JC Partners Moves to Sell Profitable GA Goodrich

Rising Interest in GAs Amid Accelerating Separation of Manufacturing and Sales

MG Non-Life Insurance Faces Tepid Market Response in Sixth Sale Attempt

As JC Partners, a private equity fund (PEF) management company, moves to sell GoodRich, a highly profitable corporate insurance agency (GA), attention is focusing on whether the merger and acquisition (M&A) will be successful. This is in contrast to the ongoing situation with MG Non-life Insurance, where JC Partners has failed to sell the company five times and is now attempting to resell it through a bridge insurer.

According to the financial sector on September 12, JC Partners is currently conducting due diligence for the sale of GoodRich. It has not yet been decided how much of the 58.4% stake in GoodRich currently held by JC Partners will be sold. As the fund matures in 2027, the sale process is proceeding with the aim of an exit (sale) sometime next year.

In March 2022, JC Partners acquired a 58.4% stake in Rich&Co. (now GoodRich), including management rights, for 185 billion won through JC Insurance Platform No.1 LLC. Meritz Fire & Marine Insurance (35.9 billion won) and Hanwha Life Insurance (20.2 billion won) also participated in this investment. After acquiring GoodRich, JC Partners implemented extensive restructuring, and GoodRich grew into a large and mid-sized GA.

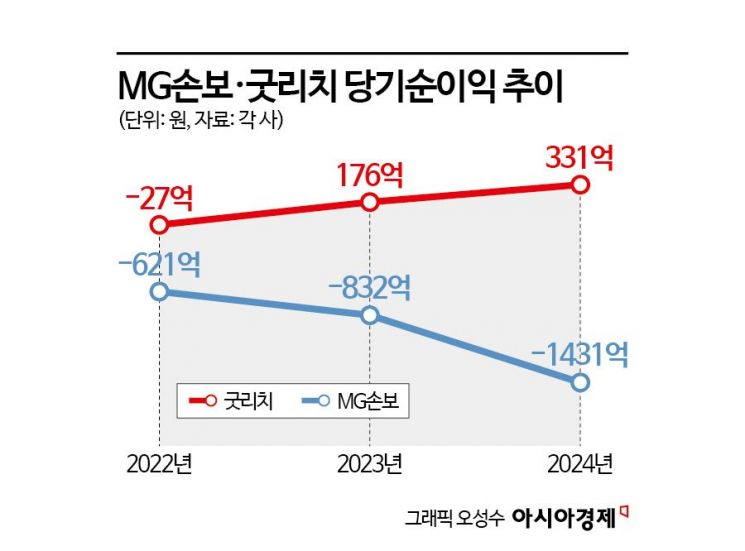

GoodRich, which recorded a net loss of 2.7 billion won in 2022, turned profitable and posted a net profit of 17.6 billion won in 2023 and 33.1 billion won last year. Revenue, which was 321.3 billion won in 2022, grew by 36.6% to 438.9 billion won last year. In the first half of this year, revenue reached 306.4 billion won and net profit was 18.1 billion won, surging by 25% and 417%, respectively, compared to the same period last year. As of the first half of this year, the number of planners stood at 5,725, ranking 11th in the industry. The investment banking (IB) industry values GoodRich at around 600 billion won, about double the 300 to 400 billion won valuation at the time of JC Partners’ acquisition.

GoodRich is considered an attractive asset as the insurance industry accelerates the separation of manufacturing and sales and the growth of GAs. Companies such as Hanwha Life Insurance and Shinhan Life, which currently own subsidiary-type GAs, may show interest. In 2021, Hanwha Life Insurance separated its exclusive planner organization to launch Hanwha Life Financial Services, a subsidiary-type GA. Currently, Hanwha Life Financial Services, along with Hanwha Life Lab, People Life, and IFC Group, has a total of 37,529 planners, making it a super-large GA. Shinhan Life's subsidiary-type GA, Shinhan Financial Plus, has 3,748 planners. Acquiring GoodRich would instantly give the buyer a top-tier GA affiliate with around 9,500 planners.

Unlike GoodRich, MG Non-life Insurance, which has been a troublesome asset for JC Partners, has yet to attract a buyer despite renewed efforts to sell. MG Non-life Insurance suspended operations on September 4 and is currently only handling contract transfers and liquidation. Upon suspension of operations, all insurance contracts were transferred to the bridge insurer, Yebyeol Non-life Insurance, and the sixth sale attempt is currently underway. Recently, Samjong KPMG was selected as the lead manager for the sale of Yebyeol Non-life Insurance.

JC Partners acquired MG Non-life Insurance from Jabez Partners for about 200 billion won in April 2020. However, due to insufficient management improvement, MG Non-life Insurance’s losses have continued to grow. The net loss increased from 62.1 billion won in 2022 to 143.1 billion won last year, more than doubling. The company was designated as an insolvent financial institution in 2022, and as of the first half of this year, its total equity stood at minus 251.8 billion won, indicating complete capital erosion.

The industry expects that the sale of MG Non-life Insurance will not be easy. The company’s management has already deteriorated beyond recovery, and with financial authorities planning to tighten capital regulations on insurers within the year, there are concerns that acquiring MG Non-life Insurance, which is in poor financial condition, would be a bottomless pit. While there are plenty of other insurance companies for sale in the M&A market, such as Lotte Non-life Insurance, KDB Life Insurance, and BNPP Cardif Life Insurance, deal activity remains sluggish. An insurance industry official commented, "There are plenty of insurance companies for sale, but GAs are in such high demand that you can’t buy one even if you want to. JC Partners is likely aiming to offset its investment losses in MG Non-life Insurance through the sale of GoodRich."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)