Analysis of Changes in Forbes Global 2000

KCCI’s “Corporate Report on Korea, US, and China”

Korean Companies’ Sales Grow 15% in 10 Years

China Surges 95%, US Up 63%

“China’s Corporate Ecosystem Fuels Rising Powerhouses”

High-Tech and IT Com

A recent study has found that over the past decade, Chinese companies have grown more than six times faster than their Korean counterparts. The analysis, which assessed the combined revenue growth of companies from both countries, suggests that the speed of innovation and productivity improvements has widened the gap between Chinese and Korean firms. Experts argue that, to catch up, Korea should shift from preemptive to post-hoc regulation and limit regulations by industry rather than by company size.

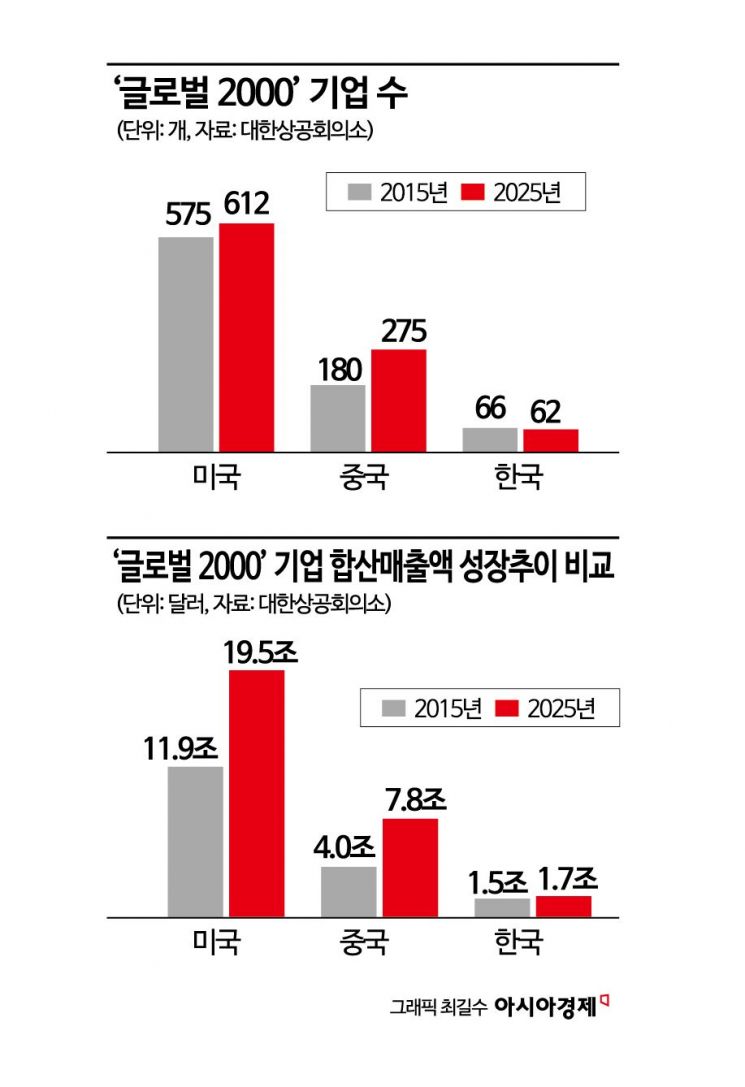

According to the report "Corporate Three Kingdoms: Korea, the US, and China as Seen Through Changes in the Global Top 2,000 Companies," released by the Korea Chamber of Commerce and Industry (KCCI) on September 23, the combined revenue of Korean companies among the world’s top 2,000 firms grew by 15% over the past decade, from $1.5 trillion in 2015 to $1.7 trillion this year. In contrast, Chinese companies’ combined revenue surged by 95% during the same period, from $4 trillion to $7.8 trillion, making their growth rate 6.3 times faster than Korea’s. The United States also widened the gap with Korea, as its companies’ combined revenue increased by 63%, from $11.9 trillion to $19.5 trillion. This report is the first installment of KCCI’s "K-Growth Series" and is based on statistics from the prominent US business magazine Forbes.

The number of companies from each country on Forbes’ list of the world’s top 2,000 also showed significant differences. The number of Chinese companies rose from 180 in 2015 to 275 this year. In contrast, the number of Korean companies decreased from 66 to 62 over the past ten years. The number of US companies increased from 575 to 612 during the same period. The emergence of many "rising stars" in China is reshaping the global market landscape.

