Czech Dukovany Nuclear Project Accounts for Nearly Half, Heavy Reliance on One-Off Deals

Middle East Orders Plunge 30%, Saudi Arabia Down 70%... Traditional Stronghold Under Threat

US Crackdown on Hyundai Engineering Battery Plant Raises Concern

This year's overseas construction orders are expected to reach their highest level in a decade. However, the construction industry is not entirely optimistic. Aside from the massive Czech nuclear power plant project, the figures are not much different from last year,and sluggish orders from the traditionally strong Middle East market persist. In addition, new local risks are emerging due to US trade pressure, further complicating the outlook.

Exterior view of the Dukovany Nuclear Power Plant in the Czech Republic. Daewoo Engineering & Construction.

Exterior view of the Dukovany Nuclear Power Plant in the Czech Republic. Daewoo Engineering & Construction.

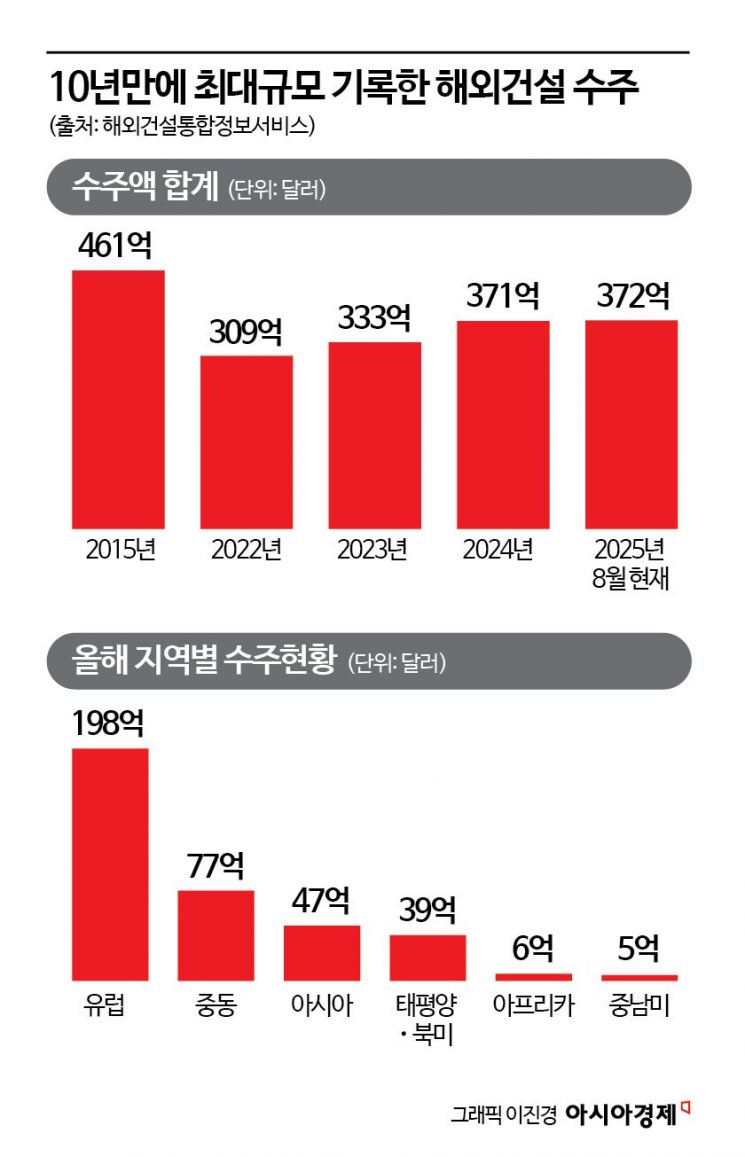

According to the Overseas Construction Information Service (OCIS) on September 14, overseas construction orders from January to August this year totaled 37.2 billion US dollars. A total of 298 companies secured 394 projects in 95 countries. The annual performance for last year was 37.1 billion dollars, a figure surpassed in just eight months, and this is the largest amount since 2015 (46.1 billion dollars). For the past decade, Korea's annual order volume has hovered around 30 billion dollars. The government’s target of 50 billion dollars for this year now appears within reach.

However, the increase in order volume is largely due to a specific project: the new Dukovany nuclear power plant in the Czech Republic, awarded to Korea Hydro & Nuclear Power in June, worth 18.7 billion dollars. This project alone accounts for nearly half of this year’s total orders and ranks as the largest single project. By sector, industrial facilities amounted to 30.3 billion dollars, representing 81.5% of the total, with the nuclear power plant project driving overall performance.

Excluding the Czech nuclear power plant project, this year’s order volume stands at 18.5 billion dollars, only a 3% increase compared to the same period last year (17.9 billion dollars). The “largest scale in a decade” is therefore reliant on a one-off project, meaning results could easily drop again. In the long term, sluggish orders from the Middle East and rising US risks are likely to become major obstacles.

The Middle East has historically accounted for nearly half of Korea’s overseas construction orders. However, from January to August this year, orders amounted to 7.7 billion dollars, a decrease of about 30% compared to the same period last year (10.9 billion dollars). In particular, the largest market, Saudi Arabia, plummeted from 8.5 billion dollars to 2.5 billion dollars, a drop of roughly 70%. Industry insiders are concerned that the slowdown in the Middle Eastern economy, combined with the rapid growth of Chinese construction companies, is significantly weakening the position of Korean construction firms.

Meanwhile, US-related risks have rapidly emerged as a new source of concern. Recently, the US Immigration and Customs Enforcement (ICE) conducted a crackdown on illegal residents at the joint battery plant construction site of Hyundai Motor Group and LG Energy Solution in Georgia, which is being built by Hyundai Engineering, resulting in mass detentions and heightened industry anxiety. Among the four battery plants being built by LG Energy Solution in the US, only the site being constructed by a Korean company, rather than a local contractor, was targeted. This has raised suspicions that the site may have been disadvantaged simply because it was not handled by a local company.

The problem is that the US has been viewed as a market with high growth potential, especially as Korean companies have increased their investments there. From January to August this year, orders in North America and the Pacific totaled 3.9 billion dollars, up 48% from the same period last year (2.6 billion dollars). Although this still represents just over 10% of all overseas orders, industry experts had anticipated that the number of construction projects would rise, given the 350 billion dollar US investment package resulting from the Korea-US tariff negotiations. This is why the recent US detention incident is seen as more than just an isolated case, but rather as a risk that could constrain future US orders and the potential of Korea’s overseas construction sector.

According to the Ministry of Land, Infrastructure and Transport, Korean companies are currently working on 39 construction sites in the US, with a total value of 8.6 billion dollars. Of these, 13 are large-scale projects worth over 100 million dollars. A ministry official said, “It is still too early to definitively conclude that the battery plant was targeted because it was built by a Korean company,” but added, “If similar cases continue to occur, the situation could change, so the government is thoroughly preparing support measures for companies and addressing visa issues.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.