Consecutive API Supply Contracts with Gilead

Over 170 Billion KRW Signed This Month

Yuhan Corporation, a leading pharmaceutical company in South Korea, is achieving remarkable results in its Active Pharmaceutical Ingredient (API) business. Its subsidiary, Yuhan Chemical, has secured global-level production capacity through the expansion of its Hwaseong plant. Meanwhile, the parent company, Yuhan Corporation, has been successfully signing a series of large-scale supply contracts with Gilead Sciences in the United States, positioning itself as the largest API exporter in the country.

According to Yuhan Corporation on August 29, the company has signed consecutive API supply contracts this month with Gilead, a global pharmaceutical company based in the United States, for HCV (hepatitis C virus) treatment and AIDS treatment APIs. The contract amounts are $61,295,000 (approximately 8.49 billion KRW) and $60,832,800 (approximately 8.42 billion KRW), respectively. In May of this year, the company also signed a contract worth $63,776,350 (approximately 8.83 billion KRW) for APIs related to HIV (human immunodeficiency virus) treatment. Yuhan Corporation’s cumulative order volume for this year has surpassed 250 billion KRW. The contracts are structured so that Yuhan Corporation signs with Gilead and then commissions its API CDMO (Contract Development and Manufacturing Organization) subsidiary, Yuhan Chemical, for production.

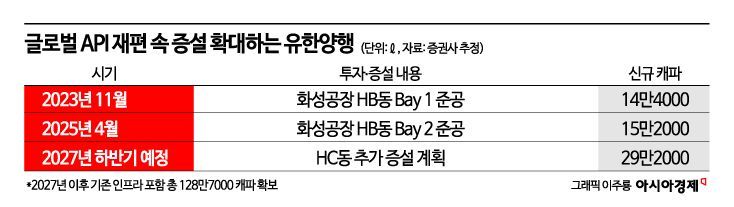

The series of API orders for Yuhan Corporation aligns with the expansion of Yuhan Chemical. In April, Yuhan Chemical completed the expansion of Bay 2 in the HB building at its Hwaseong plant in Gyeonggi Province, achieving a total production capacity of 995,000 liters. The HB building is equipped with continuous manufacturing (Flow Chemistry) facilities and a data integrity network, which differentiates it in terms of eco-friendly production and compliance with global regulations. Following the Ansan plant, Yuhan Chemical has now established a one-stop system at the Hwaseong plant as well, capable of handling everything from small-scale clinical production to large-scale commercial manufacturing. The company is also pursuing an additional expansion of the HC building with a capacity of 292,000 liters, which, upon completion in the second half of 2027, will bring the total production capacity to over 1.28 million liters.

The API business is expected to become a major cash cow for Yuhan Corporation. This year’s cumulative contract amount (250 billion KRW) accounts for about 13% of Yuhan Corporation’s sales last year (approximately 1.859 trillion KRW). It is unusual for a Korean pharmaceutical company to sign API supply contracts worth more than 200 billion KRW in a single year with a global big pharma company. Yuhan Chemical, responsible for production, is also experiencing rapid growth. Since 2020, Yuhan Chemical’s sales have grown by double digits annually, and are projected to rise more than 20% this year from 212.2 billion KRW last year to 250 billion KRW (according to securities industry estimates).

The strong performance of the API business is also linked to the restructuring of the supply chain in the United States. Since the COVID-19 pandemic, the United States and Europe have been intensifying efforts to diversify API supply chains that have been heavily concentrated in China and India. According to the United States Pharmacopeia (USP), more than half of the prescription drug APIs in the United States are produced in India and Europe, and 35% of generic APIs rely on India. With risks highlighted by the recent U.S.-China conflict and tariff policies, new opportunities are emerging for Korean companies. Unlike finished pharmaceuticals, APIs are less affected by tariffs, making this a high-margin business. In particular, since raw materials for antiviral and anticancer drugs require stringent quality control and regulatory compliance, Korean companies have significant potential to become suppliers to global big pharma companies. This is the background for the outlook that Yuhan Corporation could expand its API supply partnerships to other global pharmaceutical companies beyond Gilead.

A Yuhan Corporation representative stated, "The recently expanded HB building at Yuhan Chemical is now operating at full capacity, and with ongoing production inquiries from global pharmaceutical companies, we are planning to expand the HC building at Yuhan Chemical with a capacity of 292,000 liters. Since the new drug API business is highly profitable and has high entry barriers, we expect continued high growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)