Forbes’ "Global 2000" ranks "leading companies" with strong market influence, financial soundness, and profitability. Experts view this as an indicator of the strength of a country’s corporate ecosystem.

In the United States, companies in advanced industries and healthcare such as Nvidia (sales growth rate of 2,787%), UnitedHealth (314%), Microsoft (281%), and CVS Health (267%) led the way. New entrants in emerging fields, such as StoneX (financial product brokerage, $108.3 billion in revenue), Tesla (electric vehicles, $95.7 billion), and Uber (ride-sharing, $43.9 billion), accelerated the growth of the corporate ecosystem. In addition, global startup hubs like Silicon Valley, New York, and Boston have fostered IT companies such as Airbnb (accommodation sharing), DoorDash (food delivery), and Block (mobile payments), which have also contributed to new growth.

In China, high-tech and IT companies drove growth, including Alibaba (e-commerce, 1,188%), BYD (electric vehicles, 1,098%), Tencent Holdings (online media and gaming, 671%), and BOE Technology (display panels, 393%). Companies from diverse industries, including PowerChina (energy, $84.9 billion), Xiaomi (electronics, $50.9 billion), Didi Global (ride-sharing, $28.6 billion), and Digital China Group (IT services, $18.1 billion), also made it into the Global 2000 list.

The KCCI explained, "While China has strengthened its corporate ecosystem by nurturing new rising stars, the United States has rapidly transformed itself by leveraging advanced information and communication technologies such as artificial intelligence (AI)."

Unlike the US and China, Korea’s growth was led by manufacturing and finance, with companies such as SK Hynix (215%), KB Financial Group (162%), Hana Financial Group (106%), and LG Chem (67%). Newly listed Korean companies were mainly financial firms, including Samsung Securities, KakaoBank, Kiwoom Securities, iM Financial Group, and Mirae Asset Financial Group. However, Korea has not shown notable performance in industries that form the nation’s core competitive strengths, such as manufacturing and technology.

In the report, the KCCI recommended that policies to strengthen the corporate ecosystem are essential for Korea’s economic growth. The current structure is described as "regressive," with support for companies declining while regulations increase. KCCI Chairman Chey Tae-won stated at the "Corporate Growth Forum Launch Ceremony" earlier this month, "The larger a company gets, the more regulations it faces, so there is little incentive for companies to pursue growth. This is the fundamental reason for Korea’s stagnation and the decline in private sector vitality." In this context, Kim Youngjoo, a professor at Pusan National University, analyzed that when a small company becomes a medium-sized one, the number of regulations increases to 94, and when it becomes a large company subject to cross-shareholding restrictions, the number rises to 343.

The Chinese Five-star Red Flag (left) and the Taegeukgi.

The Chinese Five-star Red Flag (left) and the Taegeukgi.

Chairman Chey argues that a "mega sandbox" approach is needed to eliminate the increasing regulatory burden as companies grow. The idea is to establish "regulation-free experimental zones" in certain regions, allowing companies to invest in advanced industries such as AI.

Additionally, the KCCI emphasized that support should be provided to selected promising projects, regulations should be enforced post-hoc rather than preemptively, and restrictions should be applied by industry rather than by company size. In particular, the KCCI suggested that, at the very least, differentiated regulations should be lifted for advanced industries requiring large-scale investment and economies of scale, such as semiconductors and AI, to protect industrial competitiveness. To this end, the organization proposed amending the "Advanced Strategic Industries Act" to include regulatory exemptions for strategic technologies.

Experts point out that the rapid growth of Chinese companies is largely due to government involvement and that the Korean government should also strengthen its support for businesses. Park Chanhoon, head of the AI Robot Research Center at the Korea Institute of Machinery and Materials, said, "The Chinese government guarantees purchases based on research and development and provides tax benefits, enabling companies to gain sales experience and move to the next stage." He added, "In Korea’s fully capitalist system, companies without capabilities are quickly weeded out, which creates a structural disadvantage."

Lee Jongmyung, head of the Industrial Innovation Division at the KCCI, said, "Only 0.04% of small companies become medium-sized each year, and only about 1-2% of medium-sized companies become large enterprises. It is time to change the policy paradigm so that more dynamic new companies can emerge across various industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.