Supply to Incheon-Kobe route flights until 2026

Production based on co-processing enables rapid market entry

LG Chem building dedicated plant, completion targeted for 2027

HD Hyundai Oilbank will supply sustainable aviation fuel (SAF) to Korean Air's international flights to Japan. After establishing an SAF supply chain through exports to Japan last year, HD Hyundai Oilbank is now entering the domestic market. With the mandatory SAF blending regulation set to take effect in 2027, the domestic SAF market is expected to take shape.

On the 22nd, HD Hyundai Oilbank announced that it had signed a contract with Korean Air to supply SAF for the Incheon-Kobe route. The contract period runs from September this year until the end of 2026. HD Hyundai Oilbank will be the exclusive supplier, providing enough SAF for approximately 90 flights. Following its SAF export to All Nippon Airways in June last year, HD Hyundai Oilbank is now entering the domestic market as well. In August last year, Korean Air applied domestically produced SAF for the first time on its Incheon-Haneda route, with S-Oil and SK Energy as the suppliers at that time.

Officials from HD Hyundai Oilbank are taking a commemorative photo on the 22nd at the Mild Hydrocracking Process (MHC), which produces sustainable aviation fuel (SAF) at HD Hyundai Oilbank, celebrating the supply of SAF to Korean Air's international flights. HD Hyundai Oilbank

Officials from HD Hyundai Oilbank are taking a commemorative photo on the 22nd at the Mild Hydrocracking Process (MHC), which produces sustainable aviation fuel (SAF) at HD Hyundai Oilbank, celebrating the supply of SAF to Korean Air's international flights. HD Hyundai Oilbank

This agreement is more than just a supply contract. With the government set to implement mandatory SAF blending from 2027, it marks the starting point for refiners and airlines to establish a commercial supply system in advance. Industry observers expect Korean Air to expand the number of routes using SAF, while refiners are likely to accelerate their efforts to secure a leading position in the market. In March, SK Energy signed a contract to supply more than 20,000 tons of SAF to Cathay Pacific, a Hong Kong-based airline, through 2027. LG Chem, in partnership with Italy’s Eni, is constructing a dedicated SAF plant in Daesan, Chungnam, targeting an annual capacity of 400,000 tons, with completion scheduled for 2027.

HD Hyundai Oilbank’s SAF is produced using a “refinery co-processing” method. This process involves introducing bio-based feedstocks such as used cooking oil and animal fats, along with crude oil, into existing refinery facilities to produce jet fuel. The main advantage is that it does not require the construction of new plants, resulting in lower initial investment and enabling rapid commercialization. However, there are limitations to significantly expanding production due to the restricted proportion of bio-based feedstocks that can be used. Most of the SAF currently supplied commercially by domestic refiners is produced via co-processing.

Major global refining and chemical companies are focusing on dedicated plant methods. The mainstream approach is the “dedicated plant hydrogenation process,” which produces only SAF by hydrogenating used cooking oil and vegetable oils. This allows companies to secure a stable, large-scale production system capable of fulfilling major contracts with international airlines. However, the high entry barriers include the need for investments amounting to hundreds of billions of won and intense competition to secure raw materials.

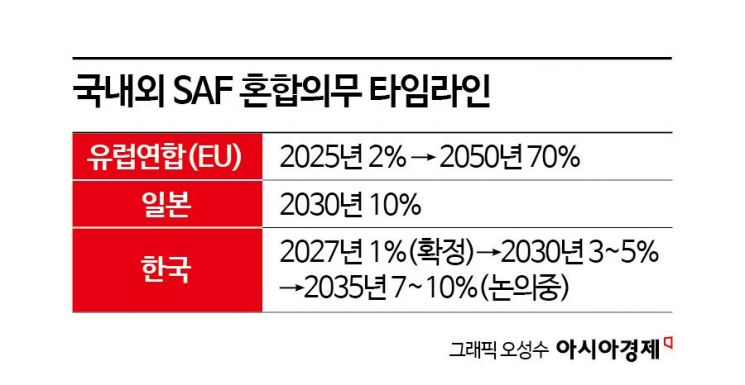

On the 19th, the Ministry of Trade, Industry and Energy announced that Korea will implement mandatory SAF blending starting in 2027. The first phase will require a 1% blend for international flights. There are discussions to increase this to 3-5% by 2030 and 7-10% by 2035. The European Union has already mandated a 2% blend from this year and plans to increase it to 70% by 2050. Japan has announced its goal to replace 10% of aviation fuel with SAF by 2030.

Cost remains a significant challenge. SAF is two to three times more expensive than conventional jet fuel. Airlines estimate that even a 1% blending rate would result in additional annual costs of around 20 billion won. For refiners, securing raw materials and obtaining international certifications are key factors for commercialization.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.