Government Pushes to Expand Venture Investment, with AI at the Center

"One-Third of Venture Capital Flows to AI and Deep Tech"

Unlisted and IPO Markets See Surging Popularity of AI Companies

In August, domestic venture investment in South Korea increased to 1 trillion won, marking a rebound for the second consecutive month. With inflows of pension fund capital and ongoing policy support, the artificial intelligence (AI) sector is drawing a dominant share of funding and revitalizing venture investment sentiment.

According to Hanwha Investment & Securities on September 8, domestic venture investment in August was estimated at approximately 1 trillion won, continuing the expansion trend seen in July (about 800 billion won).

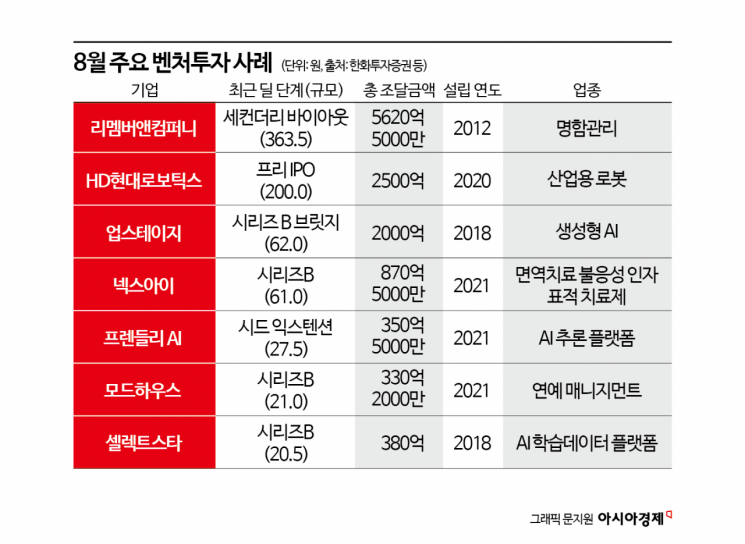

Investment was concentrated in the fields of artificial intelligence (AI), deep tech, and blockchain. According to the recent “August Startup Investment Summary” released by the startup analytics platform Innovation Forest, of the total 442.5 billion won in new investments-excluding mergers and acquisitions (M&A) and initial public offerings (IPO)-the AI, deep tech, and blockchain sectors accounted for 144.6 billion won, ranking first. Healthcare and biotech (86.3 billion won), and manufacturing and hardware (51.5 billion won) followed.

Kim Suyeon, a researcher at Hanwha Investment & Securities, said, “Since July, venture capital investment in the domestic market has begun to rebound. Pension fund investment pools, which previously did not participate in venture investment, have established venture investment funds, and from next year, Business Development Companies (BDCs) will be introduced.” She added, “In the United States, alternative asset investments such as virtual assets and private equity funds have become possible through 401(k) retirement accounts. All of these trends are increasing market demand,” she explained.

Representative examples of recent investments include: ▲ Upstage, a generative artificial intelligence (AI) company (62 billion won); ▲ FriendlyAI, an AI inference platform company (27.5 billion won); and ▲ SelectStar, an AI data company (20.5 billion won). Notably, Upstage has attracted attention in the venture investment industry as one of the five elite teams selected last month to lead the development of a domestic AI large language model (LLM). In this Series B bridge round, Upstage secured 62 billion won, bringing its total accumulated investment to approximately 200 billion won.

This latest investment in Upstage was led by Korea Development Bank, which has been actively investing across the entire AI value chain. Global companies Amazon and AMD also joined as new investors, while Intervest, KB Securities, and Shinhan Venture Investment participated as both new and existing investors.

Various policy initiatives are also lowering investment barriers for AI startups. The government is pursuing a range of investment policies-including expanding the Korea Fund of Funds and easing regulations on pension funds and financial institutions investing in venture funds-under its vision to become a “top three global AI powerhouse.” The introduction of BDCs, a type of public offering fund in which individuals can participate, is also planned. Policy finance institutions are proactively providing capital to large AI startups, and sector-specific AI demonstration projects as well as support for data and semiconductor infrastructure are being implemented in parallel.

This year has also seen a series of IPOs by AI-related companies. In July, NewN AI, a company specializing in unstructured data analysis, was listed on KOSDAQ. This month, S2W, a national security and industrial big data company, is preparing for listing, followed by Nota, an AI model optimization company, next month. Upstage, which was valued at 740 billion won during this investment round, is also aiming to go public within this year. This stands in contrast to concerns earlier in the year about the lack of listed AI software companies in the domestic stock market.

Researcher Kim Suyeon commented, “Going forward, the extent to which AI is represented in a portfolio will become increasingly important, as government policy is moving to boost investment in the unlisted market, with AI at its core.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.