Kakao, K Bank, and Toss Bank Each Achieve Record Results Since Launch

NIM, a Key Profitability Indicator, Declines

Over 90% of Profits Concentrated in Household Loans Amid Falling Interest Rates

Seeking to Diversify Income Sources Through N

The three major internet-only banks-Kakao Bank, K Bank, and Toss Bank-each recorded their highest-ever performance in the first half of this year since their respective launches. The improvement in earnings was driven by the expansion of non-interest income and platform services. However, with a decline in net interest margin (NIM) and more than 90% of profits concentrated in household loans, the outlook for the second half of the year remains uncertain.

According to the financial sector on September 4, the combined net profit of the three internet banks in the first half of this year reached 388.3 billion won, marking the largest figure since their inception. This represents a 13.8% increase compared to the same period last year, when it was 341.3 billion won.

By bank, Kakao Bank maintained its industry lead with a net profit of 263.7 billion won, up 14% year-on-year. K Bank posted a net profit of 84.2 billion won, maintaining a similar level to last year, but achieved its highest-ever quarterly result with 68.2 billion won in the second quarter alone. Toss Bank recorded a net profit of 40.4 billion won, which is the smallest among the three, but showed remarkable growth of 65% compared to last year.

On the other hand, profitability indicators deteriorated. As of the second quarter, Kakao Bank's NIM stood at 1.92%, down 0.25 percentage points from 2.17% a year earlier. K Bank recorded a NIM of 1.26% during the same period, a drop of 0.9 percentage points year-on-year. Toss Bank's NIM was 2.57%, a slight increase of 0.10 percentage points from 2.47% in the same period last year.

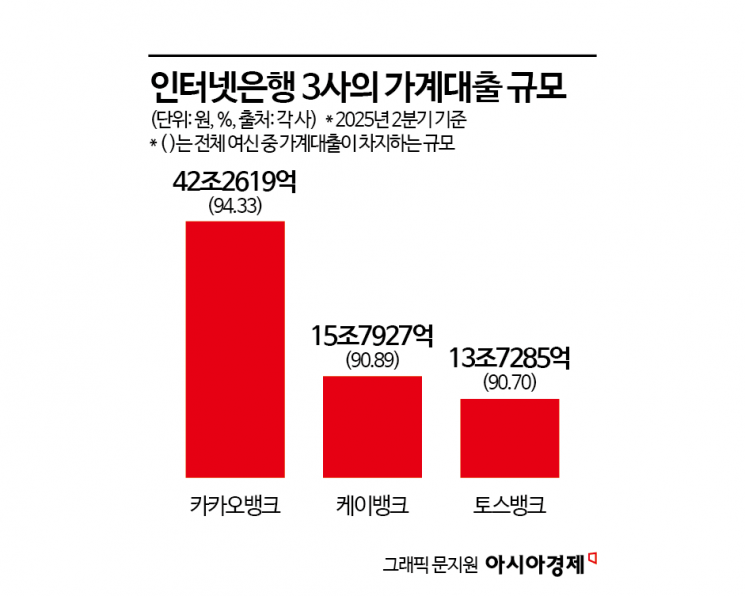

The reason profitability indicators worsened despite record-high performance is that 90% of the internet banks' revenue structure is concentrated in household loans. As of the second quarter, household loans accounted for 94.33% of Kakao Bank's total loans. K Bank followed with 90.89%, and Toss Bank with 90.70%, meaning all three internet banks have over 90% of their portfolios focused on household loans.

A financial industry official stated, "When lending is concentrated in household loans, a decline in interest rates inevitably reduces the interest margin, making profitability vulnerable. In particular, as financial authorities are strongly urging tighter management of household loans, it is difficult to ensure continued growth."

Experts also have a pessimistic outlook for the second half of the year. Park Hyejin, a researcher at Daishin Securities, said, "Loan growth will be limited, while deposits will continue to rise, making a decline in margins unavoidable. Both growth and operating profit are expected to stagnate in the third and fourth quarters."

Choi Jungwook, a researcher at Hana Securities, commented, "Kakao Bank plans to pursue growth by expanding policy loans, which are exempt from regulations, but since all banks are aiming to expand policy loans in the second half, the effect will be limited. Additionally, although the launch of secured loans for individual business owners is scheduled for the second half, the financial authorities' plan to closely monitor these loans to prevent real estate circumvention will act as a burden. As a result, achieving the 10% growth target this year will not be easy."

The internet banks are seeking to diversify revenue sources by expanding non-interest income and investment operations, but the reality is challenging. A financial industry official noted, "Most of the investment assets internet banks have entered are highly sensitive to interest rates, so in the current environment of falling rates, managing operating profit is difficult. It is also not easy to achieve rapid results in expanding non-interest income." Furthermore, the financial authorities' requirement for internet banks to maintain at least 30% of their loans to mid- and low-credit borrowers will act as a further burden on profitability, and ultimately, this structure is likely to lead to increased pressure to raise lending rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.