"The Best Scenario Is Restoration of VEU, but It Won't Be Easy"

U.S. Commerce Department Faces Increased Workload... Incentives for Streamlining Exist

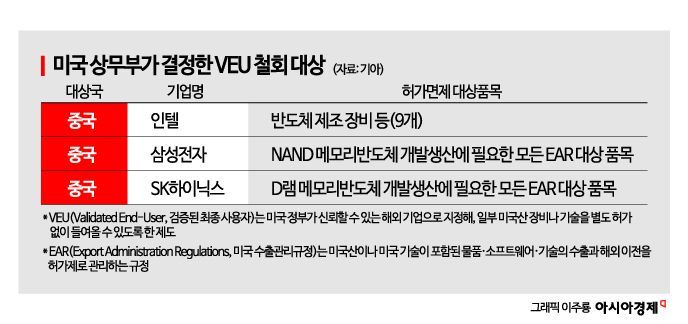

The government has begun follow-up measures in response to the United States' withdrawal of the "Validated End User (VEU)" system. With the U.S. Department of Commerce abruptly revoking the VEU status previously granted to the Chinese subsidiaries of Samsung Electronics and SK Hynix, starting next year, it will become a reality that each import of U.S.-made equipment into China will require an individual export license. The Korean government has set reversing the VEU withdrawal itself as its top priority. However, if negotiations do not yield results, the government plans to pursue alternative measures such as maintaining a comprehensive licensing system or implementing expedited review procedures to ease the administrative burden on companies.

On September 1, an official from the Ministry of Trade, Industry and Energy stated, "The goal, of course, is to have the withdrawn measure reversed," but added, "However, since the U.S. also regards the VEU system as a legacy of the Biden administration, it will not be easy to reverse it."

The official continued, "If reversal is difficult, we will continue discussions to minimize damage to our companies," and added, "We can consider various alternatives, such as fast-track reviews or bundled approvals for multiple pieces of equipment. We will negotiate comprehensively, taking into account what our industry prefers and what the U.S. Department of Commerce's Bureau of Industry and Security (BIS) has in mind."

The VEU system is a method in which the U.S. government designates certain companies as "validated end users," allowing them to broadly use U.S.-made equipment and components at their Chinese plants. Samsung Electronics' Xi'an NAND flash plant and SK Hynix's Wuxi DRAM plant have been exempt from individual licensing procedures for equipment imports under this system. However, due to this recent measure, starting next year, each export of equipment will require an individual license from BIS.

The industry is concerned that this will not only increase administrative burdens for companies, but also lead to operational disruptions and uncertainty in delivery schedules due to licensing delays. In fact, there are growing concerns within companies that if equipment imports are delayed by several weeks, production lines could come to a halt.

BIS has estimated that the withdrawal of the VEU system will result in more than 1,000 additional export license applications per year. This means that not only will the burden on Korean companies increase, but the workload for U.S. authorities will also rise significantly. As a result, it is interpreted that BIS may have an incentive to introduce simplified procedures such as comprehensive licensing or fast-track reviews.

Some observers note that this measure was announced just four days after the Korea-U.S. summit. It is interpreted not as a mere administrative procedure, but as a signal pressuring Korea to distance itself from technological cooperation with China. In particular, analysts say this move carries a strategic message from the U.S. to reduce dependence on China in supply chains for high-tech industries such as semiconductors.

In response, China's Ministry of Commerce stated, "Semiconductors are a sector intertwined with the global industrial network," and argued that "this measure could undermine supply chain stability." The ministry also announced that it would devise "appropriate countermeasures" for its domestic companies.

Amid the complex interests among Korea, the U.S., and China, and the ongoing global supply chain restructuring, the upcoming 120-day grace period is expected to be a critical juncture for negotiations. The Korean government plans to continue detailed discussions with the U.S. BIS during this period, gather feedback from companies, and prepare measures to minimize damage. An official from the Ministry of Trade, Industry and Energy emphasized, "Although it is still unclear what form the licensing system will take, we will negotiate to the end to ensure that disruptions to our companies' operations are minimized."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.