August Balance Reaches 999 Trillion Won for Second Consecutive Month

No "Money Move" Despite Rate Cuts and Higher Deposit Protection Limit

Minimal Rate Gap with Non-Banks; High-Interest Time Deposit Products Drive Growth

The balance of time deposits and installment savings at major commercial banks has increased for two consecutive months, approaching 1,000 trillion won. Despite unfavorable factors such as declining deposit interest rates and the increase in the deposit protection limit, large sums of money have continued to flow into these products. This trend is largely attributed to the fact that deposit rates at non-bank institutions, such as savings banks, are not significantly higher, while commercial banks have launched a series of high-interest time deposit products, effectively locking in customer funds.

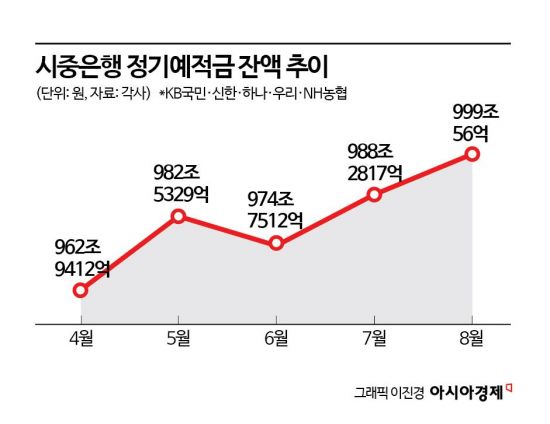

According to the financial sector on September 3, the combined balance of time deposits and installment savings at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 999.056 trillion won at the end of last month. This represents an increase of 10.7239 trillion won from the previous month (988.2817 trillion won), and a rise of about 37 trillion won compared to January. Breaking it down, time deposits accounted for 954.7319 trillion won, while installment savings made up 44.2737 trillion won.

The balance of time deposits and installment savings at commercial banks has experienced sharp fluctuations since the beginning of this year, but has now increased for two consecutive months. The scale of the increase is also significant, with monthly growth of around 10 trillion won. At this rate, the total is expected to surpass 1,000 trillion won within this month.

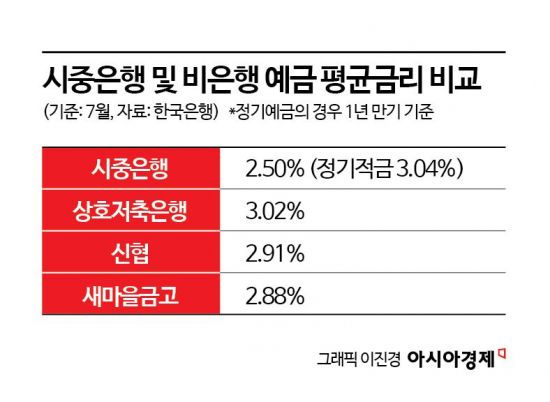

The increase in the balance of time deposits and installment savings is an unexpected outcome, given that the attractiveness of these products is declining due to falling interest rates. The interest rate on time deposits has decreased for ten consecutive months, affected by the lower base rate. According to the Bank of Korea, as of July, the average interest rate on new time deposits at deposit banks was 2.50%, a drop of 0.91 percentage points from 3.41% in September last year.

Starting this month, the deposit protection limit has been raised from 50 million won to 100 million won, leading to speculation about possible "money moves" to non-bank institutions such as savings banks and mutual finance companies. However, no significant trends or proactive fund transfers have been observed so far. Demand deposits at commercial banks, which are classified as funds waiting for investment due to their liquidity, decreased by about 17 trillion won in July, but rebounded last month with an inflow of 4.517 trillion won, returning to an upward trend.

Despite the declining interest rates, the continued inflow into bank time deposits and installment savings is believed to be due to the small interest rate gap between commercial banks and non-bank institutions. According to the Bank of Korea, as of July, the interest rate on time deposits at non-bank institutions ranged from 2.88% to 3.02%, which is similar to the average interest rate of 3.04% offered by commercial banks on installment savings. A financial sector official said, "Some savings banks are offering aggressive interest rates to attract funds, but due to ongoing restructuring in real estate project financing, they are unable to fully engage in high-interest competition."

The launch of high-interest special installment savings products by commercial banks to retain customers has also played a role. This year, banks have introduced a variety of high-interest installment savings products to commemorate events such as the 80th anniversary of Liberation or their own anniversaries. Some products, offering an annual interest rate of up to 8% with limited subscription periods or account numbers, have sold out quickly due to high demand. A commercial bank official said, "There is demand from customers who want to lock in time deposits and installment savings before interest rates fall further, and the recent stagnation in the domestic stock market also seems to be a factor. In preparation for possible fund movements, banks are making efforts by introducing interest rate preferential products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.