'KABC2025' Future Strategies for Secondary Batteries

Kwangjoo Kim, CEO of SNE Research, Emphasizes

CATL Investment Rivals Korea's Top Three Battery Companies

Immediate Bold Policy Support Needed

Kwangjoo Kim, CEO of SNE Research, is presenting at the 'KABC 2025' event held on the 17th at EL Tower in Yangjae-dong, Seoul. Photo by Heejong Kang

Kwangjoo Kim, CEO of SNE Research, is presenting at the 'KABC 2025' event held on the 17th at EL Tower in Yangjae-dong, Seoul. Photo by Heejong Kang

Experts have analyzed that the next two to three years represent the final opportunity for Korean battery companies to respond to China. They argue that bold policy support programs must be introduced immediately, as the investment amount by China's CATL surpasses the combined investments of Korea's three major battery companies.

Kwangjoo Kim, CEO of SNE Research, emphasized this point during his lecture on "Future Strategies for Korea's Secondary Battery Industry through Benchmarking Chinese Battery Companies" at the Korea Advanced Battery Conference (KABC) 2025, held on the 17th at EL Tower in Yangjae-dong, Seoul. He stated, "The next three years are a critical juncture that will determine the fate of Korea's battery industry."

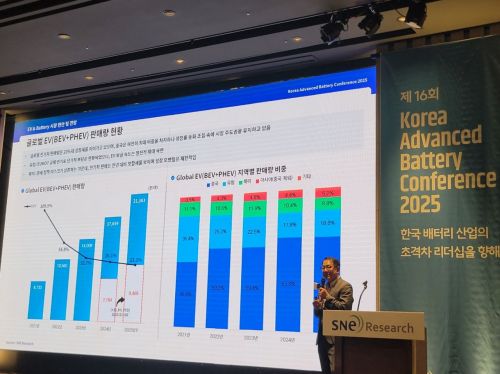

According to analysis by SNE Research, a battery market research firm, Chinese battery companies are expected to expand their market share to 77.8% in the first half of 2025, maintaining an overwhelming lead. Even outside of China, Chinese companies held a 48.2% market share in the first half of this year, significantly outpacing Korean companies, which held 38.3%.

The Chinese battery industry is expanding its market share by leveraging low-cost lithium iron phosphate (LFP) batteries. Due to intensified competition resulting from oversupply, LFP battery cells are being sold at $58 per kilowatt-hour (kWh), which is below cost. In comparison, ternary battery cells are priced at $90-95 per kWh.

While the adoption rate of LFP batteries in electric vehicle markets outside China is still only 13%, global electric vehicle manufacturers are increasingly adopting LFP batteries as battery safety and price competitiveness become more important. In particular, China holds an overwhelming share in the four major secondary battery materials-cathode materials (81%), anode materials (92%), separators (80%), and electrolytes (83%)-giving it a strong advantage in price competitiveness.

Chinese battery companies possess technological advantages over their Korean counterparts in areas such as LFP cathode materials, precursors, fast charging, semi-solid batteries, and sodium-ion batteries.

Kwangjoo Kim stressed that, drawing on the cases of liquid crystal displays (LCDs) and organic light-emitting diodes (OLEDs), Korean battery companies should focus on achieving technological supremacy rather than competing solely in mass production.

He stated, "In the case of OLEDs, Korea was able to maintain a long-term global market share by securing a technological lead and continuously enhancing it. For secondary batteries as well, the strategy should be to strengthen technological superiority in areas such as high performance, safety, and the application of new materials, rather than simply competing on scale." He predicted that the next two to three years will be the last chance for Korean battery companies to strategically differentiate themselves and respond to China.

The scale of investment by Chinese battery companies is overwhelming compared to Korean firms. SNE Research forecasts that CATL's production line investments from 2025 to 2030 will reach $56.1 billion (approximately 77.4 trillion won), which is comparable to the combined investments of Korea's three major battery companies ($60.5 billion, or 83.4 trillion won).

Government support for batteries and electric vehicles in China is also astronomical. Kim stated, "The Chinese government has provided 1,000 trillion won in various forms of support to the battery industry and 320 trillion won in subsidies for electric vehicles. In contrast, Korea lacks subsidies for the secondary battery industry, leading to a decline in competitiveness." Korean battery industry support is estimated at 50 trillion won, and electric vehicle subsidies at 4 trillion won, which are 1/20th and 1/80th, respectively, of China's support.

Kim stressed, "The next three years are a critical juncture that will determine the fate of Korea's battery industry. Korea must benchmark China's comprehensive battery and electric vehicle policies and immediately introduce policy support programs for the battery industry that match those of China."

However, recent developments such as the implementation of the United States' "One Big Beautiful Bill Act (OBBBA)" and the imposition of high tariffs on Chinese products are unfolding in favor of Korean battery companies.

According to SNE Research, starting in 2025, Chinese battery tariffs will be set at 73.4% ($37/kWh), raising the landed price in the United States to $94/kWh. If Korean battery companies produce batteries in North America and qualify for the Advanced Manufacturing Production Credit (AMPC), the price could drop to $87 by 2027, allowing them to secure a competitive edge over Chinese products.

For batteries used in energy storage systems (ESS), the price of Chinese batteries in the U.S. market is expected to rise to $134/kWh (container system basis) by 2026. Kim predicted, "From 2025, high tariffs will be imposed on Chinese batteries, and Korean batteries will have an opportunity to regain their position in the North American ESS market." Starting in October 2028, the use of Chinese batteries will be prohibited in projects funded by the U.S. Department of Homeland Security.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.