Munoz: "Swift Agreement on U.S. Tariffs Needed"

Global Sales Target Set at 5.55 Million Units by 2030

Hybrid Lineup to Expand to 18 Models

U.S. Local Production Share to Double

Pursuing Acquisition of Chinese Autonomous Driving Company 'Moment

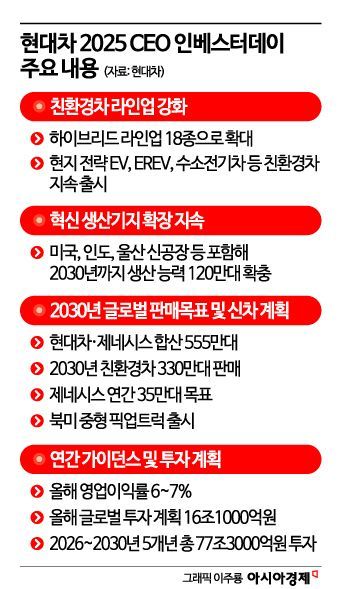

Jose Munoz, CEO and President of Hyundai Motor Company, has called for a swift agreement to lower U.S. tariffs on Korean-made vehicles to 15%, emphasizing the need for an early conclusion to Korea-U.S. trade negotiations. Despite challenges such as the tariff burden, labor regulations, and reduced electric vehicle subsidies, he expressed his determination to pursue aggressive management by increasing investment over the next five years by approximately 7 trillion won to a total of 77.3 trillion won, and by doubling the proportion of local production in the United States. He also announced for the first time Hyundai's intention to acquire a Chinese autonomous driving company.

On September 18 (local time), Munoz held the '2025 CEO Investor Day' for global investors at The Shed in Manhattan, New York, and stated, "I hope the governments of Korea and the United States will quickly reach an agreement regarding automobile tariffs." He added, "I want to present a plan for this year and next year that will deliver strong results."

(Photo by Hyundai Motor Company) Jose Munoz, CEO of Hyundai Motor Company, is giving a presentation at the '2025 Hyundai Motor CEO Investor Day'.

(Photo by Hyundai Motor Company) Jose Munoz, CEO of Hyundai Motor Company, is giving a presentation at the '2025 Hyundai Motor CEO Investor Day'.

Since April, the United States has imposed a 25% itemized tariff on imported vehicles. Japanese vehicles saw their tariff rate lowered to 15% through a bilateral agreement between the U.S. and Japan. However, despite Korea reaching an agreement at the end of July to reduce the tariff to 15%, the lack of consensus in follow-up negotiations means Korean vehicles are still subject to the 25% tariff.

Reflecting this tariff uncertainty, Hyundai has lowered its operating margin guidance for this year by 1 percentage point to 6-7%. The investment plan for this year was also revised down by 800 billion won to 16.1 trillion won. Munoz said, "The performance outlook provided today is based on a 25% tariff rate," and added, "If the tariff is reduced to 15%, it will be much easier to meet the guidance."

The outlook period for mid- to long-term investment plans has also been shortened. Whereas last year’s plans were presented in 10-year increments, this year they are presented in 5-year increments, signaling a more agile response to market uncertainties. The five-year (2026-2030) investment amount was increased by about 7 trillion won to 77.3 trillion won.

The large-scale investment will be used to expand the eco-friendly vehicle lineup and global production bases. Hyundai maintained its sales target of 5.55 million units in global markets by 2030. The company will increase the number of new eco-friendly vehicles, such as hybrid electric vehicles (HEVs) and extended-range electric vehicles (EREVs), and will more than double its hybrid lineup to 18 models.

To localize production, Hyundai aims to secure an additional 1.2 million units of global production capacity by 2030. The company plans to transform its new Ulsan plant in Korea, as well as its plants in the United States, India, and major emerging markets, into advanced innovation factories to increase local production and improve productivity.

Investments in the United States, Hyundai’s largest market, will also continue steadily. Hyundai Motor Group previously announced a plan to invest $26 billion in the United States over the next four years, aiming to increase local production from the current 40% to 80%. Through its partnership with General Motors, Hyundai plans to introduce a mid-size pickup truck to the North American market before 2030. Munoz stated, "Regardless of tariffs, our strategy in successful markets has always been localization," and addressed concerns about the hollowing out of Korean plants due to expanded U.S. production by saying, "We are actually increasing the production capacity of the Ulsan plant. This is not a shift in production, but growth."

Regarding the increasingly competitive autonomous driving market, he said, "We are seeking opportunities to acquire Momenta, a leading Chinese autonomous driving company," and mentioned that Hyundai is simultaneously pursuing various strategies, including in-house development, mergers and acquisitions, and external collaborations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.