Sangsangin Releases Economic and Trade Analysis Using GTA

About 70 Korea-Related Trade Measures Announced by July... 87% Deemed Harmful

Recent Increase in Free Trade Measures and Conclusion of Korea-U.S. Trade Agreement

Since the inauguration of U.S. President Donald Trump, who dubbed himself the "Tariff Man," there have been approximately 70 trade policy measures announced up to July of this year that directly or indirectly affect South Korea. Of these, 87% have been identified as harmful to Korea. However, as the proportion of free trade measures (Green rating) has increased since July and the Korea-U.S. trade agreement has been concluded, some analysts believe that the worst has passed. This year, South Korea's annual trade surplus is estimated to reach 50.2 billion dollars.

On September 3, Sang Sangin Securities researchers Jeong Wonil and Choi Yechan stated in their report, "Economic and Trade Analysis Using GTA (Global Trade Alert)," that "the tariff risks, which had increased global macroeconomic uncertainty, appear to have somewhat stabilized compared to the beginning of the year."

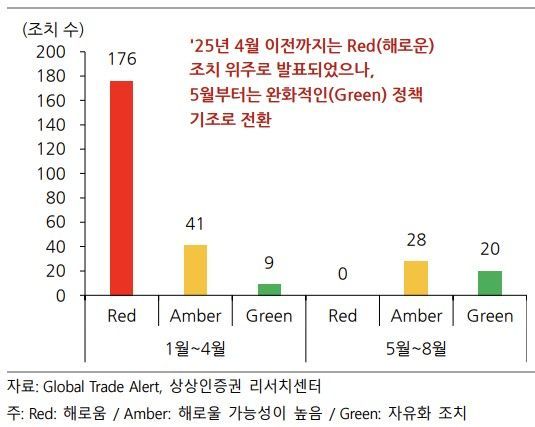

According to the report, of the U.S. trade measures announced between January and April after President Trump took office, 176 were classified as Red rating, accounting for 77% of the total. Only 9 measures were classified as Green. However, after the introduction of reciprocal tariffs, changes were observed between May and August. The GTA project, which tracks and analyzes global trade policies, categorizes each measure as Red (definitely harmful to certain countries and companies), Amber (potentially harmful), or Green (neutral or beneficial).

The report explained, "A review of officially announced or finalized trade deals and agreements between May and August shows that a total of 48 detailed agreements were coordinated by policy category," adding, "Among them, there were no Red rating protectionist measures that are clearly harmful." It further stated, "There were 28 Amber rating measures, which are likely to be harmful, and 20 Green rating free trade measures, indicating that the tension in U.S.-led trade policy negotiations has clearly eased." The report also assessed, "In the fourth quarter, the trend is expected to continue toward easing through negotiations rather than strengthening protectionism."

Looking specifically at measures that directly or indirectly affect South Korea, about 70 measures were announced up to July. Of these, 34 were classified as Red rating and 27 as Amber rating according to the GTA evaluation. The report noted, "The proportion of harmful measures was close to 87%, similar to the average proportion of harmful measures in the United States in 2025 (90%)." However, it also pointed out, "Most of these regulations do not specify an expiration date," suggesting the possibility of future negotiations. The report stated, "Since July, the proportion of measures classified as Green rating has been increasing, and in August, the Korea-U.S. trade agreement was concluded," adding, "A more relaxed policy environment can be expected going forward, rather than heightened concerns."

Accordingly, Sang Sangin Securities presented a forecast for South Korea's annual trade surplus this year at 50.2 billion dollars. This represents a decrease of approximately 3.1% compared to last year's surplus of 51.8 billion dollars. It is also an intermediate level between the Korea International Trade Association's June forecast (48.3 billion dollars surplus) and the Bank of Korea's August forecast (68.3 billion dollars surplus).

The report pointed out, "Uncertainty in the trade environment remains higher than before Trump's election. Although it is expected to ease compared to the first half of the year, the implementation of tariffs and the protectionist stance itself remain unchanged, so a negative impact on the domestic trade balance is expected for the time being." However, the report also assessed that the global trade environment uncertainty index, which peaked in April, is unlikely to fully translate into a worsening of South Korea's trade balance in the second half of the year. It noted, "There is an average time lag of 10 months before shocks from trade environment uncertainty are reflected in South Korea's trade balance."

The report also emphasized that the economic conditions of China and the United States, which are South Korea's major export destinations and largely determine its export cycle, are not particularly negative. China, which reaffirmed its commitment to boosting domestic demand, implemented expansionary fiscal policies and saw its first-half growth rate exceed market expectations. The United States, which experienced a temporary shock in the first quarter, also saw its second-quarter growth rate surpass expectations. The report analyzed, "As the global supply chain and trade structure have diversified following the pandemic, the impact of U.S.-led tariff shocks has diminished compared to the past. For South Korea, although trade conditions are gradually deteriorating, further declines in export growth are likely to be limited due to the recovery in semiconductor export prices and favorable long-term industry conditions for its main export products."

In addition, regarding monetary policy, the report forecast that the Bank of Korea would cut interest rates once in the fourth quarter, bringing the year-end base rate to 2.25%. The U.S. Federal Reserve is expected to make two rate cuts, one each in the third and fourth quarters. Based on this, the report projected the average dollar-won exchange rate for the fourth quarter to be 1,397 won. The report added, "Even if the trade environment partially eases, the upward pressure on the exchange rate is expected to remain strong."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)