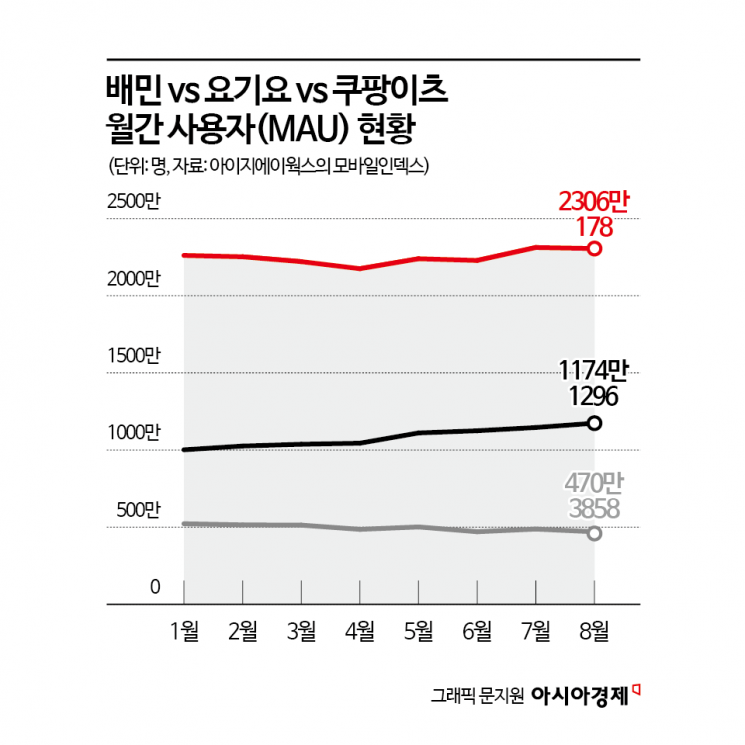

Baemin and Coupang Eats Reach 23.06 Million and 11.74 Million MAUs Last Month

Differentiation Becomes Difficult with Food Delivery Alone

Competition Heats Up in the Growing Quick Commerce Market

The "two-strong" system of Baemin and Coupang Eats is becoming increasingly solidified in the food delivery application market. Baemin, the market leader, has maintained 23 million monthly active users (MAU) in the second half of the year, thanks to its strategy targeting single-person households. Coupang Eats, after surpassing 10 million users in January, has also continued to see steady growth. As a result, both companies have now expanded their competition from the food delivery sector, where differentiation is difficult, to the quick commerce service market, which offers instant delivery upon order.

According to Mobile Index, a data platform operated by IGAWorks, on September 5, Baemin, Coupang Eats, and Yogiyo recorded 23.06 million, 11.74 million, and 4.7 million monthly active users, respectively, in the previous month. Compared to the previous month, Baemin saw a 0.3% decrease in users, while Coupang Eats experienced a 2.4% increase. Despite these slight fluctuations, both companies are steadily securing their positions as the top two players. Although there is still a gap of 10 million monthly users between them, industry insiders note that Coupang Eats' rapid growth in payment volume makes it a worthy rival in the "two-strong" system. According to WiseApp, a real-time app and payment data analysis solution, Coupang Eats' estimated monthly payment amount reached a record high of 856.3 billion won in July, marking an 86.3% increase from the previous year.

The two leading delivery platforms are now preparing to compete in the growing quick commerce service market. Global market research firm Statista projects that the domestic quick commerce market will grow from 4.4 trillion won this year to 5.9 trillion won by 2030. The competitive landscape has shifted as Coupang Eats recently began piloting its "Shopping" category, which delivers non-food items, across all of Seoul. Baemin previously entered the quick commerce market in 2019 by launching its direct-purchase service, B Mart.

Coupang Eats, as a latecomer, highlights the advantage of its shopping service in satisfying both the delivery needs of local consumers and the online business needs of small business owners. The service allows consumers to order products from nearby small businesses and sole proprietors for delivery. For example, customers can receive immediate delivery from local fruit shops or butcher shops that are known for their quality products but are not easily accessible by foot. Coupang Eats is currently focusing on onboarding a wide range of local small business owners onto its platform.

Baemin, which entered this market early with B Mart, boasts operational know-how and infrastructure accumulated in the quick commerce sector. B Mart operates over 70 urban distribution centers nationwide for its direct-purchase delivery model. It has also expanded its shopping and grocery categories to include not only local small businesses but also major retailers such as Homeplus, Emart, Homeplus Express, Emart Everyday, GS The Fresh, GS25, and CU. Baemin has built a delivery ecosystem that enables customers to receive groceries and daily necessities within one hour of ordering through B Mart, and it is now broadening its service to include various product categories such as electronics, fashion, digital devices, and beauty products.

An industry insider stated, "Recently, quick commerce has been adopted across the entire retail industry, intensifying competition," adding, "Delivery platforms are expected to compete in expanding online sales channels for local stores beyond just restaurants."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.