KOSDAQ Rises for Five Consecutive Days, Outperforming KOSPI

KOSDAQ Up 2.72% This Month, While KOSPI Gains 1.05%

Biotech Stocks Drive KOSDAQ Strength on Interest Rate Cut Expectations

Amid growing expectations of interest rate cuts, the KOSDAQ continues to outperform the KOSPI. In particular, the strong performance of pharmaceutical and biotech stocks, which tend to stand out during periods of rate cuts, is driving KOSDAQ’s relative advantage.

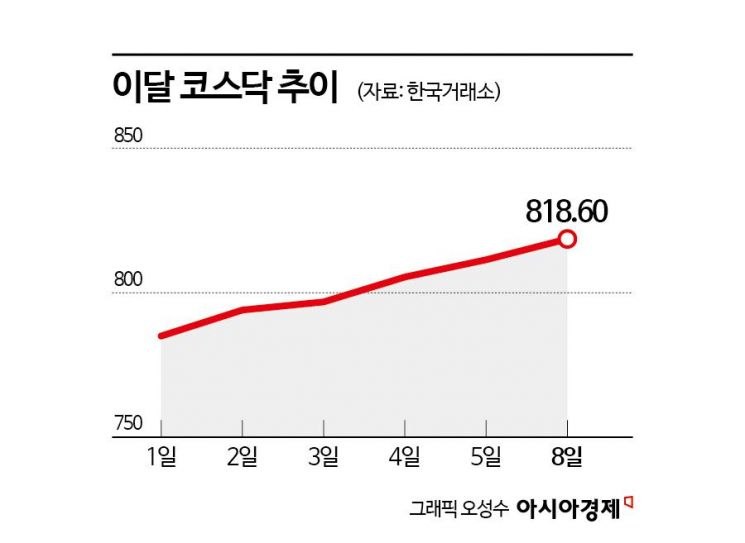

According to the Korea Exchange on September 9, the KOSDAQ closed at 818.60, up 0.89% from the previous day, marking its fifth consecutive day of gains. Although the KOSPI also continued its upward trend during the same period, the KOSDAQ’s relative outperformance was more pronounced.

So far this month, the KOSDAQ has risen by 2.72%. During the same period, the KOSPI increased by 1.05%. As expectations for rate cuts grow, the KOSDAQ, which is centered on growth stocks, has shown relatively stronger performance. Kim Ji-won, a researcher at KB Securities, explained, “As signs of a slowdown in U.S. employment have become evident, expectations for interest rate cuts have increased, and the performance gap between the KOSPI and KOSDAQ has widened.”

Last week, weak U.S. employment data led to a consensus that a rate cut at the September Federal Open Market Committee (FOMC) meeting is now a foregone conclusion. On September 5 (local time), the U.S. Department of Labor reported that non-farm payrolls in August increased by 22,000 compared to the previous month. This figure is significantly below the Dow Jones consensus estimate of 75,000. The unemployment rate rose from 4.2% in July to 4.3% in August, in line with expert forecasts.

Han Ji-young, a researcher at Kiwoom Securities, said, “Following the employment data release, the probability of a 25 basis point (1bp=0.01% point) rate cut in September, according to CME FedWatch, has become almost certain at 99%, while the probability of an additional 25 basis point cut in October has also exceeded 50%. Reflecting these expectations for rate cuts, the KOSDAQ, which is centered on growth stocks, has shown relatively stronger performance compared to the KOSPI.”

In particular, the strong performance of pharmaceutical and biotech stocks, which account for a large portion of the KOSDAQ’s market capitalization, is leading the KOSDAQ’s relative strength. Pharmaceutical and biotech stocks are considered prime beneficiaries of rate cuts. Alteogen, the leading stock on the KOSDAQ, has continued its rally for seven consecutive trading days recently.

Shin Seung-jin, head of investment information at Samsung Securities, analyzed, “Due to both domestic and global uncertainties, it is difficult for mega-cap stocks to maintain a dominant upward trend for the time being. Biotech stocks have a clear tendency to perform strongly during periods of rate cuts. This is because, given the high cost of raising capital in the sector, a low interest rate environment is advantageous for biotech companies.”

The KOSDAQ’s relative strength is expected to continue for the time being. Kim Jun-woo, a researcher at Kyobo Securities, said, “The signal of strength in small- and mid-cap stocks that appeared in mid-July is persisting in the KOSDAQ. It is expected that increasing the proportion of small- and mid-cap stocks within the KOSDAQ in September will be effective. This is because, as expectations for a September rate cut combine with this trend, there is a high likelihood that the rally and momentum in small- and mid-cap stocks will expand and strengthen.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.