Bank of Korea's "September Financial Stability Report": Housing Prices Reviewed After Real Estate Measures

Seoul Apartment Prices Rose 0.1% Ten Weeks After June 27 Measures... Minimal Impact Compared to Previous Policies

After September 7 Measures,

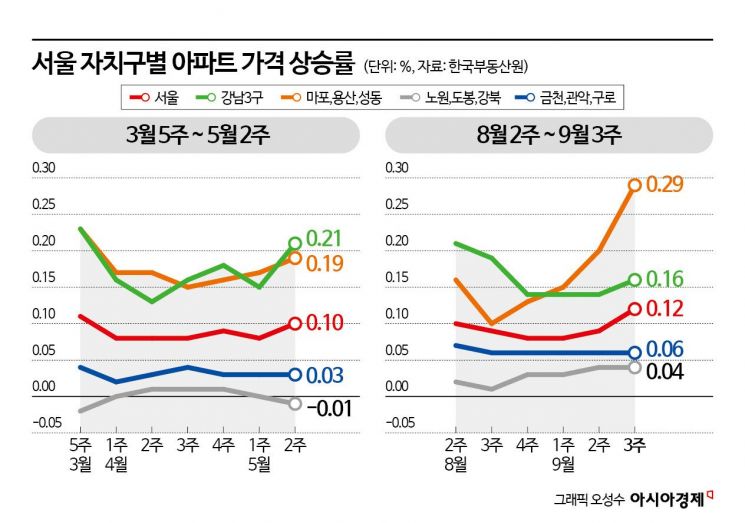

Despite the government’s repeated announcements of measures to cool down the real estate market, housing purchase sentiment-especially in Seoul-remains strong. After the September 7 measures, which focused on expanding housing supply, Seoul’s housing price growth rate actually increased compared to May, when the average price growth was similar, and the number of districts experiencing price increases also expanded. The Bank of Korea emphasized that it is necessary to continue strengthening macroprudential policies to manage expectations in the housing market.

Seoul Apartment Prices Rose 0.1% Ten Weeks After the June 27 Measures... Minimal Impact Compared to Past Policies

In its “September 2025 Financial Stability Review” released on September 25, the Bank of Korea examined trends in metropolitan housing prices and household debt following the government’s announcement of strengthened household debt management measures on June 27 and the additional housing supply and loan demand management measures on September 7. The findings showed that the slowdown in apartment sales price increases after the June 27 measures was limited compared to previous policies.

Transaction volume dropped sharply. The number of apartment transactions in Seoul fell by 64.0%, from 12,131 in June to 4,362 in July. Price growth also moderated somewhat. In June, Seoul apartment prices rose by 1.4%, marking the highest monthly increase since September 2018 (1.8%) during a period of pronounced market overheating. However, after the policy announcement, the growth slowed to 1.1% in July. Still, when comparing the post-June 27 market trend with periods following major policy announcements since 2017, the degree of slowdown was minimal. Jang Jeongsu, Director General of the Bank of Korea’s Financial Stability Department, pointed out, “After past policy announcements, the weekly sales price growth rate dropped to an average of 0.03% after ten weeks, but this time it remains close to 0.1%.”

After the September 7 measures, the increase in prices also spread to more districts. Comparing the third week of September with the second week of May-when Seoul’s average price growth was similar-not only the three Gangnam districts (Gangnam, Seocho, Songpa) and the “Mayongseong” area (Mapo, Yongsan, Seongdong), but also Nowon, Dobong, Gangbuk, Geumcheon, Gwanak, and Guro showed higher price growth rates.

“Betting on Price Increases” - Housing Purchase Sentiment Persists... Housing Price Outlook CSI Rises for Second Consecutive Month

Housing purchase sentiment has remained strong in Seoul even after the implementation of the new policies. Both the Seoul Housing Market Consumer Sentiment Index and the Housing Price Outlook Consumer Sentiment Index (CSI) fell sharply in July but still remain above the baseline of 100. In particular, the Housing Price Outlook CSI has risen for two consecutive months since August, fueling concerns that expectations for further price increases are intensifying. Demand for apartment auctions and new subscriptions also remains high.

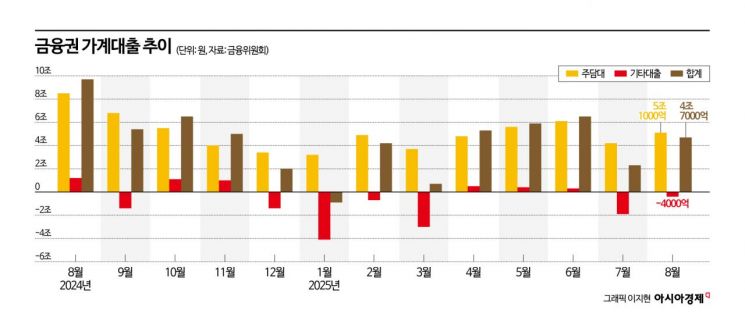

Household loans saw slower growth after the June 27 measures, but loans related to housing continue to rise. Household loans from financial institutions increased by 2.3 trillion won in July, a sharp decrease from 6.5 trillion won in June, but rose again to 4.7 trillion won in August as housing transactions from May and June were executed with a time lag. By loan type, housing-related loans continued to increase in July and August (4.2 trillion won in July, 5.1 trillion won in August), though slightly below the second-quarter level. By sector, both banks and non-bank lenders saw a significant slowdown in July, but some expansion resumed in August.

Director General Jang stated, “As the slowdown in housing price growth in Seoul and the greater metropolitan area remains limited even after the government’s real estate measures, further strengthening of macroprudential policy may be necessary. We must closely monitor price increases in certain parts of Seoul, preemptive buying before additional regulations, the degree of regional spillover, transaction volume trends, and household debt dynamics, and respond accordingly.”

Delinquency Rates for Vulnerable Household and Self-Employed Borrowers Have Risen Sharply Since the Second Half of 2022

Meanwhile, there are growing concerns as about 100 trillion won in household loans are held by “vulnerable borrowers,” defined as low-income or low-credit individuals with multiple debts. As of the end of the second quarter this year, the number of vulnerable borrowers was estimated at 1.383 million for households and 437,000 for the self-employed. They hold 99.9 trillion won in household loans and 130.2 trillion won in self-employed loans.

The delinquency rates for vulnerable household and self-employed borrowers rose sharply to 10.48% and 11.34%, respectively, since the second half of 2022. The proportion of delinquent borrowers also surged during the same period, reaching 20.1% for households and 25.6% for the self-employed by the end of the second quarter. Director General Jang noted, “With the number of vulnerable household and self-employed borrowers continuing to rise, both the rate of entering delinquency and the duration of delinquency are increasing. This raises the risk of prolonged and expanded defaults, especially among the self-employed. As these defaults can quickly spread across different financial sectors, it is necessary to strengthen credit risk management, including proactively increasing loan loss provisions.”

There is also a need for policy support to help self-employed individuals recover income, as well as tailored debt restructuring and interest burden relief for vulnerable borrowers. Recent initiatives such as the distribution of livelihood recovery consumption coupons and the expansion of the New Start Fund through the supplementary budget are expected to have a positive effect in reducing their debt burden.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.