Court Rules Reciprocal Tariffs Under IEEPA Illegal

U.S. Government Faces Potential Tariff Refunds, Heightening Fiscal Concerns

September Market Slump History Weighs on Investor Sentiment

All Eyes on Employment Report to Be Released September 5

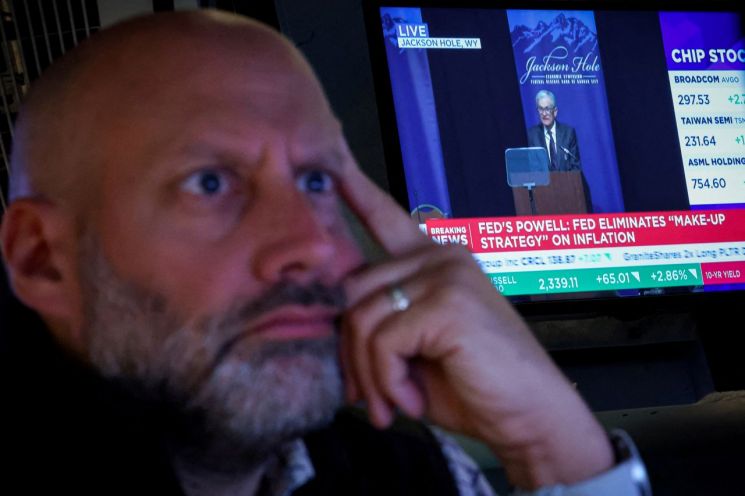

All three major indices on the New York Stock Exchange fell across the board on September 2 (local time), the first trading day of September. Concerns over fiscal instability have grown after a U.S. court ruled President Donald Trump's reciprocal tariff policy illegal, and the resulting rise in Treasury yields is weighing on the stock market. Additionally, with September historically being a weak month for stocks, investor sentiment has deteriorated, leading to a sharp decline in technology stocks.

As of 11:34 a.m. on the New York Stock Exchange, the blue-chip Dow Jones Industrial Average was down 489.04 points (1.07%) from the previous trading day at 45,055.84. The large-cap S&P 500 Index fell 86.35 points (1.34%) to 6,373.91, while the tech-heavy Nasdaq Index plunged 356.666 points (1.66%) to 21,098.886.

Previously, on August 29, the U.S. Federal Circuit Court of Appeals ruled by a 7-4 vote that the Trump administration's reciprocal tariffs, imposed globally under the International Emergency Economic Powers Act (IEEPA), were illegal. Following this, concerns grew over increased fiscal burdens due to the potential for tariff refunds by the Trump administration, and expectations of increased Treasury issuance spurred a rise in yields. However, as President Trump has announced plans to appeal, the final decision is expected to be made by the Supreme Court.

Yields on U.S. Treasury bonds are rising across both short- and long-term maturities. Currently, the yield on the 30-year U.S. Treasury bond stands at 4.96%, up 5 basis points (1bp = 0.01 percentage point) from the previous trading day. The yield on the 10-year Treasury is up 2bp at 4.27%, and the 2-year yield is up 2bp at 3.64%. The magnitude of the increase has narrowed somewhat since the market opened.

Ed Yardeni, President and Chief Investment Strategist at Yardeni Research, analyzed, "If expectations that tariff revenues would significantly reduce the federal deficit disappear, the bond vigilantes may take action once again."

Seasonal factors are also weighing on the market. The S&P 500 Index has averaged declines of 4.2% in September over the past five years and more than 2% over the past ten years.

Investors are awaiting a series of employment indicators scheduled for release this week. The key report is the August employment report to be released by the U.S. Department of Labor on September 5. According to Bloomberg, nonfarm payrolls are expected to increase by 75,000 in August. While this is a slight increase from July's 73,000, it marks the fourth consecutive month below 100,000, indicating the weakest trend since the COVID-19 pandemic in 2020. The unemployment rate is expected to rise from 4.2% in July to 4.3% in August.

Before that, on September 3, the Department of Labor's July Job Openings and Labor Turnover Survey (JOLTs) will be released, followed by the August ADP private employment report and weekly initial jobless claims on September 4. The Federal Reserve's Beige Book, which contains an assessment of the U.S. economy, is scheduled for release on September 3.

By stock, Nvidia is down 3.38%. Apple is down 2%, and Microsoft is down 1.2%. Tesla is trading down 1.87%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.