Second Quarter Economic Growth Rate at 0.7%

Additional Reflections Include Government R&D Execution and Software Development Investment

Second Quarter Real Gross National Income Growth Rate, Highest in 15 Months

To Achieve 0.9% Growth This Year,<

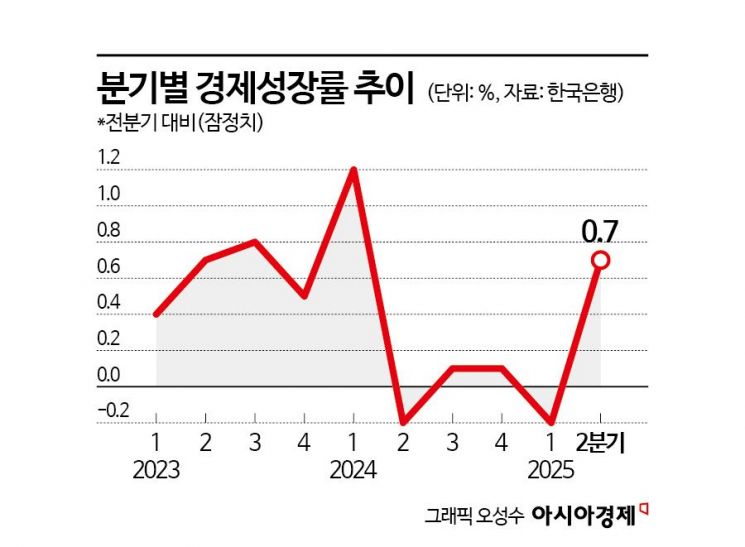

In the second quarter of this year, South Korea's economy grew by 0.7%. This figure is an upward revision from the preliminary estimate of 0.6% announced in July. Private sector exports and consumption led the growth. Thanks to improved terms of trade, South Korean households also experienced an improvement in their financial situation in the second quarter. Looking ahead, domestic demand is expected to continue a moderate recovery centered on consumption, while the impact of U.S. tariffs on exports will be a key factor for future economic trends.

Second Quarter Economic Growth Rate at 0.7%... Additional Reflections of Government R&D Execution and Software Development Investment

According to the "Provisional National Income for the Second Quarter of 2025" released by the Bank of Korea on September 3, real gross domestic product (GDP) in the second quarter grew by 0.7% compared to the previous quarter. This is a 0.1 percentage point upward revision from the preliminary estimate of 0.6% announced in July. To the second decimal place, the preliminary estimate was 0.61%, while the provisional figure is 0.67%, meaning an upward revision of 0.06 percentage points. Accordingly, the growth rate for the first half of the year also rose from 0.2% to 0.3%.

The South Korean economy experienced negative growth of -0.2% in the second quarter of last year, followed by only 0.1% growth in both the third and fourth quarters. In the first quarter of this year, the growth rate was again negative at -0.2%, but a recovery began in the second quarter. In the second quarter, private sector exports and consumption drove growth.

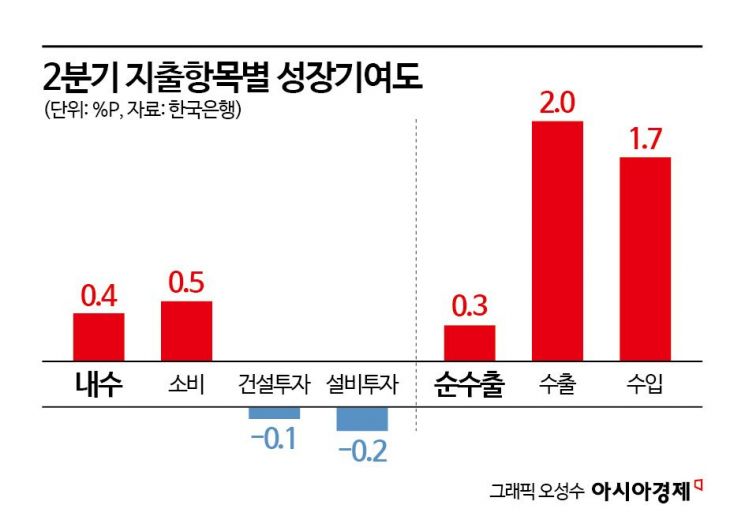

Kim Hwayong, Director of the National Income Division at the Economic Statistics Department 2 of the Bank of Korea, explained, "The provisional growth rate for the second quarter was revised upward by 0.1 percentage points, mainly in investment, reflecting newly released data on industrial activity trends, balance of payments, and fiscal execution since the preliminary announcement." He added, "While facility investment was revised downward by -0.6 percentage points, construction investment (0.4 percentage points), intellectual property product investment (1.1 percentage points), and exports (0.4 percentage points) were revised upward." Construction investment was revised upward because actual construction performance exceeded the preliminary estimate, and intellectual property product investment was revised upward due to increased government research and development (R&D) execution and robust software development investment. The contribution of net exports remained the same, while domestic demand was revised upward by 0.1 percentage points, mainly due to investment.

