Only Mild Gains Despite the September 7 Real Estate Policy

Lowered Earnings Expectations Lead to Reduced Target Prices

15 Trillion Won in Nuclear Power Plant Orders Anticipated by First Half of Next Year

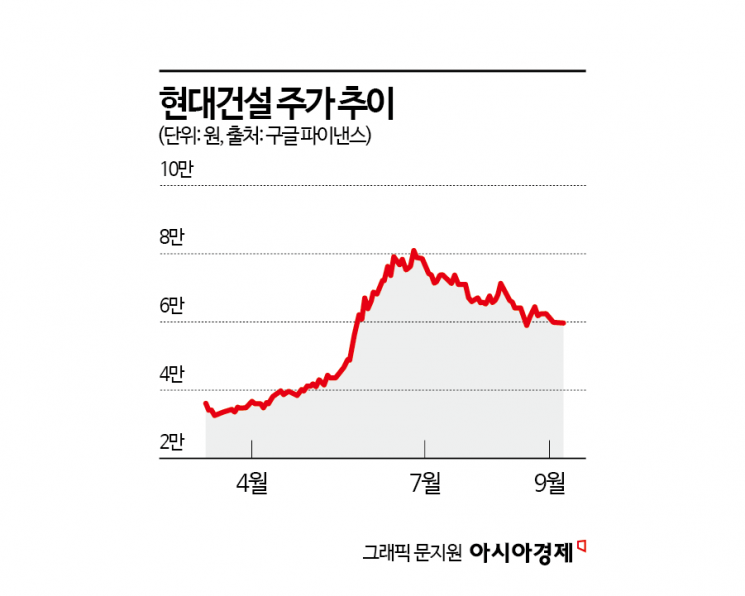

Hyundai Engineering & Construction has seen its stock price decline in the second half of this year, failing to benefit from the government's real estate policy measures and raising concerns among investors. However, analysts in the securities industry are highlighting Hyundai E&C's potential for overseas nuclear power plant orders, suggesting that this could be an opportunity for value investing.

According to the Korea Exchange on September 9, Hyundai E&C closed at 60,100 won the previous day, up 0.84%. While the Lee Jaemyung administration's "September 7 Real Estate Policy," which aims to start construction of 1.35 million housing units in the Seoul metropolitan area, sent small and mid-sized construction stocks such as KD (+30%), Dongsin Construction (+13.38%), and Kumho Construction (+10.05%) soaring, major construction companies like Hyundai E&C, HDC Hyundai Development Company (-0.24%), and Samsung C&T (+0.11%) did not see significant gains.

Jang Moonjun, an analyst at KB Securities, commented, "Due to the repeated announcements of housing supply measures by previous administrations and the low implementation rates, stock market investors have become less responsive to the 'numbers' in housing supply targets. There are currently no factors to create a turning point in the stock price trends of the construction sector." Jang pointed out that the government's September 7 real estate policy emphasizes the 'public' sector, such as increasing the housing supply role of Korea Land & Housing Corporation (LH), making it unlikely that investor sentiment will recover for companies with a high proportion of private housing projects.

Over the past two months, construction stocks have continued to underperform due to the government's real estate regulatory stance and labor issues represented by the so-called "Yellow Envelope Law." The KRX Construction Index has fallen by 7.21% from July to the previous day, recording the largest decline among all KRX indices. During the same period, the KOSPI Construction Index also dropped by 8.17%, ranking among the lowest in returns across all indices. Notably, Hyundai E&C has been one of the most underperforming companies, with its stock price plummeting by 30% from its 52-week high at the end of June.

Kang Minchang, an analyst at KB Securities, stated, "One of the main reasons for Hyundai E&C's recent stock price slump was its announcement during the second-quarter earnings release that it would lower its annual earnings guidance. The bigger issue was that this increased the uncertainty that the stock market dislikes even more than profit declines." Previously, Hyundai E&C posted an operating profit of 217 billion won in the second quarter, up 47% year-on-year, but issues such as Hyundai Engineering's bond call (performance bond claim) led to a downward revision of its annual operating profit forecast for this year to 793.3 billion won, about 13% lower than previous estimates.

Although Hyundai E&C's stock price has been on a steady decline in the second half of the year, the securities industry remains optimistic. There are growing expectations that Hyundai E&C's nuclear power plant pipeline, built through cooperation with Westinghouse in the United States and participation in Team Korea, will soon bear fruit. Lee Eunsang, an analyst at NH Investment & Securities, lowered the target price for Hyundai E&C from 108,000 won to 97,000 won but maintained it as a "top pick" in the construction sector, stating, "The partnership with Westinghouse, which is jointly pursuing large-scale nuclear power projects in Finland and Slovenia, remains strong, giving Hyundai E&C a competitive edge in securing nuclear power plant orders in Europe, the United States, and other regions."

Song Yurim, an analyst at Hanwha Investment & Securities, also commented, "Hyundai E&C has established the most dominant position among domestic construction companies as a global player in nuclear power plant engineering, procurement, and construction (EPC), both in large-scale nuclear power plants and the SMR market. Even excluding nuclear power, the company has clear mid- to long-term growth drivers such as urban redevelopment projects and the full-scale launch of investment development sales." Song raised the target price from 78,000 won to 92,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.