Improvement in Banks' CET1 Ratios Driven by Decline in Won-Dollar Exchange Rate

All Domestic Banks Meet International Capital Soundness Standards

In the second quarter, the domestic banks' capital adequacy ratios, based on the Bank for International Settlements (BIS) standards, improved significantly as the won-dollar exchange rate declined and net income increased.

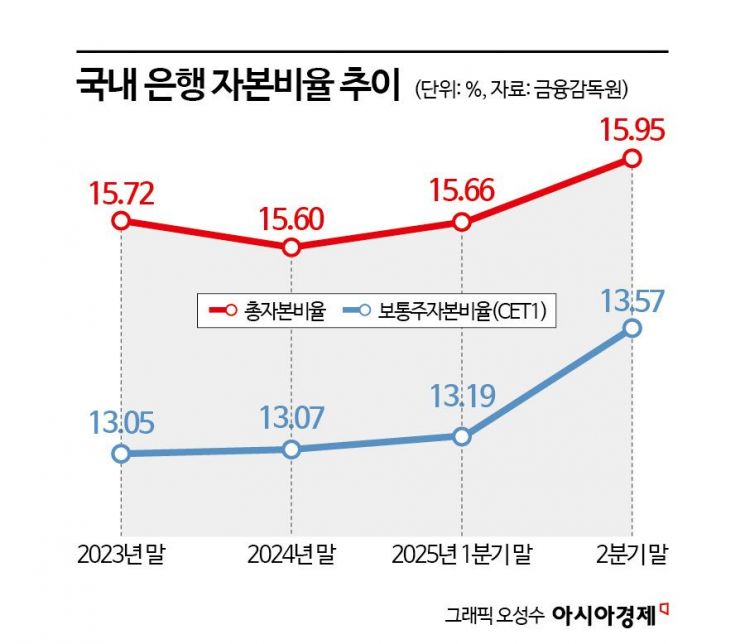

According to the "Status of BIS-Based Capital Ratios of Bank Holding Companies and Banks as of the End of June (Provisional)" released by the Financial Supervisory Service on September 9, the Common Equity Tier 1 (CET1) ratio of domestic banks at the end of the second quarter was 13.57%, up 0.38 percentage points from the previous quarter. During the same period, the total capital ratio rose by 0.29 percentage points to 15.95%.

The BIS capital ratio is a key indicator for assessing the soundness of a bank's financial structure, representing the ratio of equity capital to total assets (risk-weighted assets). In particular, the Common Equity Tier 1 ratio is used as a major indicator not only for a bank’s capital soundness but also for determining shareholder returns such as dividends and the repurchase or cancellation of treasury shares. The regulatory standards set by supervisory authorities are a CET1 ratio of 8.0%, a Tier 1 capital ratio of 9.5%, and a total capital ratio of 11.5%.

The improvement in capital soundness of domestic banks in the second quarter was largely due to a significant decline in the won-dollar exchange rate. The drop in the exchange rate reduced the risk-weighted assets (RWA) denominated in dollars, which in turn improved the banks’ capital ratios and boosted net income. While the won-dollar exchange rate was in the high 1,400 won range in the first quarter of this year, it fell to the low to mid-1,400 won range in the second quarter.

A Financial Supervisory Service official explained, "The sharp decline in the won-dollar exchange rate in the second quarter led to a reduction in banks’ RWA and an improvement in net income," adding, "All domestic banks are currently maintaining sound financial health, with capital regulatory ratios well above the required levels."

By institution, Citibank Korea, Standard Chartered Korea, KakaoBank, Export-Import Bank of Korea, and Toss Bank recorded CET1 ratios of 14% or higher, while KB Kookmin Bank, Hana Bank, Shinhan Bank, and Korea Development Bank posted ratios of 13% or higher, indicating relatively high levels.

The Financial Supervisory Service official emphasized, "Domestic economic recovery remains delayed, uncertainties persist both at home and abroad, and the possibility of increased credit losses is rising due to the continued increase in delinquency rates. We will continue to monitor capital ratios and other indicators to ensure that banks maintain sufficient loss-absorbing capacity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.