U.S. Government Approval Required for Semiconductor Equipment Imports to Chinese Plants

120-Day Grace Period Before Implementation

SK Hynix: "We Will Respond Through Close Communication with Both Governments"

Former Vice Chairman Lee Changh

With the removal of Samsung Electronics and SK Hynix from the "Validated End-User (VEU)" list by the U.S. government, analysts suggest there is now a high likelihood that these companies will reduce their production share in China over the long term and shift manufacturing back to South Korea-a so-called "U-turn." Industry experts believe this measure will not be a short-term variable but will continue to pose ongoing risks moving forward. On this day, SK Hynix issued an official statement saying, "We will respond by maintaining close communication with both the South Korean and U.S. governments to minimize the impact on our business."

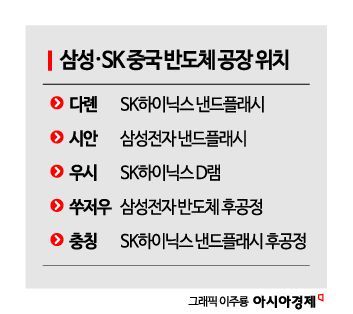

On September 1, Lee Changhan, former Vice Chairman of the Korea Semiconductor Industry Association, stated, "This is a signal not to manufacture processes below 12nm (1nm = one-billionth of a meter) in China," adding, "Given that U.S. controls have persisted for years, companies are likely to consider withdrawing from China." He further explained, "Since the Chinese plants were established to meet local demand, it is more likely that production will be shifted back to South Korea rather than relocated to a third country such as Southeast Asia."

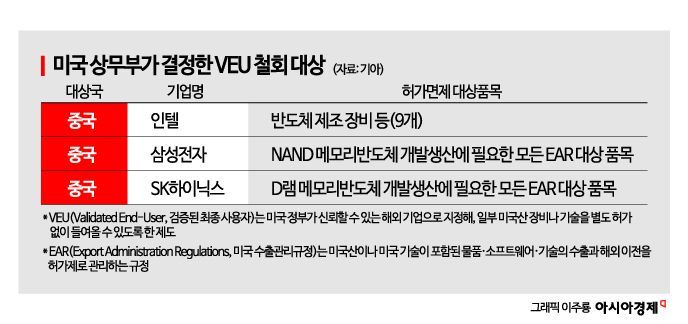

This measure stems from the U.S. government’s decision to remove Samsung Electronics and SK Hynix from the VEU system, which allows trusted foreign companies to export certain items without separate approval. Without VEU status, every shipment of semiconductor equipment to Chinese factories will now require individual approval from the U.S. government.

Lee also commented, "Given that research is underway to blur the boundaries between memory and central processing units (CPUs), it is difficult to say that the risk of technology leakage from China is entirely absent." However, he added, "If controls on production equipment persist, it will not be easy for Chinese companies to catch up using only current legacy equipment."

Some in the industry have speculated about Southeast Asia as an alternative production base, but experts consider this unlikely. Since the semiconductor industry bases its location decisions more on market demand and profitability than on cheap labor, it will be difficult to immediately replace China. However, Lee noted, "It has now been almost six years since the United States began to strictly control the semiconductor sector, starting with the first Trump administration and continuing through the Biden administration," adding, "In the long term, companies may seek to exit the highly volatile Chinese market."

Samsung Electronics and SK Hynix have maintained a calm stance. An industry insider stated, "Since the U.S. decision to revoke VEU status will be published in the Federal Register on September 2, there is a 120-day grace period before it takes effect, so we need to monitor developments during this time." Another source added, "As this is an issue that requires consultation between the South Korean and U.S. governments, we are also closely watching how the government will respond."

In October 2022, during the Biden administration, the U.S. imposed a complete ban on equipment exports to Chinese semiconductor companies to prevent technology leaks, and introduced a case-by-case approval system for multinational companies operating in China, granting exceptions to only a few firms. In October 2023, Samsung Electronics and SK Hynix were granted VEU status for all items, allowing them to export advanced equipment to China.

However, with the Trump administration announcing on August 29 that it would overturn this policy, the situation has changed. The industry believes there is virtually no chance of reversal.

An industry official commented, "If equipment imports are delayed, it will immediately become difficult to expand production or transition to advanced processes, which could directly lead to a decline in sales," adding, "This is essentially forcing companies to choose between the U.S. and China."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.