Publication of the KB Insurance Customer Language Guide

Simplifying Complex Insurance Terms

Enhancing Customer Understanding and Communication

On September 4, KB Insurance announced the publication of the "KB Insurance Customer Language Guide," which translates complex insurance terminology into simpler language to help customers use insurance services more easily and clearly.

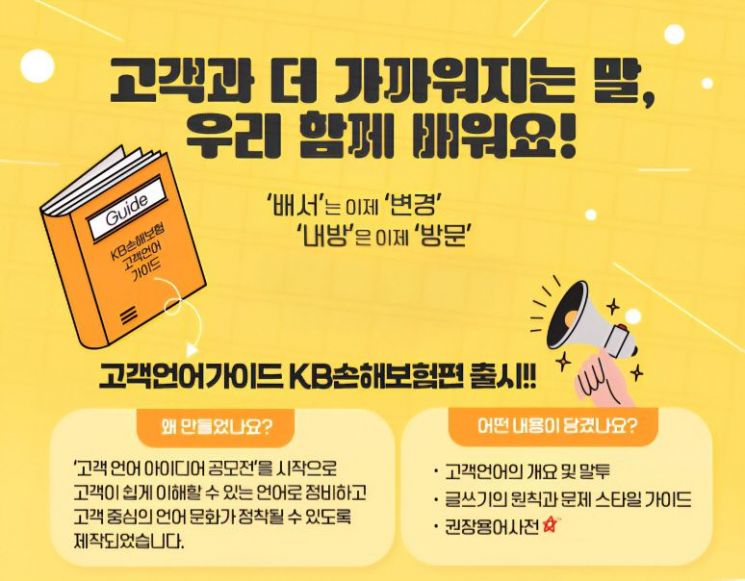

The Customer Language Guide was created based on various suggestions submitted during the "Speak Easily in Customer Language" contest, an internal idea competition for KB Insurance employees focused on refining customer communication. The guide was developed by transforming difficult-to-understand expressions into simpler and clearer language for customers.

The Customer Language Guide was reorganized to suit the non-life insurance sector, building on the "KB Customer Language Guide" published by KB Financial Group last year. It includes sections such as voice and tone, basic writing principles, notation rules, and a recommended terminology dictionary to ensure consistent communication with customers. The guide is designed to help customers easily understand information at various touchpoints, including insurance product brochures, customer consultations, policy documents and forms, as well as website and application interfaces.

For example, the phrase "This product is not available for those over 65 years old" was changed to the more customer-friendly and indirect "This product is available for those aged 20 to 65." Similarly, "Payment is not possible as the refund claim period has expired" was revised to "The refund claim period is three years, and payment is not possible for this case as the period has expired," delivering information more clearly.

The "Recommended Terminology Dictionary" focuses on replacing complex insurance terms with more customer-friendly expressions. For instance, "endorsement" was changed to "modification," "duty of disclosure" to "pre-contractual notification obligation," and "policy loan" to "insurance contract loan," thereby enhancing customer understanding.

KB Insurance plans to continue refining customer language and to consistently promote language improvement activities at customer touchpoints in the future.

A KB Insurance representative stated, "Insurance is directly connected to our customers' lives, so communication based on trust and understanding is essential. Through this Customer Language Guide, we will continue to improve our language so that customers can use insurance services more easily and conveniently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.