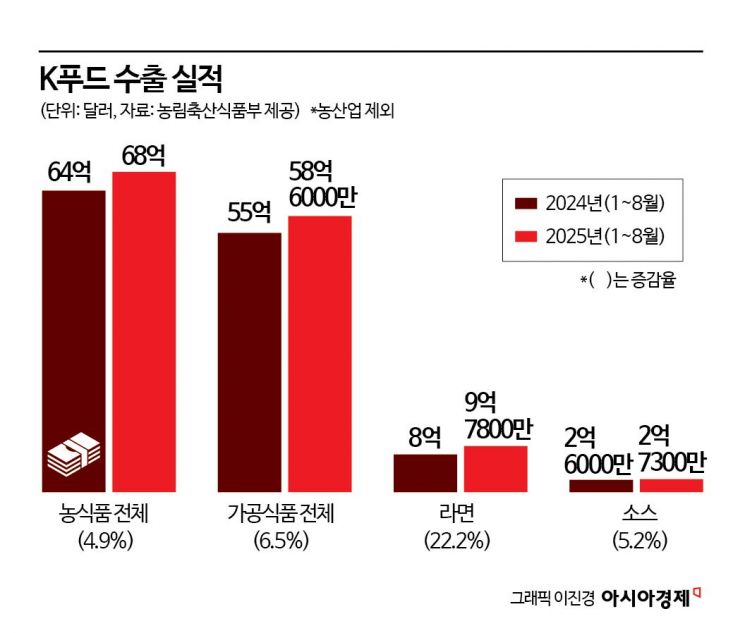

On the other hand, ramen exports are hitting record highs, as the impact of tariffs is limited. From January to August this year, ramen exports amounted to 978 million dollars, a 22.2% increase compared to the same period last year. The Ministry of Agriculture, Food and Rural Affairs stated, "The provisional total through September has already exceeded 1 billion dollars," adding, "Ramen exports are certain to surpass 1.5 billion dollars this year."

The main driver of ramen exports is Samyang Foods’ "Buldak Bokkeum Myeon series." Buldak has expanded to over 100 countries worldwide in the 10 years since its launch, and as of the first half of this year, cumulative sales have surpassed 8 billion units. This figure is nearly equivalent to the global population of 8.2 billion. Samyang Foods is expanding production capacity at its Miryang Plant 1 and 2 to meet global demand. An industry official analyzed, "The Buldak series has successfully attracted global Gen Z consumers with its 'challenging spiciness.'"

Sauce exports are also steadily increasing. From January to August, sauce exports reached 273 million dollars, up 5.2% from the same period last year. Since officially launching Buldak Sauce in 2018, Samyang Foods has expanded its lineup with products like Carbo and Nuclear Buldak, broadening its overseas market. CJ CheilJedang has developed "K-Sauce" products based on traditional fermented pastes such as gochujang, doenjang, and ssamjang, strengthening its global presence. In particular, in the United States, "Drizzle Sauce" has been placed in Walmart and Target, while in Vietnam, spicy "Hotjang" is produced locally and supplied to major supermarkets.

Daesang is also fostering sauces as a strategic product. The company exports more than 500 products based on traditional fermented pastes like gochujang and doenjang to over 40 countries, and last year’s sauce exports reached 58 billion won, an 81.2% increase compared to 32 billion won in 2018.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.