Impact of Delayed Implementation of Trump Tariff Reduction

Automakers Postpone U.S.-Bound Exports

Steel Exports to the U.S. Plunge 30% Year-on-Year

Even High-Demand Products Like Flat-Rolled and Long Steel Hit

Korea GM's North American (United States, Canada, Mexico) exports in August dropped by nearly 60% in just three months. Although South Korea and the United States agreed to lower the U.S. export tariff on finished vehicles to 15%, the delay in the U.S. government's executive order has led companies to postpone exports. Steel exports, which are subject to a high tariff rate of 50%, were also hit hard.

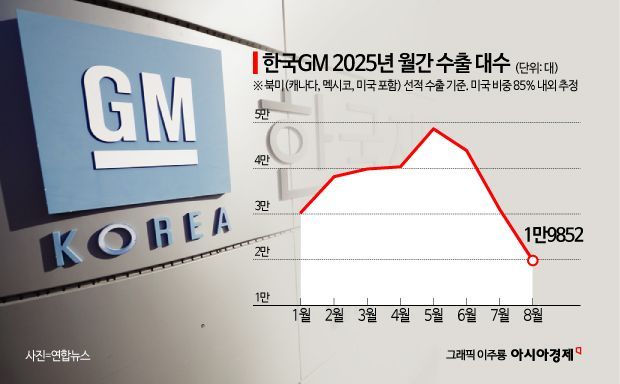

On September 2, Korea GM announced that its export volume for August, based on shipments, totaled 19,852 units. This is the lowest monthly figure in the past 12 months and represents a 59% decrease over the past three months. Korea GM's export volume is mainly concentrated in North America, including the United States, Canada, and Mexico, with as much as 85% of the total heading to the U.S. mainland.

Since the imposition of a 25% high tariff in April, Korea GM had increased its monthly export volume to around 48,000 units. As rumors of withdrawal surfaced due to the impact of tariffs, GM headquarters emphasized Korea GM's role as a small car production base and actually increased its production allocation by more than 30,000 units annually.

However, since the Korea-U.S. tariff negotiations were concluded in August, both export and production volumes have been on a downward trend. Industry insiders believe that although the two governments agreed to lower the U.S. export tariff on finished vehicles to 15%, domestic automakers have temporarily put exports on hold because the revised tariffs have not yet been implemented due to U.S. administrative procedures.

Strikes, which recur every year during wage and collective bargaining negotiation seasons, are also holding back exports. In particular, with the passage of the Yellow Envelope Act this year, speculation about Korea GM's withdrawal is expected to continue. The passage of a bill that effectively strengthens the union's right to strike by expanding the grounds for industrial action and limiting companies' claims for damages during strikes is seen as giving the union a stronger foundation for more aggressive collective action.

The Korea GM union, which is currently conducting a partial strike, is also expected to escalate the intensity of its industrial action. An industry official said, "With the U.S. tariff cut, which is crucial for our country's exports, still not in effect, and the domestic strike overlapping, there is no other choice but for production and exports to decline in the second half of the year." From August 1 to 25, Korea's automobile exports to the U.S. reached 1.58 billion dollars, down 3.5%, while exports of auto parts amounted to 440 million dollars, a 14% decrease.

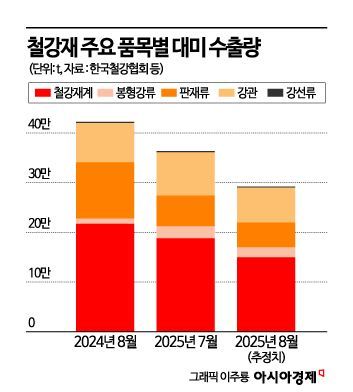

Steel exports also totaled 2.37 billion dollars, a 15.4% decrease compared to the same period last year. According to the Korea Iron & Steel Association and industry sources, last month's steel exports to the U.S. were estimated at 150,000 tons. This is a 30% drop from the same month last year (217,000 tons) and a 21% decrease from the previous month (188,000 tons). The implementation of the 50% high tariff in the U.S., combined with global demand slowdown and falling prices, led to a downturn across all product categories.

By product, steel pipes saw the largest hit, with a 10% decrease. Although demand for this product, used for energy and piping, remains steady in the U.S., it has been difficult to expand exports due to the burden of high tariffs. Plate steel is expected to fall to about 50,000 tons, more than halving from the same month last year (113,000 tons). Bar and shape steel reached about 20,000 tons, up 77% from the same month last year (11,000 tons), but down nearly 20% from the previous month (24,000 tons).

Bar and shape steel, which is used in a wide range of fields including construction rebar, civil engineering materials, machinery and auto parts, and ship components, was unable to sustain the temporary increase seen in July due to the combined effects of economic slowdown and tariff burdens. An industry official said, "The fact that even products with a solid demand base, such as plate steel and bar and shape steel, have been hit means that a recovery in exports to the U.S. is unlikely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.