Although the base interest rate was announced to have been lowered by 0.25 percentage points from 2.75% to 2.5% in May, consumers are still not feeling the effects of reduced loan rates, and their financial burden continues to grow. In this context, recent trends in building sales transactions have been released.

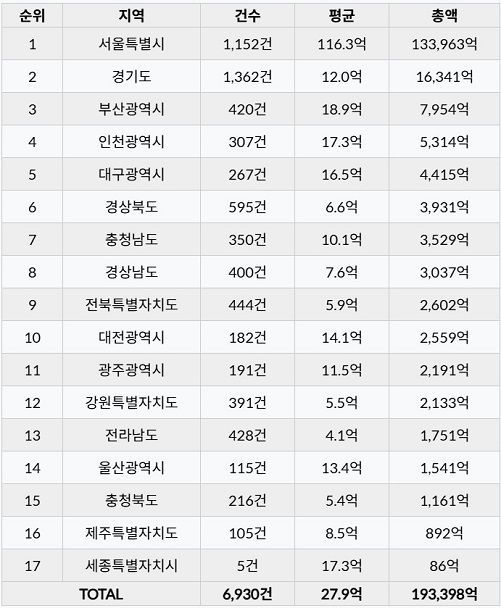

Silgeorae.com Limited Liability Company, a research company specializing in commercial real estate and building sales transactions, announced that the total transaction amount for building and property sales nationwide from January to August 2025 reached 19.4 trillion won. Seoul ranked first with 13.4 trillion won, followed by Gyeonggi Province with 1.6 trillion won, Busan in third place with 795.4 billion won, Incheon with 531.4 billion won, and Sejong Special Self-Governing City ranked last in 17th place with 8.6 billion won in sales.

These statistics exclude residential properties, land, villa-type apartments, and collective commercial buildings, so if residential real estate were included, the total transaction amount would be even higher.

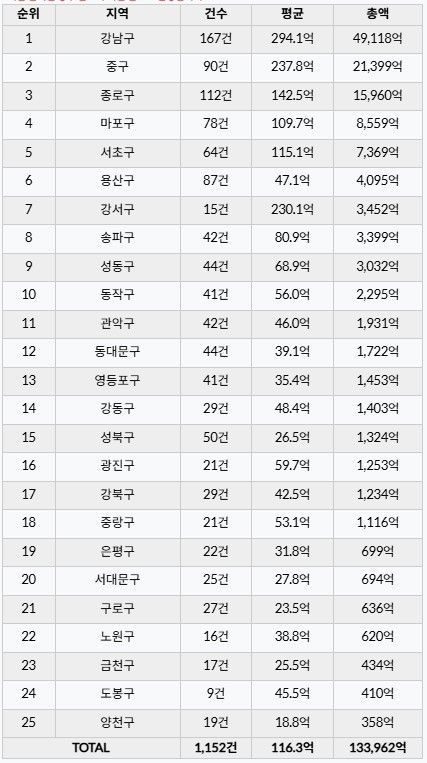

Among the notable regions in Seoul, Gangnam District recorded the highest transaction amount at 4.9 trillion won, not only ranking first in Seoul but also nationwide. Jung District came in second with 2.2 trillion won, followed by Jongno District in third with 1.6 trillion won. Yangcheon District was at the bottom in 25th place, with 35.8 billion won in sales.

Park Jongbok, Director of Naheyo Academy Limited Liability Company, commented, "This is a typical phenomenon that appears during periods of high interest rates and economic downturn." He explained that in times of high interest rates and recession, the market becomes dominated by the wealthy rather than the working or middle class. Wealthy individuals tend to purchase distressed real estate properties during downturns and then sell them at higher prices when the economy recovers, thereby increasing their assets. He noted that this pattern is being repeated without exception in 2025.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.