Up 6.4 Billion Won (3.3%) From Last Year

Payment Deadline: September 30

The Daejeon city government has imposed a total of 203.2 billion won in regular September property taxes (land and housing portions). This represents an increase of 6.4 billion won (3.3%) compared to the same period last year.

This round of property tax assessments consists of 177.7 billion won in main property tax, 3.8 billion won in local resource facility tax, and 21.7 billion won in local education tax. By taxable category, 136.6 billion won was levied for land and 66.6 billion won for housing.

Property tax is imposed on those who own property as of the tax reference date, June 1. The payment period runs from September 16 to 30, during which taxpayers can pay the land portion and half of the housing portion of their property tax.

Compared to the previous year, the land portion increased by 2.2 billion won (1.7%) and the housing portion by 4.2 billion won (6.7%). The increase in the land portion was 2.2%, while the rise in the housing portion was mainly due to the occupancy of large-scale newly built apartments and an increase in the officially announced housing prices.

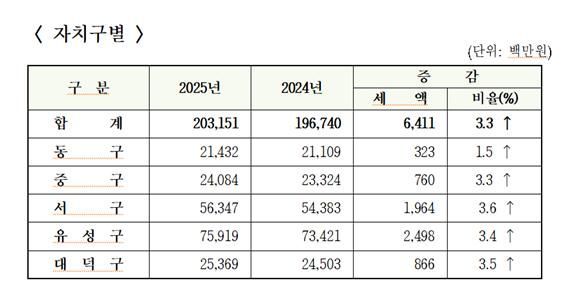

By district, property tax assessments were as follows: Yuseong-gu, 75.9 billion won (up 3.4%); Seo-gu, 56.4 billion won (up 3.6%); Daedeok-gu, 25.4 billion won (up 3.5%); Jung-gu, 24.1 billion won (up 3.3%); and Dong-gu, 21.4 billion won (up 1.5%).

Tax relief measures for single-home households continue to apply. The fair market value ratio is set according to the officially announced price: 43% for properties up to 300 million won, 44% for those between 300 million and 600 million won, and 45% for those exceeding 600 million won. For homes valued at 900 million won or less, special tax rates are also applied.

The payment deadline is September 30. Payments can be made online (WETAX, Giro), via virtual accounts, local tax payment accounts, ARS, or simple payment apps (KakaoPay, NaverPay, Payco, card company apps). Taxpayers can also pay without a bill at ATMs or cash dispensers at financial institutions nationwide.

Electronic billing is also available. Those who are away for extended periods or have difficulty receiving mail can receive their bill by email and receive a 500-won tax credit. Automatic payment, which processes payment on a designated date, also provides a 500-won tax credit per transaction. By applying for both electronic billing and automatic payment, taxpayers can receive a total tax benefit of 1,000 won. These benefits apply from the month following application, which can be done via WETAX or by visiting the district tax office.

Cho Jungyeon, Daejeon City’s Director of Taxation, stated, "Detailed information on property tax and payment methods can be found through the Daejeon City tax office and WETAX. Since property tax is an important resource for operating the local community, we ask all taxpayers to pay diligently within the deadline."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.