"Myeonvidia" Rally Gains Reversed

Investor Sentiment Shifts to Undervalued Nongshim Holdings

Improving Overseas Profitability Is Key

Nongshim, which had surged after being highlighted as a promising "Myeonvidia" (ramyeon + Nvidia) stock, has recently given up some of its gains, raising concerns among investors. Analysts say that in order to sustain the special boost from "K-Pop Demon Hunters," Nongshim needs to improve the profitability of its overseas operations.

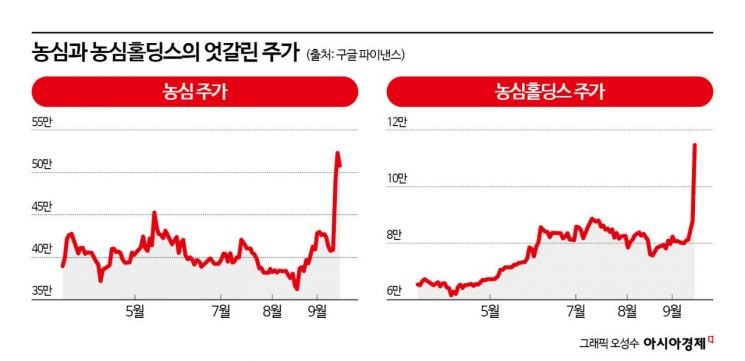

According to the Korea Exchange on September 16, Nongshim closed at 511,000 won the previous day, down 2.11%. After consecutive sharp gains on September 11 and 12 led to profit-taking, investor sentiment shifted toward the holding company Nongshim Holdings, which hit its upper price limit that day, impacting Nongshim's stock.

Previously overshadowed by Samyang Foods' dominance, Nongshim recently recorded the highest stock price growth among the three major ramyeon companies (Samyang Foods, Ottogi, and Nongshim), thanks to the popularity of its collaborative product with the Netflix movie "K-Pop Demon Hunters." This stands in stark contrast to earlier this year, when Samyang Foods doubled in size (+104%) while Nongshim (+9%) remained range-bound until last month.

However, the stock’s sharp short-term rise prompted foreign and institutional investors to sell large volumes for profit-taking, putting the brakes on its upward trajectory. On September 12, in particular, the stock soared to 579,000 won shortly after the market opened, nearly reaching its all-time high of 599,000 won. On that day, foreign investors sold 63.3 billion won (ranking second in net selling), while institutions sold 57.3 billion won (ranking first), erasing more than half of the recent gains.

While Nongshim faltered, the spotlight shifted to its holding company, Nongshim Holdings. The fact that Nongshim has not yet been consolidated as a subsidiary means the price-to-book ratio (PBR) remains at just 0.2 times, suggesting greater upside potential. With Nongshim Holdings owning only a 32.7% stake in Nongshim, the latter’s earnings currently contribute only through dividends. However, analysts say that if Nongshim is consolidated in the future, Nongshim Holdings could be revalued as a holding company that directly reflects its core food business, rather than as a pure holding entity.

Nongshim also faces the challenge of overcoming lowered market expectations following an "earnings shock" in the second quarter of this year. In the previous quarter, Nongshim’s operating profit (40.2 billion won) fell about 19% short of market expectations due to sluggish U.S. consumption and increased marketing expenses related to the global launch of Shin Ramyeon Tumba. As a result, as many as ten securities firms lowered their target price for Nongshim last month.

Despite weak second-quarter results, analysts say that Nongshim, which managed a stock rebound thanks to the "K-Pop Demon Hunters" effect, must maintain sales growth in overseas markets to sustain its momentum. Kang Eunji, a researcher at Korea Investment & Securities, said, "The recent establishment of a European sales subsidiary is accelerating penetration into the European market, and with the full-scale launch of Shin Ramyeon Tumba in the U.S. beginning in the second half, there are various factors that could drive top-line growth." If an increase in sales in the U.S. market is confirmed, it could once again raise expectations for ramyeon growth.

Shim Eunju, a researcher at Hana Securities, said, "With a price increase (in the low 10% range) implemented in the Americas in July, a recovery in the performance of the North American subsidiary is expected in the second half." She estimated, "The profit improvement effect from the price increase, which is estimated to be around 10 billion won, along with ongoing cost efficiency efforts, will improve Nongshim’s standalone operating margin by 1.4 percentage points year-on-year in 2025."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)