By sector, except for construction and facility investment, all categories including consumption, exports, and imports increased in the second quarter. Looking at the growth rates by expenditure item, private consumption rose by 0.5% quarter-on-quarter as both goods such as passenger cars and services such as medical care increased. Government consumption increased by 1.2%, mainly due to higher health insurance benefit expenditures. In contrast, construction investment fell by 1.2%, primarily due to a decline in civil engineering, and facility investment decreased by 2.1% as investments in transportation equipment such as ships and machinery for semiconductor manufacturing declined. Exports increased by 4.5% due to growth in semiconductors and petroleum and chemical products, while imports rose by 4.2%, mainly driven by energy products such as crude oil and natural gas.

By economic activity, manufacturing increased by 2.5% as computers, electronics and optical devices, and transportation equipment grew. Construction decreased by 3.6% due to a decline in building and civil engineering. The service sector grew by 0.8%, as declines in information and communication were offset by increases in wholesale and retail, accommodation and food services, and transportation. Exports increased by 4.5% due to semiconductors and petrochemical products, while imports rose by 4.2%, mainly due to crude oil, natural gas, and other energy products.

In terms of contribution to growth, by expenditure item, net exports (exports minus imports) slightly widened from 0.2 percentage points in the previous quarter to 0.3 percentage points, while domestic demand (0.4 percentage points) turned significantly positive, mainly driven by consumption. Considering that domestic demand dragged down the growth rate by 0.5 percentage points in the first quarter, the recovery in domestic demand was clear. By item, private consumption turned positive at 0.2 percentage points, but construction investment and facility investment recorded -0.1 and -0.2 percentage points, respectively, pulling down the growth rate.

Nominal GDP in the second quarter grew by 2.0% quarter-on-quarter. Compensation of employees increased by 0.8%, mainly due to growth in healthcare and social welfare services. Gross operating surplus increased by 4.0%, led by transportation equipment, manufacturing, and wholesale and retail trade.

Second Quarter Real Gross National Income Growth Rate, Highest in 15 Months

In the second quarter of this year, real gross national income (GNI) increased by 1.0% compared to the previous quarter. This figure exceeds the real GDP growth rate of 0.7% over the same period and marks the largest increase in 15 months since the 1.7% rise in the first quarter of last year. Real GNI is an indicator that reflects the real purchasing power of income earned by South Koreans both domestically and abroad. An increase in real GNI indicates that the economic capacity of the population has improved.

The increase in real GNI was largely due to improved terms of trade, which led to a significant reduction in real trade losses from 13 trillion won in the first quarter to 8.6 trillion won in the second quarter. Kim explained, "The improvement in terms of trade was because import prices for items such as crude oil fell more sharply than export prices for products like petroleum." Real net factor income from abroad decreased from 13 trillion won in the first quarter to 10 trillion won in the second quarter. Net factor income from abroad is calculated by subtracting the income earned by foreigners in South Korea from the income earned by South Koreans abroad.

The GDP deflator, an index representing the overall price level in the country, rose by 2.8% year-on-year. The gross savings rate reached 35.6%, up 0.7 percentage points from the previous quarter, as the growth rate of gross national disposable income outpaced final consumption expenditure. The net household savings rate was 8.8%, up 1.9 percentage points from the previous quarter. The gross domestic investment rate was 28.8%, down 0.1 percentage points from the previous quarter, as the growth rate of gross national disposable income exceeded the rate of gross capital formation.

To Achieve 0.9% Growth This Year, Second Half Must Grow by 0.6%

According to the Bank of Korea's economic outlook in August, annual growth of 0.9% this year requires growth of about 0.6% in the second half. To reach growth in the 1% range, the second half must grow by at least 0.7%. The key issue is when and to what extent the impact of tariffs on exports will materialize.

Looking ahead, the economy is expected to continue a moderate recovery in domestic demand, while the impact of U.S. tariffs on exports will gradually emerge. Kim stated, "As confirmed in July and August, exports have shown a solid trend, but as the impact of U.S. tariffs expands, growth is expected to slow. Since mutual tariffs have already taken effect and the range of items subject to steel and aluminum tariffs has been expanded, negative effects are anticipated. However, since some aspects have not yet been finalized, the impact will appear gradually." As for domestic demand, he predicted that the recovery trend will continue in the third quarter, as indicators such as the retail sales index, durable goods sales, and credit card usage remain favorable.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.