Concerns Over Liquidity Dispersion and Investor Losses If Platforms Proliferate

The Financial Services Commission has decided to allow up to two over-the-counter trading platforms (distribution platforms) for fractional investment securities. This decision stems from concerns that, as the fractional investment market is still in its early stages and remains relatively small, an excessive number of platforms could disperse liquidity, reduce market efficiency, and potentially lead to investor losses.

On September 4, the Financial Services Commission announced plans to establish a new licensing category for operating distribution platforms by the end of this month. To this end, amendments to the Enforcement Decree of the Capital Markets Act and related supervisory regulations will be submitted to the Vice Ministers' Meeting and the Cabinet Meeting within this month.

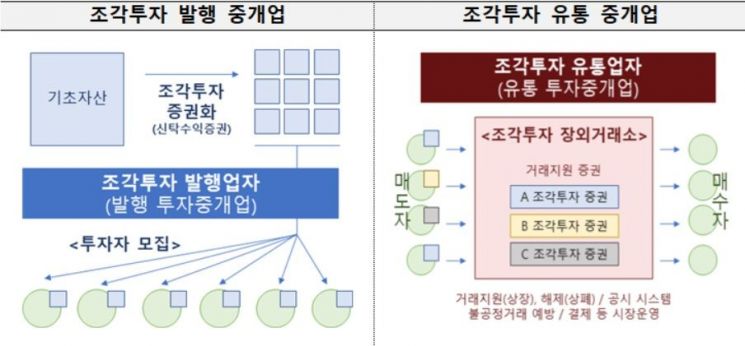

Following the amendments to the capital markets regulations related to fractional investment issuance, which took effect in June, the institutionalization of distribution platforms scheduled for this month will mark the completion of the main regulatory improvements for fractional investment.

The Financial Services Commission plans to permit up to two fractional investment distribution platforms. However, if fewer than two companies meet the licensing requirements, the final number of licenses granted will be adjusted accordingly.

If there are multiple applicants, the licensing review will be conducted using a batch evaluation method, similar to the cases of internet-only banks and real estate trust companies, involving an external evaluation committee.

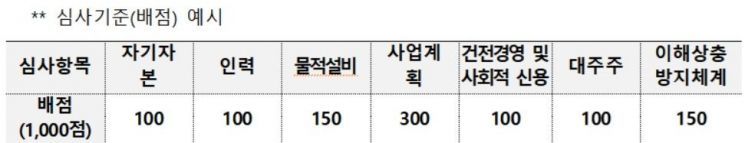

To ensure fairness and transparency in the licensing review, an external evaluation committee composed of experts will assign scores to applicants. Based on these scores, the Securities and Futures Commission and the Financial Services Commission will determine the final license recipients.

During the batch evaluation, the review criteria will be based on the licensing requirements stipulated in the Capital Markets Act. However, considering the unique characteristics of operating a fractional investment over-the-counter exchange, additional points will be awarded in three areas: consortium participation, specialization as a securities company for small and medium-sized enterprises, and the ability to launch services quickly. The detailed evaluation standards and scoring will be finalized by the external evaluation committee.

After the completion of amendments to the Enforcement Decree of the Capital Markets Act and supervisory regulations related to the institutionalization of fractional investment distribution platforms, the financial authorities will announce the application period and accept preliminary license applications in a batch process. If there are multiple applicants, the batch evaluation method will be applied to the review process.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.