The U.S. stock daytime trading service will be gradually resumed starting in November this year. This comes about a year after the service was suspended due to a large-scale trade cancellation incident at the U.S. alternative trading system (ATS) Blue Ocean last year.

On the 24th, the Financial Supervisory Service and the Korea Financial Investment Association announced that they plan to sequentially resume the U.S. stock daytime trading service from November this year by strengthening safety measures such as securing multiple trading channels, establishing a rollback system, and enhancing risk disclosures.

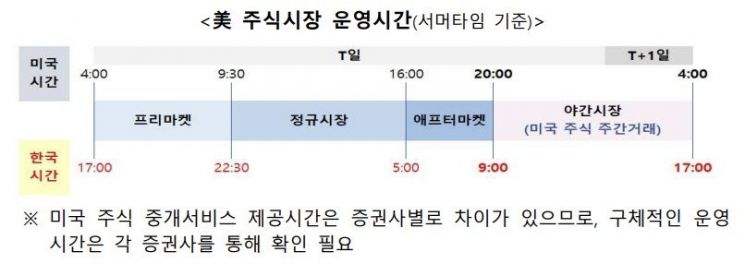

The U.S. daytime trading service allows domestic investors to trade U.S. stocks during the daytime, from 9 a.m. to 5 p.m. However, in August last year, an incident at Blue Ocean led to the mass cancellation of orders worth approximately 630 billion KRW, resulting in a complete suspension of the service.

The Financial Supervisory Service stated, "Securities firms and the association have jointly worked to identify the cause of the incident and discuss the resumption of the daytime trading service," adding, "Recently, based on the use of multiple ATS, we have decided to resume the U.S. stock daytime trading service, which has been suspended for a long period."

The Financial Supervisory Service plans to prioritize the protection of domestic investors in relation to the resumption of daytime trading and will actively ensure that sufficient safety measures are in place.

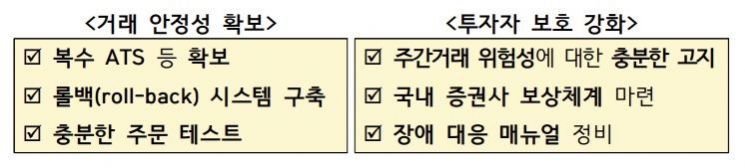

First, to ensure stability, domestic securities firms are required to connect order lines with at least two U.S. local brokers and ATS. This will enable trading to continue even if a problem occurs at a specific exchange. In addition, a rollback system has been introduced to allow order recovery by account, time slot, and execution number. Since August, mock tests have also been conducted in real trading environments for each securities firm.

For investor protection, the measures include: ▲ enhanced risk disclosures regarding liquidity shortages and price distortions ▲ establishment of a compensation system in case of incidents ▲ improvement of response manuals for system failures ▲ and the establishment of emergency contact networks with local ATS.

The Financial Supervisory Service emphasized, "Together with the association, we will closely monitor the industry's preparations to ensure the smooth resumption of the daytime trading service," adding, "If large-scale IT incidents or other problems occur after the resumption due to inadequate internal controls, we will take strict action in accordance with laws and principles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.