Key Differences in U.S. Local Production Share

Korea Ratings: "Hyundai Motor and Kia Can Absorb Tariff Burden"

Global Automakers Not Raising Prices in Line with Tariffs

U.S. Confirms 15% Tariff on European Cars After Japan

After the United States imposed high tariffs on imported automobiles, the price gap between Hyundai Motor Company and Kia and Japan's Toyota has widened. Over the past five months, Hyundai Motor Company and Kia raised their prices by 2.3%, while Toyota's price increase was only 0.1%, effectively keeping prices unchanged.

Automakers have been securing profits not by directly raising vehicle prices after the tariffs, but by reducing dealership incentives. However, as the 25% tariff rate continues, there is growing analysis that Hyundai Motor Company and Kia are facing increasing pressure in terms of price competitiveness. In particular, as the U.S. government has decided to impose a 15% tariff on European cars following Japanese vehicles, the market position of Korean cars in the United States is expected to become even more limited.

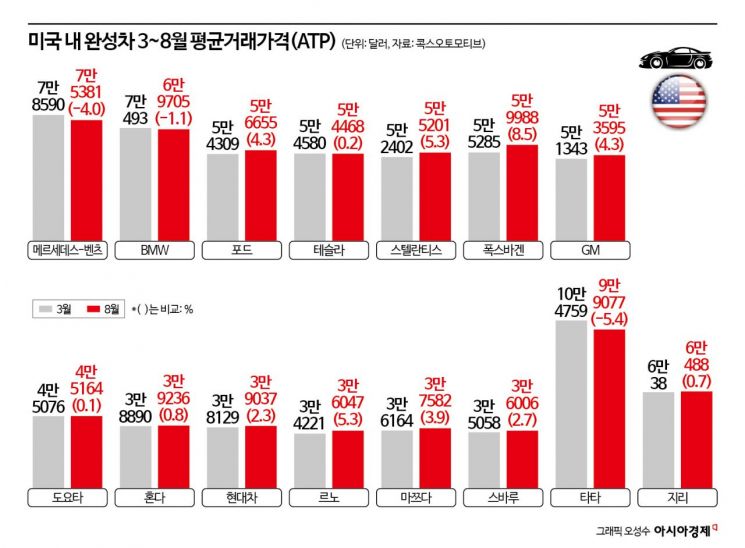

According to a comparison of the average transaction prices (ATP) of 15 major automakers, released monthly by U.S. market research firm Cox Automotive on September 25, the ATP for Hyundai Motor Company (including Kia and Genesis) rose 2.3% from $38,129 (about 53.14 million won) in March to $39,037 (about 54.40 million won) in August. This is an increase of about 1.26 million won. ATP refers to the average price at which consumers transact in the car market, reflecting final prices after incentives or discounts offered by automakers.

In contrast, Toyota (including Lexus) saw its ATP rise only 0.1%, from $45,076 (about 62.90 million won) to $45,164 (about 63.02 million won), an increase of just 120,000 won. Honda's ATP increased by only 0.8% (480,000 won), from $38,890 (54.27 million won) to $39,236 (54.75 million won).

The widening price increase gap is due to differences in the proportion of local production. According to Korea Ratings, the local production ratio for Hyundai Motor Company and Kia in the U.S. is 42%, which is relatively low, while Toyota's is 54% and Honda's is 72%. Volkswagen, which has only a 24% local production ratio in the U.S., saw its ATP increase by 8.5% during this period, the highest among global automakers.

As a result, despite raising prices, Hyundai Motor Company's operating margin in the second quarter fell to 8.2%, down 2.7 percentage points from 10.9% in the same period last year. Toyota's operating margin was 9.5%, down only 1.6 percentage points from the previous year. However, Korea Ratings commented, "Given Hyundai Motor Company and Kia's strong profit-generating ability, the tariff burden remains at a manageable level."

With competitors such as Toyota minimizing price increases, Hyundai Motor Company and Kia have even less room to raise prices. According to Cox Automotive, the average ATP for the 15 major automakers rose 3.2% over five months, from $47,512 (about 66.20 million won) in March to $49,077 (about 68.38 million won) in August.

This was a significant contrast to the 25% tariff rate that took effect in the United States last April. Jose Munoz, President of Hyundai Motor Company, recently stated at the 'CEO Investor Day' that "the imposition of tariffs by the United States does not immediately translate into higher vehicle prices." In fact, automakers are tightening their belts to the point where they are even considering price cuts.

As the U.S. government decided to apply a 15% tariff on European cars following Japanese vehicles, Hyundai Motor Company and Kia have become even more disadvantaged in the U.S. market. The U.S. Department of Commerce and the United States Trade Representative (USTR), in a pre-release of the official gazette on September 24 (local time) ahead of its official publication on the 25th, specified that tariffs on imported European cars would be retroactively applied from August 1, lowering the rate from the current 27.5% to 15%.

An industry official commented, "The fact that other automakers are not actively reflecting tariffs in their prices is a burden for Hyundai Motor Company as well," adding, "The 15% tariff agreed upon by the U.S. and Korean governments needs to be implemented quickly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.