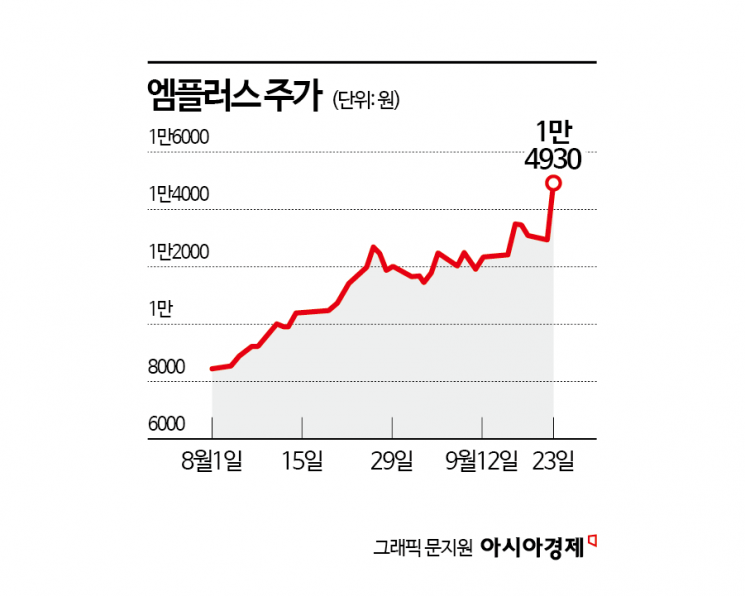

Stock Price Up 69% Since Late July

First-Half Sales Surge 105% Year-on-Year

Growth Continues with Prismatic Battery Assembly Equipment

The stock price of Mplus, a secondary battery manufacturing equipment company, has been rising sharply recently. The surge in operating profit in the first half of this year, along with expectations that this trend of improved performance will continue through next year, is driving the stock’s upward momentum.

According to the financial investment industry on September 23, Mplus shares closed at 14,930 won, up 69.9% from 8,790 won at the end of July. During this period, foreign investors and institutional investors recorded cumulative net purchases of 7.8 billion won and 2.5 billion won, respectively. The average purchase price for foreign investors was 12,114 won, resulting in an estimated return of 23%.

Mplus succeeded in developing secondary battery assembly equipment in 2008 through a partnership with A123 Systems in the United States. It is the only company in the world capable of producing the entire secondary battery assembly process as a turnkey solution. While SK Innovation, a latecomer among the three major domestic secondary battery companies, aggressively expanded its overseas plants, Mplus responded proactively and scaled up its operations. Recently, the company has expanded its business area to include prismatic battery types.

Mplus has enhanced the performance of its main products, strengthening its competitiveness in ultra-high-speed and high-precision equipment. Its flagship equipment, the 600PPM ultra-high-speed notching machine, offers a 70% reduction in capital expenditure (CAPEX).

To secure a leading position in the future battery market, Mplus is also developing next-generation battery manufacturing equipment, including solid-state batteries and lithium metal batteries. Since last year, the company has been supplying solid-state battery assembly equipment to pilot lines of battery manufacturing clients. For lithium metal batteries, Mplus is developing not only assembly equipment but also electrode manufacturing equipment that utilizes roll-to-roll lamination and vacuum deposition technologies.

In the first half of this year, Mplus recorded sales of 82.8 billion won and operating profit of 14.6 billion won, up 105% and 957%, respectively, from the same period last year.

Oh Hyunjin, a researcher at Kiwoom Securities, explained, "Performance improved as the company recognized revenue from highly profitable backlogs that were previously secured," adding, "New orders are also increasing."

The value of orders secured by Mplus in the first half of this year reached 78.1 billion won, already surpassing last year’s annual order volume. In addition to its main revenue source of pouch-type assembly processes, the company is actively responding to growing demand for prismatic battery equipment. Kiwoom Securities estimates that Mplus will achieve sales of 170.9 billion won and operating profit of 23.3 billion won this year, up 33% and 131%, respectively, from last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.