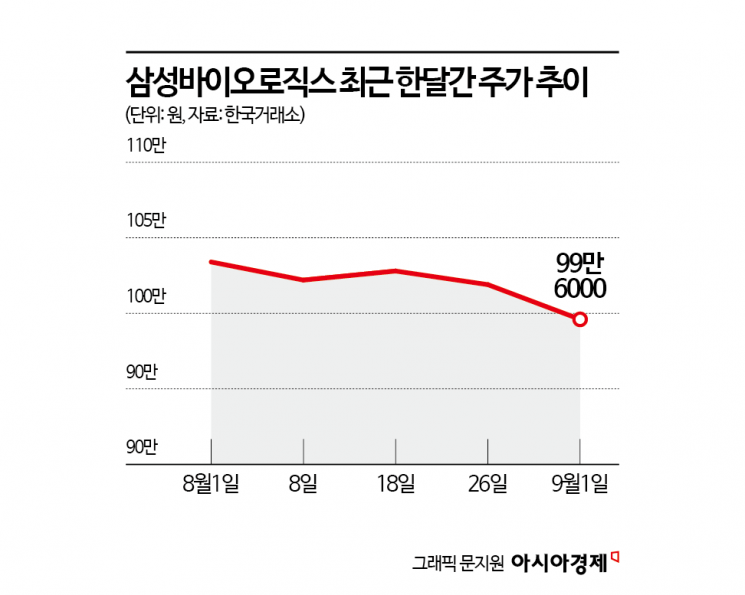

Stock Price Falls Below 1 Million Won for the First Time in Two Months

Down 3.68% Over the Past Month

Continued Selling by Foreign and Institutional Investors

Stock Recovery Unlikely Before Spin-off Completion

The stock price of Samsung Biologics, which is set to undergo a spin-off, continues to stagnate. While the spin-off has been cited as a major factor, the recent postponement of the spin-off schedule by one month is expected to further prolong the sluggish stock performance.

According to the Korea Exchange on September 2, Samsung Biologics closed at 996,000 won on the previous day, down 5,000 won (0.5%) from the previous session. This is the first time in two months that Samsung Biologics’ stock price has fallen below 1 million won. Over the past month, the stock has declined by 3.68%.

Ongoing selling by foreign and institutional investors has been dragging down the stock price. Foreign investors and institutions have been net sellers of Samsung Biologics for six consecutive trading days. Last month, foreign investors sold a total of 114.5 billion won, while institutions sold 40 billion won worth of shares.

Despite solid second-quarter results this year, the stagnation in the stock price is attributed to the spin-off. On a consolidated basis, Samsung Biologics posted second-quarter sales of 1.2899 trillion won, up 11.5% year-on-year, and operating profit of 475.6 billion won, up 9.46%. As a result, Samsung Biologics raised its annual consolidated sales growth outlook for this year from the previous 20-25% to 25-30%.

Heo Hyemin, a researcher at Kiwoom Securities, stated, “With no momentum strong enough to trigger a sharp rebound in the stock price, we expect a box-range trend until the spin-off is completed. However, the company continues to deliver solid results, so if external factors such as tariffs, supply chain issues, and exchange rates turn favorable, it could have a positive impact on the stock price.”

The recent delay in the spin-off schedule is expected to further extend the period of stock stagnation. On August 22, Samsung Biologics announced that the spin-off date would be changed from October 1 to November 1. As a result, the planned suspension of trading has been postponed from September 29-October 28 to October 30-November 21. The relisting date for the surviving company, Samsung Biologics, and the new company, Samsung Episholdings, has also been changed from October 29 to November 24. This postponement is reportedly due to the extended preliminary review process by the Korea Exchange for the spin-off relisting. Previously, on August 21, the Korea Exchange’s KOSPI Market Division had determined that Samsung Biologics was eligible for the spin-off relisting following its preliminary review.

Kim Seona, a researcher at Hana Securities, commented, “The stock price of Samsung Biologics has remained stagnant since the spin-off decision. While uncertainty regarding pharmaceutical tariffs is a factor, the spin-off event itself is also a major reason. We believe there is a gap between the corporate values of the surviving entity, Samsung Biologics, and the new entity, Samsung Episholdings, based on the current spin-off ratio, compared to their post-spin-off valuations. Therefore, with the spin-off schedule being postponed, the period of stock stagnation for Samsung Biologics is also expected to be prolonged.”

Despite both domestic and external uncertainties, there are expectations that solid performance will be maintained. Shin Jihoon, a researcher at LS Securities, predicted, “There may be short-term supply and demand volatility due to the trading suspension, but despite both domestic and external uncertainties, strong sales growth and robust profit trends are expected to continue.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.