Joint Response Team Uncovers 100 Billion Won Stock Manipulation Scheme

First Administrative Fine Imposed for Major Unfair Trading Practices

...Double the Illicit Gains Recovered

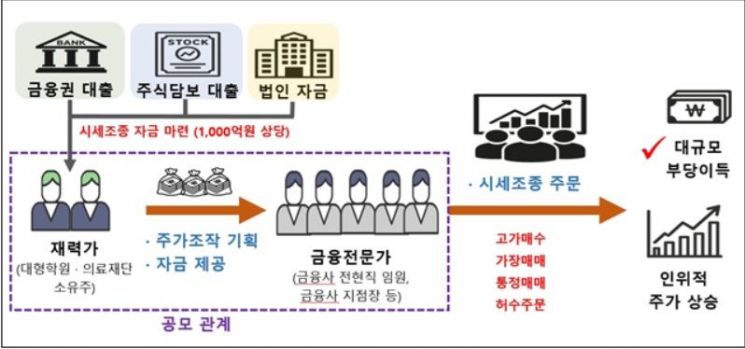

President Lee Jaemyung's strong warnings against unfair practices in the capital market and the implementation of a "one-strike-out" policy are becoming a reality. The joint response team, established to eradicate stock price manipulation, has uncovered its first major case: a 100 billion won stock manipulation scheme involving wealthy individuals and financial experts. Their assets have been frozen.

On September 23, the Joint Response Team for Eradication of Stock Price Manipulation-comprising the Financial Services Commission, the Financial Supervisory Service, and the Korea Exchange-announced that it had detected a large-scale operation that covertly manipulated stock prices from early 2024 to the present, resulting in illicit profits of approximately 40 billion won.

This is the first case handled by the joint response team since the launch of the new administration. The operation involved ultra-wealthy individuals who run general hospitals and large academies, as well as former executives of well-known private equity funds and other financial experts. They systematically manipulated stock prices over an extended period by dispersing trades across dozens of accounts. The team has so far confirmed illicit gains of 23 billion won and current stock holdings worth about 100 billion won.

Lee Seungwoo, head of the Joint Response Team for Eradication of Stock Price Manipulation, explained, "They engaged in cross trading, continuously buying and selling between themselves. Since these trades had no economic justification, we have determined that this was unequivocally price manipulation."

The Securities and Futures Commission, under the Financial Services Commission, implemented its first-ever payment suspension on dozens of accounts used for stock manipulation, in accordance with the Capital Markets Act. The joint response team also conducted extensive searches and seizures at more than 10 locations, including the suspects' homes and offices, as a preemptive measure to ensure the full recovery of illicit gains obtained by the operation.

The joint response team plans to keep all possibilities open in its investigation, given that the company involved is currently entangled in a management rights dispute. Lee emphasized, "We have not yet secured circumstantial evidence implicating the company, but we will investigate all possibilities."

Lee further stated, "The Korea Exchange and the Financial Supervisory Service began monitoring for unusual signs in the market early this year, and the Financial Supervisory Service launched a planned investigation in March. While the exact scale is unknown, there is ample potential for the case to expand."

The joint response team highlighted "speed" as one of its key achievements in this case. Lee said, "If the Financial Supervisory Service had conducted the investigation first and then transitioned to a joint investigation with the Financial Services Commission, it would have taken more than a year to reach the search and seizure stage. In this case, we began in March and conducted the search and seizure in September, effectively cutting the timeline by more than half."

Additionally, the first administrative fine for one of the three major types of unfair trading in the capital market (insider trading, price manipulation, and fraudulent trading) was announced. The target of the fine, insider B from company A, acquired favorable information through their position regarding the company's decision to repurchase its own shares. Before the information was made public, B used an account under their spouse's name to buy approximately 120 million won worth of company stock, earning an illicit profit of about 24.3 million won. At its second extraordinary meeting on September 18, the Securities and Futures Commission decided to impose an administrative fine of 48.6 million won-twice the amount of the illicit gain, which is the legal maximum-against B.

The Securities and Futures Commission explained, "Although the individual being sanctioned is a first-time offender and the amount of illicit gain is relatively small compared to other unfair trading cases, we determined that it is more important to uphold the fairness of the capital market and restore general investor confidence through strict action against insider use of undisclosed material information."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.