Financial Supervisory Service Employees Strongly Oppose Separation of Agencies

Criticism Raised Even in the United Kingdom and Australia, Which Have Adopted the Twin Peaks System

Cooperation Between Agencies Is Difficult, and Overlapping Regulation Is Also a Controversy

Concerns About Wasteful Costs Due to Establishment of Additional Financial Agencies

The government's decision to separate the Financial Consumer Protection Agency from the Financial Supervisory Service has led to growing opposition among Financial Supervisory Service employees. They are deeply concerned that overlapping regulations will significantly reduce work efficiency. Overseas, countries such as the United Kingdom, Australia, and the Netherlands have introduced a twin peaks financial supervisory system, but even there, criticism has been raised regarding overlapping regulations.

Criticism Raised Even in the United Kingdom and Australia, Which Have Adopted the Twin Peaks Financial Supervisory System

According to the financial industry on September 12, hundreds of Financial Supervisory Service employees are expected to continue their protest against the separation of the Financial Consumer Protection Agency for the fourth consecutive day in the lobby at the main entrance of the Financial Supervisory Service in Yeouido, Seoul. About 700 employees, equivalent to one-third of the entire staff, have been voicing their opposition to the separation of the Financial Consumer Protection Agency and its designation as a public institution since early morning.

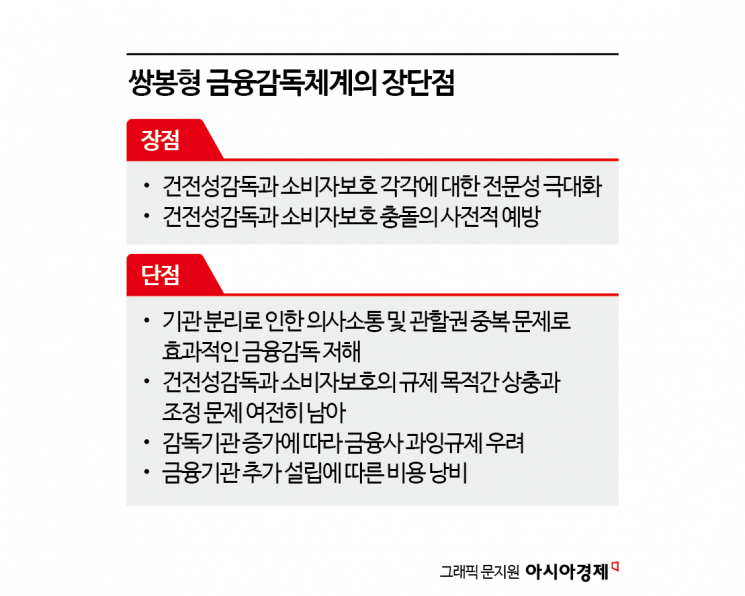

Previously, the ruling party and the government announced that they would strengthen financial consumer protection by separating the Financial Consumer Protection Agency from the Financial Supervisory Service, making both organizations independent and designating them as public institutions. The aim is to introduce the twin peaks financial supervisory system, which has been adopted in some advanced countries, into South Korea. Under this system, financial supervisory agencies are divided into two: one responsible for prudential supervision of financial companies, and another overseeing business conduct and consumer protection.

Australia, the United Kingdom, the Netherlands, and some other advanced countries have previously adopted the twin peaks model. However, even in these countries, criticism has emerged regarding the reduced efficiency of financial supervision under the twin peaks system.

According to a paper written at the end of 2022 by Professor Lim Jaejin of the Department of Public Administration at the University of Seoul, titled "Challenges of Introducing the Twin Peaks Model as Korea's Financial Supervisory System," the twin peaks model was first introduced in Australia in 1998 and later adopted in the Netherlands, Belgium, the United Kingdom, Spain, and New Zealand. The initial idea stemmed from the belief that, as traditional boundaries in the financial sector disappeared, separating supervisory agencies would allow for more effective oversight.

Professor Lim explained that, although the twin peaks system started with good intentions, various problems have emerged. First, cooperation between the two agencies was not easy. Even though the goals of prudential supervision and consumer protection are interconnected, the two supervisory agencies faced multiple issues.

In 2001, HIH, a giant insurance company in Australia with assets of 36 trillion won, went bankrupt, marking the worst crisis in the history of the Australian financial market. An investigation at the time revealed the shocking result that the crisis was exacerbated because the responsibilities and roles of the two supervisory agencies were not clearly defined. In 2009, when Trio Capital, Australia's largest pension management company, was involved in a financial fraud case resulting in a loss of about 240 billion won, it was pointed out that the failure to prevent the incident was due to poor information sharing between the two supervisory agencies.

Employees of the Financial Supervisory Service held a rally on the 11th in the lobby of the Financial Supervisory Service in Yeouido, Yeongdeungpo-gu, Seoul, opposing the government’s organizational restructuring plan to separate the Financial Consumer Protection Agency from the Financial Supervisory Service and designate it as a public institution. Photo by Yonhap News

Employees of the Financial Supervisory Service held a rally on the 11th in the lobby of the Financial Supervisory Service in Yeouido, Yeongdeungpo-gu, Seoul, opposing the government’s organizational restructuring plan to separate the Financial Consumer Protection Agency from the Financial Supervisory Service and designate it as a public institution. Photo by Yonhap News

Cooperation Between Agencies Is Difficult, and Overlapping Regulation Is Also a Controversy

The independence and scope of authority of supervisory agencies have also been problematic. In Australia, the executive branch holds the power to direct and appoint financial supervisory agencies, raising concerns about independence. Because the agencies are subject to executive orders, their authority is limited, and major supervisory decisions require ministerial approval. This has been cited as a factor hindering effective supervision.

Professor Lim emphasized, "Looking at overseas cases, establishing the relationship between supervisory agencies is extremely important when introducing the twin peaks model in Korea." He added, "Special attention must be paid to jurisdiction, information sharing, and conflict resolution between the prudential supervisory agency and the business conduct supervisory agency."

In the United Kingdom, the twin peaks financial supervisory system was introduced in 2013 by dividing the Financial Services Authority (FSA), a unified financial supervisory body, into the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), but several problems were identified. In a recent report, the UK Parliament pointed out that the FCA failed to adequately protect financial consumers in several incidents since its establishment. It also criticized that overlapping regulations by each supervisory agency hindered the business activities of financial companies and delayed institutional improvements.

Concerns have also been raised about the large additional costs associated with establishing the Financial Consumer Protection Agency. The financial industry estimates that at least tens of billions of won will be required for office space, staff recruitment, and system implementation. There is also inevitable controversy over who will bear these costs.

An official from the Financial Supervisory Service said, "Even with a conservative estimate, hundreds of billions of won will be needed depending on the size of the Financial Consumer Protection Agency," adding, "If it is designated as a public institution, taxpayer money will inevitably be used, and there will be no citizens who welcome this."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.