Conditional Approval for Joint Venture by Fair Trade Commission

Gmarket and Alibaba JV to Become Subsidiaries

Expansion of Cross-Border Sales with Chinese Capital and Global Network

Consumer Benefits Expected to Grow with Price Reductions

With the formation of an alliance between Gmarket (Gmarket and Auction), an affiliate of Shinsegae Group, and Aliexpress, a subsidiary of China's Alibaba Group, a massive e-commerce joint venture with nearly 19 million users has been launched. The combination of Shinsegae Group's expertise, which has a significant influence in the domestic retail market, and Alibaba's robust financial resources, IT infrastructure, and global network has positioned this joint venture as a formidable new player in the e-commerce sector. Industry observers expect the joint venture to expand its domestic and international reach and influence by leveraging price competitiveness. However, they also predict that it will not be easy to surpass Coupang, which has already established a dominant market position.

On September 18, the Fair Trade Commission announced that it would conditionally approve the alliance between Gmarket and Aliexpress Korea. The companies will operate under a structure in which Grand Opus Holdings, a joint venture equally funded by Shinsegae Group and Alibaba International, holds 100% of the shares in both Gmarket and Aliexpress Korea, making them subsidiaries of the joint venture.

Visitors are touring the Alibaba booth at the "2025 Korea Import Expo" held at COEX in Gangnam-gu, Seoul. Photo by Yonhap News

Visitors are touring the Alibaba booth at the "2025 Korea Import Expo" held at COEX in Gangnam-gu, Seoul. Photo by Yonhap News

Strengthening Security and Opening Doors to Overseas Markets

The Fair Trade Commission gave final approval to the merger based on voluntary corrective measures regarding the management of customer information and data by both companies. This appears to reflect concerns among consumers and the market about potential leaks of personal information. By establishing safeguards, the commission determined that domestic sellers and products would have increased opportunities to enter the cross-border direct sales market by utilizing the global platform's infrastructure.

Immediately after the joint venture was approved, Shinsegae and Alibaba stated, "Based on over 20 years of digital commerce expertise and a global network spanning more than 200 countries, we will provide international business opportunities to over 600,000 domestic brands and small and medium-sized enterprises registered on Gmarket, and actively support more than 20 million Korean brand products in continuously gaining recognition in the global market. Through our collaboration, we will significantly expand product choices for customers and deliver an advanced shopping experience."

Sellers registered on Gmarket are expected to be able to sell products to overseas customers within this year. Overseas sales will be conducted by listing products on Alibaba’s global platform through Gmarket. The first regions targeted for expansion are five Southeast Asian countries: Singapore, Vietnam, Thailand, the Philippines, and Malaysia. The companies plan to further expand to more than 200 countries and regions where Alibaba operates, including Europe, South Asia, South America, and the United States.

The two companies expect that Gmarket sellers will benefit from more than just listing products on a global platform, as they will be able to utilize Alibaba’s systems for customs clearance, logistics, local delivery and returns, and customer management. Gmarket sellers will also be able to list products in the Korean product section of Aliexpress. The "K-Venue" channel operated by Aliexpress saw its transaction volume grow by more than 290% in July this year compared to a year earlier, indicating rapid growth.

Gmarket also plans to introduce a personal shopping assistant for domestic customers by applying advanced technologies such as Alibaba’s open-source artificial intelligence models, offering 24-hour hyper-personalized product recommendations and consultation services. Additionally, to protect customer personal information, Gmarket and Alibaba platforms will manage data on separate systems even if the platforms are linked, ensuring the safety of customer and seller information.

The two sides have immediately begun practical work on organizing the joint venture, convening the board of directors, and establishing business plans. They stated that once preparations are complete, they will hold sessions to share their vision and provide explanations to customers and sellers.

Strengthening the Anti-Coupang Alliance... "Uncertain Whether It Will Curb Coupang’s Dominance"

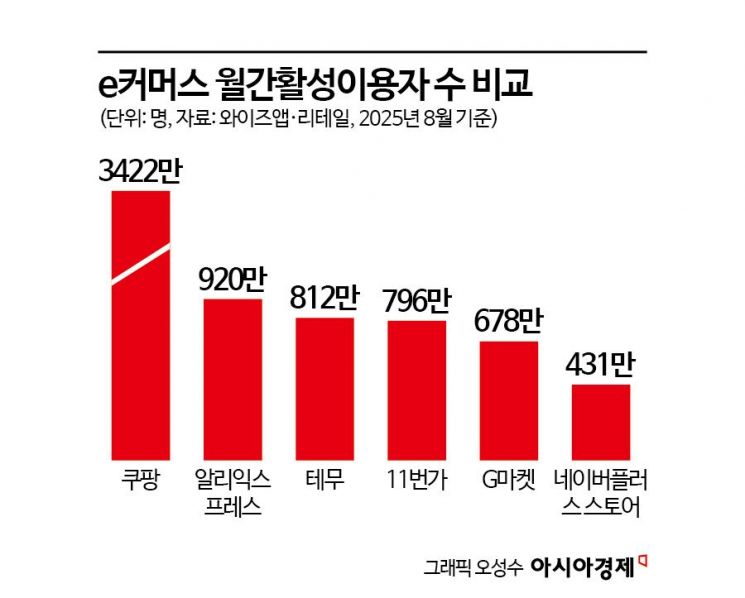

With the launch of the Shinsegae-Alibaba joint venture, the gap with Coupang, which has an overwhelming user base in the domestic e-commerce market, could be significantly narrowed. According to WiseApp Retail, which analyzed comprehensive mall application usage last month, Coupang ranked first with about 34.217 million monthly active users (MAU) during this period. Aliexpress ranked second with 9.2 million users, followed by Temu (8.12 million), 11st (7.96 million), Gmarket (6.68 million), and Naver Plus Store (4.31 million). When the 2.66 million users of Auction are added to Aliexpress and Gmarket, the total number of users increases to 18.54 million.

As Coupang continues to dominate, the e-commerce market has seen a proliferation of platforms, with online and offline companies breaking down boundaries and forming alliances. For example, Naver recently agreed to a strategic partnership with the Lotte retail group in four areas: artificial intelligence, shopping, marketing, and ESG (environmental, social, and governance). Naver has also launched "Kurly N Mart" on the Naver Plus Store App through a partnership with fresh food specialist Kurly. In addition, quick commerce services that deliver from large supermarkets, super supermarkets (SSMs), and convenience stores within an hour of ordering are also being expanded.

In this environment, the Gmarket-Alibaba joint venture is expected to intensify competition with Coupang, Naver, and others by leveraging its expanded user base, transaction volume, and price competitiveness. An industry official noted, "From the consumer's perspective, as competition intensifies, there will be more opportunities to purchase similar products at lower prices and to benefit from improved services."

However, there are also skeptical views regarding the synergy of the joint venture. One e-commerce seller commented, "There is a widespread perception among consumers that products listed on Aliexpress are of lower quality but cheap, so they are willing to take the risk and try them. In overseas markets, there are already many global suppliers offering similar product categories, so from a seller’s perspective, there is little merit in joining the platform."

The seller added, "What Coupang is most concerned about, after years of building its infrastructure at a loss, is the potential departure of sellers and users. To prevent this, Coupang is likely to closely monitor the pricing policies of its competitors and respond quickly, making it difficult for rivals to overturn the market landscape."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.