If Lee Soyoung's Proposal Is Adopted, Higher Dividend Payout Ratios Lead to Surging Tax Revenue

A 5 Percentage Point Increase in Average Dividend Payout Ratio Boosts Tax Revenue by 1 Trillion KRW

Align Partners Simulation Based on Last Year's Data

Government Proposal Offers Little Incentive for Major Shareholders to Increase Dividends

President Lee: "If the Loss in Tax Revenue Is Not Significant, Companies Should Pay More Dividends"

As the likelihood increases that the current major shareholder threshold for capital gains tax on stock transfers will remain unchanged, the market's attention is shifting toward the separate taxation of dividend income. President Lee Jaemyung also emphasized the importance of separate taxation for dividend income in revitalizing the stock market during a press conference marking his first 100 days in office, stating, "If the loss in tax revenue is not significant, we should encourage companies to pay as much in dividends as possible."

On September 11, Align Partners Capital Management (hereafter referred to as Align) released the results of a simulation on dividend-related tax revenue for KOSPI 200 companies, which accounted for 91% of the net profit of listed companies in Korea last year. The key finding is that if the bill proposed by Assemblywoman Lee Soyoung, which lowers the highest tax rate compared to the government proposal, is implemented, companies' dividend payout ratios will increase, resulting in an exponential rise in tax revenue.

Tax Revenue Decrease: Government Proposal 70 Billion KRW vs. Lee Soyoung Proposal 140 Billion KRW

Currently, under the comprehensive taxation of financial income, if an individual earns more than 20 million KRW per year from financial income such as interest and dividends, the excess amount is taxed together with earned, business, and rental income. As a result, there have been calls to lower the separate tax rate on dividend income to revitalize the stock market. The logic is that if controlling shareholders receive more profit from dividends, listed companies' dividend payout ratios will rise, ultimately benefiting retail investors as well.

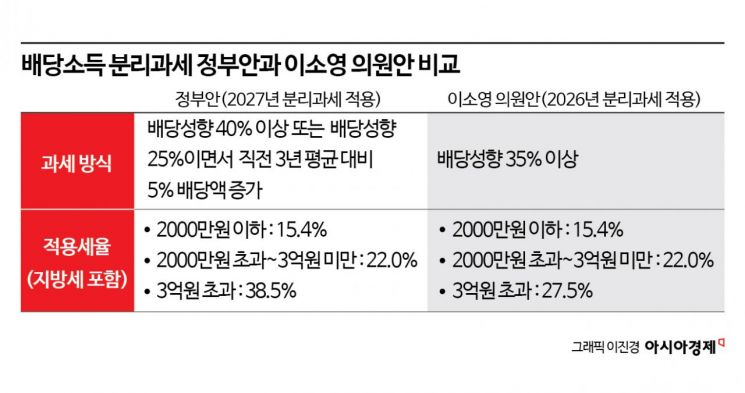

In July, the government announced a proposal to lower the highest separate tax rate (including local taxes) on dividend income from high-dividend listed companies from 49.5% to 38.5%. This is higher than the 27.5% proposed by Assemblywoman Lee Soyoung of the Democratic Party of Korea. The government argues that if the tax rate is lowered further, tax revenue could decrease significantly.

However, Align's simulation showed that the decrease in tax revenue would be minimal. Assuming that the dividend payout ratios of KOSPI 200 companies remain the same as last year, total tax revenue related to dividends would decrease by only 70 billion KRW from the previous 5.65 trillion KRW under the government proposal. Under Assemblywoman Lee Soyoung's proposal, the decrease would be just 140 billion KRW. Contrary to common belief, individual major shareholders account for only 19.2% of total dividend-related tax revenue.

The Higher the Dividend Payout Ratio, the Greater the Exponential Increase in Tax Revenue

On the contrary, when companies increase their dividend payout ratios, tax revenue rises exponentially, forming a J-curve. If the average dividend payout ratio of KOSPI 200 companies rises by just 0.6 percentage points from the current 22.1%, total tax revenue related to dividends would increase by 150 billion KRW due to higher corporate taxes on corporate shareholders, increased withholding taxes on foreign investors, and other shareholder dividend taxes. This would offset the 140 billion KRW decrease in personal dividend income tax resulting from the lower tax rate.

If the average dividend payout ratio of KOSPI 200 companies increases by 5 percentage points, total tax revenue related to dividends would rise by 1.12 trillion KRW. If it increases by 10 percentage points, the increase would be 2.24 trillion KRW. If the 35% dividend payout ratio proposed by Assemblywoman Lee Soyoung (a 12.9 percentage point increase from the current level) is achieved, tax revenue would rise by as much as 2.94 trillion KRW.

"Government Proposal Fails to Incentivize Controlling Shareholders to Increase Dividends"

Align argues that the government proposal does not provide sufficient incentives for controlling shareholders to increase dividend payout ratios. The highest separate tax rate, including local taxes, is 38.5%, which is not much different from the highest effective comprehensive tax rate of 42.85% after accounting for dividend income tax credits. Therefore, controlling shareholders are unlikely to make efforts to benefit from separate taxation.

Furthermore, the minimum criteria for separate taxation-"a dividend payout ratio exceeding 25% and a dividend amount at least 5% higher than the average of the previous three years"-are too easy to meet. As of last year, 42% of KOSPI 200 companies had a dividend payout ratio exceeding 25%, and the average net profit growth rate over the past three years was 6.7%.

Lee Changhwan, CEO of Align Partners Capital Management, stated, "A substantial reduction in the highest tax rate that directly incentivizes controlling shareholders, who have an absolute influence on dividend payout decisions, is necessary. If companies increase their dividend payout ratios, the government's total tax revenue related to dividends will also increase, which is advantageous from the government's perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.